Product

Anhydrous Hydrofluoric Acid Price Trend and Forecast

Anhydrous Hydrofluoric Acid Price Trend and Forecast

Anhydrous Hydrofluoric Acid Regional Price Overview

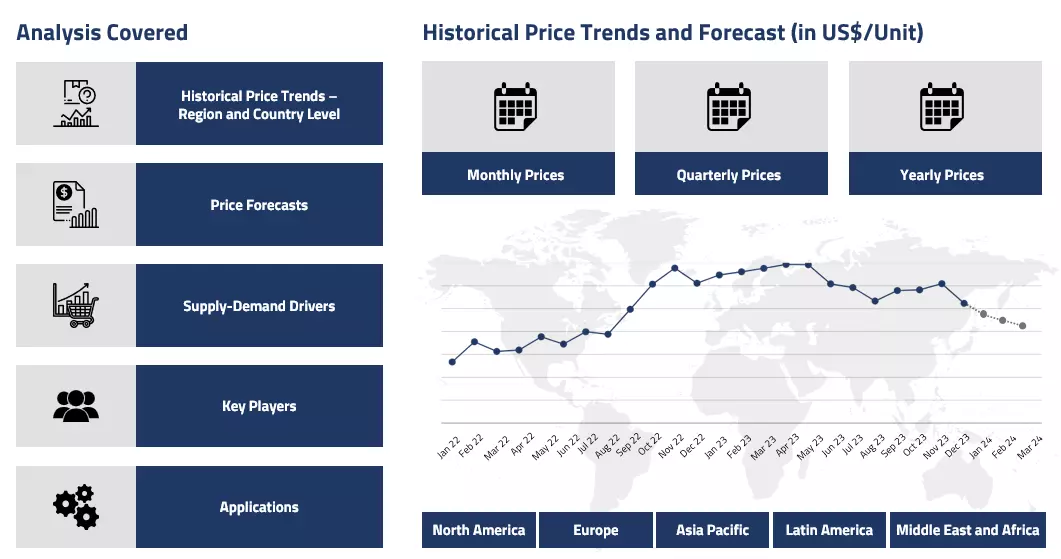

Get the latest insights on price movement and trend analysis of Anhydrous Hydrofluoric Acid in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Anhydrous Hydrofluoric Acid Price Trend for the Q4 of 2024

Asia

In Q4’24, the Asian market for anhydrous hydrofluoric acid experienced a stable trend, though with fluctuations driven by raw material costs. The price of fluorite, a key feedstock, remained high throughout the quarter, influenced by tight domestic supply and ongoing regulatory changes in mining.

Anhydrous Hydrofluoric Acid Price Chart

Please Login or Subscribe to Access the Anhydrous Hydrofluoric Acid Price Chart Data

Despite efforts to improve mining conditions, the supply remained constrained, limiting production and causing pressure on the prices of downstream products like hydrofluoric acid. Additionally, the demand from the refrigerant sector saw a reduction, primarily due to the seasonal slowdown and maintenance activities at factories, which somewhat tempered the market’s momentum.

Europe

The European market for anhydrous hydrofluoric acid in Q4’24 showed stability, with prices being largely influenced by the same upstream supply issues. Fluorite availability remained a challenge, which contributed to higher feedstock prices. However, demand in Europe was relatively stable, supported by industries such as refrigerants and certain chemical sectors, which continued to maintain steady production. Similar to Asia, some factors such as maintenance shutdowns in plants led to reduced consumption in the latter part of the quarter, affecting overall market dynamics.

North America

In North America, the anhydrous hydrofluoric acid market also experienced a period of stability in Q4’24. The region faced similar challenges with tight fluorite supply, which kept pressure on prices. Demand from the refrigerant sector was weaker as the quarter progressed, with factories reducing output as quotas reached their limits and maintenance activities took precedence. This led to a more cautious approach towards procurement and less aggressive price fluctuations compared to earlier in the year. Despite this, the region saw some increase in prices early in the quarter before stabilizing towards the end of the year.

Analyst Insight

According to Procurement Resource, the Hydrofluoric Acid market is expected to remain stable, with potential price adjustments largely dependent on the balance between supply chain dynamics and seasonal demand shifts.

Anhydrous Hydrofluoric Acid Price Trend for the Q3 of 2024

Asia

In the Chinese market, anhydrous hydrofluoric acid prices remained range-bound, primarily due to a balance between supply limitations and weak demand. The supply of fluorite, a key feedstock, was restricted as fluorite mining enterprises faced increasing safety and environmental regulations, limiting production. While the reduced supply of fluorite could have pushed prices higher, the impact was moderated by weak demand.

The terminal demand for refrigerants was sub-par during the rainy season, which led to a decrease in purchasing interest for anhydrous hydrofluoric acid. This, in turn, kept prices from rising significantly. The interplay between restricted supply and weak demand kept prices stable within a narrow range during the quarter. Overall, fluctuating market dynamics were witnessed.

Europe

In the European market, anhydrous hydrofluoric acid prices were influenced by trends in the Chinese market. Prices fluctuated throughout the third quarter of 2024, driven by the intricate interplay between supply and demand factors. Logistical challenges from the previous quarter continued to affect supply levels. The downstream consumption was at its usual level in most of the member countries. Conclusively, a buoyant market performance was observed.

North America

In the North American market, anhydrous hydrofluoric acid prices remained consolidated throughout the quarter. Inclined feedstock prices, coupled with weak demand from the consuming sectors such as refrigerants, contributed to this volatility. Additionally, logistical challenges caused by the hurricane season disrupted the market. Even though there was no defined direction the American anhydrous hydrofluoric acid market took during the said period occasional ups and downs could be seen.

Analyst Insight

According to Procurement Resource, the prices of anhydrous hydrofluoric acid are expected to show a declining trend in the coming winter months due to an anticipated decline in downstream demands, particularly from the refrigerating industry.

Anhydrous Hydrofluoric Acid Price Trend for Q2 of 2024

Asia

Anhydrous hydrofluoric acid prices in the Asian markets were found to be fluctuating for the majority of the said period of Q2’24. In both Indian and Chinese markets, the anhydrous hydrofluoric acid rates were observed to be wavering within very close limits. After a muted first quarter, the Chinese market still showcased some marginal upliftment; the Indian market, on the other hand, remained confined for the most part.

AHF is a highly significant industrial chemical primarily used in the production of fluorocarbons and fluoropolymers, which are essential in the manufacturing of refrigerants, pharmaceuticals, and high-performance plastics. Therefore, the consumer demands from these sectors also heavily influence the price trajectories. With close-bound supply and demand, the anhydrous hydrofluoric acid prices exhibited a mixed overall outlook.

Europe

In the European market, the price performance was not very different from the Asian markets; the similarities described the interdependencies of these major global markets. However, for Europe, the logistical challenges remained paramount for most of the commodities throughout Q2’24. The Red Sea crisis was still going on, and amidst a continuation of the Russian war in its third year, the Israel and Hamas conflict deepened even more. Even though the situation did not escalate with Iran as per prior expectations, the shipping issues remained intact for the European suppliers and market stakeholders.

North America

Influenced by the buoyancy in the global anhydrous hydrofluoric acid market, the prices in the American markets also showcased borderline stagnancy throughout the given span. Along with all the ongoing global trade complications, the impending presidential elections in the United States also kept the domestic markets stable. With a cautious approach from suppliers and regular customer interest, the prices remained anchored; conclusively, a balanced market run was observed.

Analyst Insight

According to Procurement Resource, the Anhydrous Hydrofluoric Acid market consumption is not likely to improve in the upcoming monsoon seasons, and the supply outlook also appears to be balanced. Hence, owing to this, a similar pricing situation is anticipated going forward as well.

Anhydrous Hydrofluoric Acid Price Trend for the Q1 of 2024

Asia

Anhydrous hydrofluoric acid prices fluctuated in the Asian market throughout the said period of time. With a zig-zag trajectory, the prices were observed to be wavering within very narrow limits for the majority of time. The Indian anhydrous hydrofluoric acid market was relatively more stable than the Chinese market. Since the acid is primarily used in the etching and cleaning operations, the price trends directly depend on the downstream demands from these sectors.

The pharma industry also consumes HF capaciously, thus the demands from the pharma sector also influence the market prices. During the said period, however, the supply and demand outlooks were largely able to maintain their gaps for the most part. Demands have been humble since the very beginning of the quarter in January. To complement this, the suppliers were also cautious in procuring stocks, which managed the inventory levels in accordance with the demands. Overall, a very muted market performance was witnessed.

Europe

Influenced by the fall in the Chinese market prices, the European anhydrous hydrofluoric acid industry too underwent a steady run during the given period. The economic uncertainties in the region that have persisted since the onset of the Russian war have been trampling the general trade sentiments in the region and also affecting the anhydrous hydrofluoric acid market. Primarily, it was the downfall in the market queries and orders in the European market that made the prices waver for anhydrous hydrofluoric acid.

North America

The American anhydrous hydrofluoric acid market followed the same suit as its global counterparts. The price trend was experienced to be fluctuating for the most time. Supply chains were disrupted for most of the global trade as freight issues were unfolding in different regions. Along with that, the demands were also not such that suppliers could do much about it. The existing inventories were largely sufficient to cater to these orders and queries. Overall, mixed market sentiments were seen.

Analyst Insight

According to Procurement Resource, Anhydrous Hydrofluoric Acid price trends are expected to continue wavering in the coming months as well. The current supply and demand dynamic presents similar projections for the near future.

Anhydrous Hydrofluoric Acid Price Trend for the October - December of 2023

Asia

Anhydrous hydrofluoric acid market trend closely followed the price movements of its feedstock materials, concentrated sulfuric acid, and hydrofluoric acid. Since the industrial activities ramped up as the year-end approached, the market saw an elevation in the downstream demand, and prices for Anhydrous Hydrofluoric Acid exerted positive trend.

This rise in demand further pulled the market trend up for the Asian markets, particularly India and China. Feedstock sulfuric acid prices also almost doubled by the end of the quarter; this provided an additional push to the hydrofluoric acid market. Overall, with rising demands from the glass and metal industries and inclined feedstock prices, the anhydrous hydrofluoric acid price graph moved uphill during Q4’23.

Europe

The European market trend for anhydrous hydrofluoric acid were found to closely reflect its Asian counterpart during the last quarter of 2023. The European dependency on Asian imports justified these trend. Other than this, the disparity between the supply and demand dynamics of anhydrous hydrofluoric acid also pushed the European market forward.

North America

The North American market trend for anhydrous hydrofluoric acid were positive yet wavered within narrow limits. Demands were a little higher than the regular, and the supply chain issues pertaining to the Israel-Hamas war affected the upstream market dynamics. Overall, rising trend were observed for anhydrous hydrofluoric acid during Q4’24.

Analyst Insight

According to Procurement Resource, market analysis gives positive projections for the Anhydrous Hydrofluoric Acid for the coming months. The existing gap between supply and demand outlooks will take a little time to stabilize.

Anhydrous Hydrofluoric Acid Price Trend for the July - September of 2023

Asia

The third quarter of 2023 was observed to be disconcerting for the market trend of anhydrous hydrofluoric acid, especially in the Asian region. The market demands from the downstream pharma and chemical sector were struggling to keep the market momentum going. Further, the inventories were stacked to a limit of saturation.

All these situations made market demand the limiting factor influencing anhydrous hydrofluoric acid price trend. Since the demands remained bearish, the prices for anhydrous hydrofluoric acid also tottered at the lower end of the price graph. Hence, according to the anhydrous hydrofluoric acid price analysis, very unsatisfactory performance was experienced throughout the said period.

Europe

The European anhydrous hydrofluoric acid price trend were observed to be mixed during Q3’23. Price trend first inclined in the first half of the quarter and then declined in the latter half. The downstream demands from the glass and metal industries guided these price patterns.

North America

The North American market’s performance for anhydrous hydrofluoric acid was no different than the Chinese market. Amidst growing interest rates and heightening inflation, the end customer demands were severely struggling in the region. The consumer approach had become very necessity-centric, and whatever queries arrived in the domestic American market, the existing inventories were well capable of taking care of that. The silent tiffs with China had also put offshore trading under confusion. Overall, an underwhelming and cold market run was observed.

Analyst Insight

According to Procurement Resource, the anhydrous hydrofluoric acid price analysis doesn’t suggest any noteworthy improvements in the price dynamics going forward. Some long and high jumps in the demand spectrum can pivot the price graph upwards.

Anhydrous Hydrofluoric Acid Price Trend for the First Half of 2023

Asia

The prices of anhydrous hydrofluoric acid fell in the first quarter of 2023 and fluctuated in the second quarter. The trend in the first quarter was affected by the slow demand from the domestic and overseas markets, weak support from the feedstock prices, and ample availability of the product in the market. In the initial months of the second quarter, the anhydrous hydrofluoric acid market was supported by the positive push by the feedstock prices and increased demand from the refrigeration industries. But in the later months, the demand became flat, which led to the stockpiling of the product in the market, and with declining feedstock and crude oil prices, the price trend of anhydrous hydrofluoric acid declined.

Europe

A volatile trend was observed in the first and second quarters of 2023 in the anhydrous hydrofluoric acid market. In the initial months of the first quarter, the price trend inclined as the entry of new market players increased the competition in the market. However, in the following months, the rising pressure of inflation and uncertainties in the economic condition of the anhydrous hydrofluoric acid market led to a decline in its prices. In the second quarter, the trend was mostly affected by the rising prices of feedstock materials, low inventories, and high demand from the end-user industries. The rising demand and spreading of heatwaves in the region also helped drive the anhydrous hydrofluoric acid prices positively.

North America

The prices of anhydrous hydrofluoric acid inclined initially in the first quarter of 2023 as they were supported by the balance in the supply and demand dynamics of North America. However, the trend declined towards the end of Q1 as the rising rates of inflation and poor purchasing potential of buyers negatively impacted the market. Then again, in the second quarter, with improvement in the demand sector and the onset of the summer season, the price trend inclined. The prices then stabilized in May and June and resulted in a flat trend of anhydrous hydrofluoric acid.

Analyst Insight

According to Procurement Resource, anhydrous hydrofluoric acid prices are estimated to showcase a fluctuating trajectory in the upcoming quarter, given the uncertain downstream demands.

Procurement Resource provides latest prices of Anhydrous Hydrofluoric Acid. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Anhydrous Hydrofluoric Acid

Anhydrous hydrofluoric acid is a highly corrosive and hazardous chemical compound with the chemical formula HF. It is a colorless and pungent gas when in its purest form or a fuming liquid when dissolved in water. Anhydrous hydrofluoric acid is a strong acid and can react violently with various materials, including glass and metals. It is primarily used in industrial processes, such as etching and cleaning operations, and also finds applications in the manufacturing of certain chemicals and pharmaceuticals.

Anhydrous Hydrofluoric Acid Product Details

| Report Features | Details |

| Product Name | Anhydrous Hydrofluoric Acid |

| Chemical Formula | HF |

| CAS Number | 7664-39-3 |

| Molecular weight | 20.006 g/mol |

| Synonyms | Fluorane, Hydrogen fluoride |

| Industrial Uses | Glass etching, Glass metal cleaning, Fluorine gas production, Catalyst |

| HS Code | 28111100 |

| Supplier Database | Daikin, Dongyue Group, SinochemYingpeng Chemical, Honeywell International Inc, Stella Chemifa Corp., Koura Global, Lanxess, Solvay |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Anhydrous Hydrofluoric Acid Production Processes

The process starts with the aqueous hydrofluoric acid solution reacting with sulfuric acid. After heating the resulting solution, sulfuric acid works as a dehydrating agent to separate the water from the hydrofluoric acid component. After heating, the water vaporizes, and the resulting chemical compound is anhydrous hydrofluoric acid.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com