Product

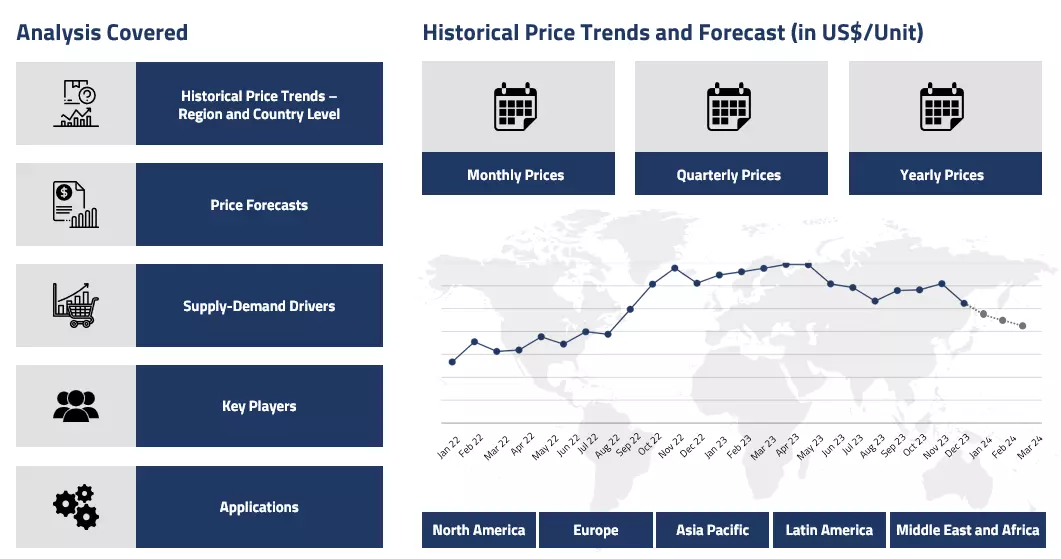

2-Ethylhexanoic Acid Price Trend and Forecast

2-Ethylhexanoic Acid Price Trend and Forecast

2-Ethylhexanoic Acid Regional Price Overview

Get comprehensive insights into the 2-ethylhexanoic Acid market, with a focused analysis of the 2-ethylhexanoic Acid price trend across Asia, Europe, North America, Latin America, and the Middle East & Africa.

2-Ethylhexanoic Acid Price Trend for the Q4 of 2024

| Product | Category | Region | Price | Time Period |

| 2-Ethylhexanoic Acid | Chemical | China | 1882 USD/MT | September'24 |

| 2-Ethylhexanoic Acid | Chemical | China | 1855 USD/MT | December'24 |

| 2-Ethylhexanoic Acid | Chemical | Europe | 1810 USD/MT | September'24 |

| 2-Ethylhexanoic Acid | Chemical | Europe | 1754 USD/MT | December'24 |

| 2-Ethylhexanoic Acid | Chemical | USA | 1830 USD/MT | October’24 |

| 2-Ethylhexanoic Acid | Chemical | USA | 1800 USD/MT | December'24 |

Stay updated with the latest 2-Ethylhexanoic Acid prices, historical data, and tailored regional analysis

Asia

During the last quarter of 2024, the 2-Ethylhexanoic Acid market in Asia saw prices steadily drop. The main reason for this was a lack of strong demand from industries that typically use the product. In China the average monthly prices went from about 1882 USD/MT (FOB) to around 1855 USD/MT (FOB) in December of 2024. Even though 2-Ethylhexanoic Acid production levels stayed stable, buyers were cautious about making big purchases.

2-Ethylhexanoic Acid Price Chart

Please Login or Subscribe to Access the 2-ethylhexanoic Acid Price Chart Data

Many businesses were holding off due to economic pressures in the region, including rising costs in other areas and uncertainty about market conditions. Suppliers had plenty of stock on hand, but that didn’t help much since there just weren’t enough buyers to absorb it. This mismatch between supply and demand kept prices on a downward path throughout the quarter. The market felt sluggish, with no big events or shifts to change the sentiment.

Europe

In Europe, 2-Ethylhexanoic Acid prices followed a similar downward trend to those in Asia. Major consumer industries, such as automotive and chemicals, reduced their purchasing activity. Suppliers across the region maintained sufficient inventories, with no significant supply chain disruptions. However, the steady supply was not met with adequate demand, causing prices to decline further. Buyers remained cautious, opting to purchase only essential quantities rather than stockpiling. Stable logistics ensured a smooth flow of goods, but the market remained sluggish.

In the European markets the monthly average prices 2-ethylhexanoic acid prices went from about 1810 USD/MT (FOB) to around 1754 USD/MT (FOB) in December of 2024. Economic uncertainties in key European countries also contributed to business hesitation, limiting spending and risk-taking. Overall, it was a subdued quarter for the market, with no indications of a demand recovery.

North America

In North America, 2-Ethylhexanoic acid prices declined consistently throughout the fourth quarter of 2024, primarily due to oversupply. Despite steady production levels, demand from downstream industries such as coatings and chemicals remained insufficient to balance the excess supply. Many companies were already managing surplus stock from previous months, reducing their urgency to place new orders. Additionally, seasonal trends prompted buyers to adopt a more cautious approach, as they aimed to avoid carrying excess inventory into the new year.

The overall economic climate in the region further contributed to restrained purchasing activity, with businesses prioritizing cost-cutting measures and maintaining a conservative stance. These combined factors drove prices downward as the quarter progressed, with no significant market shifts to alter the trend. In USA the monthly prices were at about 1830 USD/MT (CFR) in October’24, and closed December at around 1800 USD/MT (CFR).

Analyst Insight

According to Procurement Resource, the 2-Ethylhexanoic Acid market is expected to improve in the first quarter of 2025 after experiencing weakness for most of the given quarter.

2-Ethylhexanoic Acid Price Trend for the Q3 of 2024

Asia

In China, the 2-EHA market exhibited an upward price trend during the initial weeks of Q3 2024, driven by strong demand from the downstream paints and coatings industry. The automotive sector, particularly electric vehicles (EVs), played a significant role in boosting demand, as manufacturers like BYD and Nio reported impressive sales figures, reinforcing the consumption of 2-EHA in automotive paints and coatings.

Despite the surge in EV sales, the market faced material shortages, exacerbated by reduced production rates and challenging weather conditions, which contributed to tighter supply levels. This imbalance between supply and demand led to an upward push in 2-EHA prices throughout the early part of the quarter. However, as the quarter progressed, prices began to stabilize as the market adjusted to the production constraints, and the off-season for car sales tempered the demand outlook.

Europe

In Europe, the 2-EHA market remained relatively stable compared to other regions. While the automotive sector continued to exhibit steady demand, the European market experienced fewer supply chain disruptions than North America. However, feedstock prices, particularly for propylene, maintained an upward pressure on production costs, contributing to a modest rise in 2-EHA prices. The paints and coatings sector, a major consumer of 2-EHA, saw consistent demand, particularly from the construction and automotive industries, which helped sustain the upward trend in prices. The stable performance in Europe was underpinned by steady supply levels and a balanced demand outlook, with no significant disruptions impacting market dynamics.

North America

The North American 2-EHA market followed a similar trajectory, with prices rising initially due to supply constraints and elevated freight charges. The supply chain disruptions, including port congestion and tropical storms affecting key trade routes, created significant challenges for importers, particularly for shipments from Asia. These logistical bottlenecks added pressure to the already tight supply of 2-EHA in the region.

Despite this, the demand for 2-EHA from the automotive sector, while modest in June, experienced a rebound in July, supported by a strong performance in passenger vehicle sales and growth in the two-wheeler segment. This uptick in automotive activity, particularly in the paints and coatings industry, pushed 2-EHA prices upward. However, by the end of the quarter, the supply chain issues began to ease slightly, though lingering effects from earlier disruptions kept prices relatively elevated.

Analyst Insight

According to Procurement Resource, the price trend of 2-Ethylhexanoic Acid is likely to be dependent upon the fluctuating sentiments of its feedstock commodities.

2-Ethylhexanoic Acid Price Trend for the Q2 of 2024

| Product | Category | Region | Price | Time Period |

| 2-Ethylhexanoic Acid | Chemical | China | 1874 USD/MT | April'24 |

| 2-Ethylhexanoic Acid | Chemical | China | 1841 USD/MT | June’24 |

| 2-Ethylhexanoic Acid | Chemical | Europe | 1819 USD/MT | April'24 |

| 2-Ethylhexanoic Acid | Chemical | Europe | 1790 USD/MT | June’24 |

| 2-Ethylhexanoic Acid | Chemical | USA | 1820 USD/MT | April'24 |

| 2-Ethylhexanoic Acid | Chemical | USA | 1791 USD/MT | June’24 |

Stay updated with the latest 2-Ethylhexanoic Acid prices, historical data, and tailored regional analysis

Asia

2-Ethylhexanoic Acid, or EHA, did not perform well in the Asian markets during the second quarter of the year 2024. The price trajectory was relatively tepid compared to the previous quarter. In the Chinese market, the monthly average prices went from about 1874 USD/MT (FOB) in April to around 1841 USD/MT (FOB) in June’24. The sluggishness in the market was attributed to several factors. In the upstream outlook, the feedstock propylene prices failed to provide any substantial cost support as the procurement rates slid in the concerned markets.

The downstream demands from the adhesive and coating industries were also sub-satisfactory and supported the downward movement in 2-ethylhexanoic acid prices in the Chinese market. The export queries were also largely underwhelming. Concurrently, the Indian market’s performance was also in alliance with its Chinese counterpart, as the supply and demand dynamics were tepid here as well.

Europe

The European 2-EHA prices were found to be wavering in the European markets as well. The monthly average prices stood at around 1819 USD/MT (FOB) at the beginning of the quarter in April’24. However, as the quarter progressed, the average came down to around 1790 USD/MT (FOB) in June’24. The downturn in crude oil prices during this quarter affected the overall commodity markets. Along with that, the coating and adhesive industries were also unable to support the 2-ethylhexanoic acid prices much from the downstream side. Overall, a mixed market performance was observed in Q2’24.

North America

2-Ethylhexanoic acid market trajectory in North America was in close alliance with the Asian and European markets. In the US market, the prices shifted from approximately 1820 USD/MT (CFR) in April to about 1791 USD/MT (CFR) in June’24. The strengthening of the US Dollar was also one reason the commodity prices took a general downfall around the concerned time frame. Other than this, the supply and demand dynamic played a big role in keeping the market consolidated during the said period.

Analyst Insight

According to Procurement Resource, with the current buoyancy in global 2-Ethylhexanoic Acid markets, the prices are expected to remain range-bound going forward in the coming months as well.

2-Ethylhexanoic Acid Price Trend for the Q1 of 2024

| Product | Category | Region | Price | Time Period |

| 2-Ethylhexanoic Acid | Chemical | USA | USD 2845/ MT | March’24 |

| 2-Ethylhexanoic Acid | Chemical | Europe | 1920 USD/MT | January’24 |

| 2-Ethylhexanoic Acid | Chemical | Europe | 1857 USD/MT | March’24 |

| 2-Ethylhexanoic Acid | Chemical | Asia | 1975 USD/MT | January’24 |

| 2-Ethylhexanoic Acid | Chemical | Asia | 1913 USD/MT | March’24 |

| 2-Ethylhexanoic Acid | Chemical | MEA | USD 2787/ MT | March’24 |

Stay updated with the latest 2-Ethylhexanoic Acid prices, historical data, and tailored regional analysis

Asia

During the first quarter of 2024, the 2-ethylhexanoic acid prices moved in the southward direction after swindling on the lower end of the spectrum in the previous quarters. This notable distress in the market was an expected ill consequence of depreciation in industrial growth and consecutive fall in demand from the downstream industries such as automotive and construction throughout Q1 of 2024.

The Asian countries also witnessed a dim momentum of exports due to the ongoing trade struggles, which eventually resulted in the decline in 2-ethylhexanoic acid prices (FOB) from approximately 1975 USD/MT in January to 1913 USD/MT in March’24.

Europe

The advent of the new year brought a slow start for the 2-ethylhexanoic acid market as the prices depicted an oscillating journey during Q1 of 2024. However, as the quarter grew, the 2-ethylhexanoic acid price trend started to decline; however, the fall was not as steep as was observed in the Asian countries. The slow-paced downward movement of the 2-ethyl hexanoic acid prices was based on stagnancy in economic development and demand from the downstream industries.

Among the end-user sectors, the automotive and construction sectors showcased prominent growth, which somehow helped in the rise of 2-ethyl hexanoic acid market momentum, but other challenges, such as low export rates and a rise in inventories, became a cause of concern for the traders. Further, the loss of imports in European countries due to the disruption of the Red Sea route shifted the focus point of the consumers, well evident in the fluctuating movement of 2-ethylhexanoic acid prices as they fell from an average of 1920 USD/MT in January to 1857 USD/MT in March.

North America

Following the global trend, the 2-ethylhexanoic acid price trend in North America too showcased a southward journey as the downstream industries failed to present positive demand of the commodity.

The sour trend in the prices of 2-ethylhexanoic acid was also an indirect consequence of oscillations in the cost of crude oil and raw materials which in turn affected the operational costs heavily. Further, the consumers also seemed reluctant while placing bulk orders due to the consistent rise in inflation and interest rates charged by the banking sector, restricting their spending budgets. However, the price-wise depreciation in the market was only around 3% in the first quarter, but the meek sentiments of the downstream industries do not showcase any favorable sentiments.

Analyst Insight

According to Procurement Resource, the price trend of 2-Ethylhexanoic Acid is estimated to oscillate in the upcoming quarters as the end user demand and cost trajectory of feedstock industries are less likely to support the uptrend of 2-ethylhexanoic acid prices.

2-Ethylhexanoic Acid Price Trend for the October - December of 2023

| Product | Category | Region | Price | Time Period |

| 2-Ethylhexanoic Acid | Chemical | North America | 1945 USD/MT | January 2024 |

| 2-Ethylhexanoic Acid | Chemical | North America | 1952 USD/MT | December’23 |

| 2-Ethylhexanoic Acid | Chemical | North America | 1875 USD/MT | October’23 |

| 2-Ethylhexanoic Acid | Chemical | Europe | 1888 USD/MT to 1960 USD/MT | Oct-Dec 23 |

| 2-Ethylhexanoic Acid | Chemical | China | 2005 USD/MT | December’23 |

| 2-Ethylhexanoic Acid | Chemical | China | 1900 USD/MT | October’23 |

Stay updated with the latest 2-Ethylhexanoic Acid prices, historical data, and tailored regional analysis

Asia

The past quarters failed to support the 2-ethylhexanoic acid market as the prices experienced a consistent downfall, but the fourth quarter picked up the momentum. The dynamics of the market rose on the back of the increasing demand from the downstream industries. Some of the manufacturing plants in the region also underwent maintenance shutdown that helped the prices in China to go from around 1900 USD/MT (FOB) in October’23 to 2005 USD/MT in December’23.

Europe

The European countries showcased a significant appreciation for the 2-ethylhexanoic acid price trends. The third quarter already provided several hints for the revival of the market, which was followed well in the fourth quarter of 2023. The downstream domestic and overseas markets showed significant appreciation in demand, which led to the rise in the 2-ethylhexanoic acid prices from approximately 1888 USD/MT (FOB) to 1960 USD/MT in the last quarter of 2023. The main driver of the market was the paint and adhesives industries as they gained momentum during this time and helped in the rise in the 2-ethylhexanoic acid prices.

North America

The 2-ethylhexanoic acid prices in North America showed a remarkable recovery after a steep fall in the third quarter. The appreciation in the 2-ethylhexanoic acid prices in the fourth quarter of 2023 was around 4% as the market was powered by the demand from the paints and coating industries. The prices went from around 1875 USD/MT (CFR, USA) in October’23 to around 1952 USD/MT in December’23.

Additionally, the long struggle of the US construction and automotive sector seemed to be balanced by the steady recovery of the region’s economy, which in turn favored the rise in the 2-ethylhexanoic acid price trends. However, the market is still recovering, and given the current dynamics, the 2-EHA prices are expected to waver around 1945 USD/MT in January’24.

Analyst Insight

According to Procurement Resource, the price trends of 2-Ethylhexanoic Acid are estimated to grow consistently. The 2-ethylhexanoic acid price graph is likely to be supported by the cost of upstream materials and a significant rise in the demand from the downstream industries.

2-Ethylhexanoic Acid (EHA) Price Trend for the July - September 2023

Asia

In the third quarter of 2023, the prices of 2-Ethylhexanoic Acid (EHA) followed a bearish trend as the demand from overseas players remained muted throughout this period. The consistent downfall of the price trajectory was the result of the lower number of sales in the upstream propylene sector and the overall plunging outlook of the 2-EHA market. However, there was a slight incline in the price momentum during the end phase of this quarter on account of a sudden disruption in the supply chain due to the closure of some significant production units in Japan.

Europe

In the third quarter, the European countries enjoyed a rush in the demand for 2-Ethylhexanoic acid from the downstream paints and coatings sector. In view of this, the manufacturers also looked forward to increasing their production activities, but soon, the demand shifted from an exponential trajectory to stagnancy that, affected the overall market sentiments of 2-Ethylhexanoic Acid (EHA). Further, to maintain the equilibria of the region, the producers lowered their manufacturing activities, and due to this, the trend of 2-EHA prices was able to maintain its stability.

North America

As opposed to the Asia-Pacific and European regions, the prices of 2-EHA in North America followed a bearish trend. Initially, the market momentum was supported by the rise in demand from the automotive, paints and coatings, and construction industries. But with the rise in the influx of imports from the European countries, the level of stockpiles inclined as the demand-supply gap widened. In addition to this, the trend of muted demand was not only shown by the domestic sector but also by the overseas industries, and as a result, the price trend for 2-EHA experienced a downfall.

Analyst Insight

According to Procurement Resource, the price trend of 2-EHA is expected to follow an oscillating trajectory on account of uncertainties in its demand from the downstream industries.

2-Ethylhexanoic Acid (2-EHA) Price Trend for the First Half of 2023

Asia

The Asia-Pacific market in the first quarter of 2023 suffered from the weak performance of the feedstock market and slow demand from the downstream industries, which hampered the growth of 2-Ethylhexanoic acid. Among the downstream industries, the paints and coatings segment remained stable and somehow supported the market of 2-Ethylhexanoic Acid (EHA).

The second quarter further saw a major decline as the construction, plasticizers, and upstream industries showed weak performance, and in view of this, some of the manufacturing units had to reduce their production rates, adversely affecting the prices of 2-Ethylhexanoic Acid (EHA).

Europe

The European countries witnessed a positive trend in the first quarter of 2023 in the 2-Ethylhexanoic Acid (EHA) market as the downstream industries supported the growth of 2-EHA prices. In addition to this, the consumption rates of consumers also improved in the region, which was balanced by the steady supply of imports from Asian countries. However, in the second quarter, the trend shifted towards a downward track as the feedstock costs and demand from the construction, paints, and cosmetics sectors slumped, pushing the price trend of 2-Ethylhexanoic Acid (EHA) towards a negative zone.

North America

The first quarter of 2023 proved to be fruitful for the 2-Ethylhexanoic Acid (EHA) market as the prices inclined gradually. The market sentiments of 2-Ethylhexanoic Acid (EHA) were supported by rising demand and a high influx of new orders from both domestic and international players. However, in the second quarter, as seen in European nations, the prices began to decline due to a fall in industrial activities. The poor performance of the raw material market and the low interest of buyers in this sector further helped in the downward movement of the 2-EHA price trend.

Analyst Insight

According to Procurement Resource, the price trend of 2-EHA is expected to follow a declining trajectory as the demand from the downstream sector and market activities of the feedstocks does not seem to support the 2-EHA price trend.

Procurement Resource provides latest prices of 2-Ethyl Hexanoic Acid. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About 2-EHA

2-Ethylhexanoic acid is characterized by faint smell and pale-yellow color. In chemical production, it serves as the precursor in the synthesis of metal salts such as carboxylates. These carboxylates find application in several formulations such as paints, inks, etc. 2-Ethylhexanoic acid is also used as a plasticizer in the manufacturing of synthetic rubbers and plastics, enhancing their flexibility and durability. Its versatility makes it an essential chemical in the coatings and polymer industries.

2-EHA Product Details

| Report Features | Details |

| Product Name | 2-Ethylhexanoic Acid |

| Chemical formula | C8H16O2 |

| Industrial Uses | Adhesives, Lubricants, Solvents, Coatings and paints |

| CAS Number | 149-57-5 |

| Molecular weight | 144.21 g/mol |

| HS Code | 29159090 |

| Supplier Database | BASF SE, Dow Inc, Perstorp Holding AB, The Eastman Chemical Company, OQ Chemicals Corporation, Jiangxi JYT Chemical Co Ltd, Shenyang Zhang Ming Chemical Co Ltd, TCI Chemical India Pvt Ltd |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com