Product

Bauxite Price Trend and Forecast

Bauxite Price Trend and Forecast

Bauxite Regional Price Overview

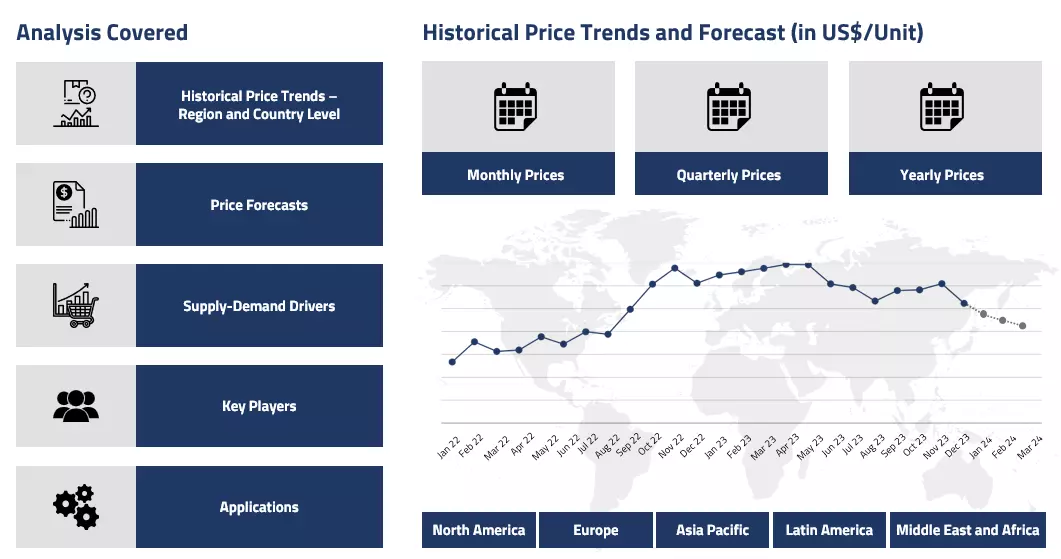

Get the latest insights on price movement and trend analysis of Bauxite in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Bauxite Price Trend for the Q4 of 2024

Asia

The Asian bauxite market experienced significant price appreciation throughout the fourth quarter of 2024, with Chinese imports facing pressure. The region saw record-high prices, driven by supply constraints and strong demand from aluminium refineries. China's domestic bauxite production remained constrained by environmental inspections, forcing increased reliance on imports.

Bauxite Price Chart

Please Login or Subscribe to Access the Bauxite Price Chart Data

The situation was further complicated by disruptions in Guinea, China's primary bauxite supplier, leading to heightened market anxiety and price volatility. The Shanghai Futures Exchange saw unprecedented trading volumes in related commodities, reflecting the market's nervousness about raw material availability.

Europe

European bauxite markets demonstrated strong upward momentum in Q4'24, influenced by global supply chain disruptions and increased regional demand. The market tightness was particularly pronounced as European refineries competed for available supplies amid worldwide shortages. The situation was exacerbated by logistics challenges and increased energy costs, which affected the overall cost structure of bauxite processing. European buyers faced additional pressure due to limited alternative supply sources, as traditional suppliers focused on serving Asian markets where prices were more attractive.

North America

The North American bauxite market followed the global upward trend but with relatively more stability compared to other regions. Supply concerns emerged late in the quarter when shipping disruptions affected Brazilian exports, a key source for North American refineries. The market saw increased pressure from rising freight costs and longer delivery times, while domestic aluminium producers maintained steady demand for the raw material. The region's prices reflected the global supply tightness, though the impact was somewhat moderated by strategic stockpiling earlier in the year.

Analyst Insight

According to Procurement Resource, the Bauxite market is expected to remain tight moving into 2025, with supply constraints likely to continue supporting elevated price levels. The industry's focus on developing alternative supply sources and improving supply chain resilience could help stabilize prices in the medium term, though immediate relief appears unlikely given the structural nature of current market challenges.

Bauxite Price Trend for the Q3 of 2024

Asia

In Q3'24, the prices of bauxite showed mixed trends in the Asian market. The market began on a softer note after running bullish in the previous quarter. The prices showed a declining trajectory for most of July. As the quarter progressed, the shortage in the supply of bauxite, primarily due to lower shipments from Guinea, the world's top producer, had turned the prices northwards. A steep incline was seen for the rest of the quarter, which remained well supported by the positive downstream demand from aluminum industries.

The smooth functioning of smelting plants in Yunnan Province was ensured due to improved rainfall that alleviated power shortages in the hydro-rich province, supporting the demand for bauxite. Meanwhile, the Indonesian House of Representatives (DPR RI) has proposed lifting the bauxite export ban enforced in June 2023. The ban has led to a surplus in domestic bauxite supply but has severely limited exports, particularly to China. The lifting of the ban will be good news for smelters as they face challenges from the current rising prices of aluminum metal.

Europe

The prices of bauxite in the European market mirrored the trend found in the Asian market. Initially, the market dynamics presented a humble picture as the demand from construction, automotive, and other sectors was low. The downstream aluminum market was experiencing a slowdown in Germany along with other regions such as Italy and Spain. However, the supply constraints still kept the bauxite prices elevated for the majority of the said quarter.

North America

In North America, bauxite prices were expected to benefit from rising aluminum prices. The most anticipated interest rate cuts by the U.S. Federal Reserve were announced on September 19, 2024. The Fed announced a 50-basis point cut, which made the aluminum prices surge dramatically. This contributed to higher aluminum prices both domestically and globally, profiting from the prices of bauxite.

Analyst Insight

According to Procurement Resource, the prices of bauxite are expected to run bullish in the near future influenced by rising prices of aluminium metal. The supply of bauxite could be affected in the coming winter months due to logistical and mining challenges brought on by snowstorms.

Bauxite Price Trend for the Q2 of 2024

Asia

China’s bauxite imports surged consistently throughout the second quarter of 2024 due to the growing demand from primary metal production as several smelters, particularly from Yunnan, resumed their operations given the increased generation of hydropower supported by sufficient rainfall. This could also be derived from the National Bureau of Statistics data, which reports that the primary aluminium production in May soared to approximately 3.65 million tonnes.

Other sectors fueling the demand for the commodity were automotive, aerospace, construction, packaging, and consumer products. Also, the growing dependence of Chinese aluminium production lines on overseas imports as the domestic supply fails to suffice with the demand further supported an uptrend in the prices of bauxite. However, the growing dependence of the world on Guinea and Australian produce amid the energy transitioning phase has severed the supply chains since the advent of this year and has thus raised the bar for bauxite prices even further.

Europe

After experiencing a slow start in the initial phase of the second quarter, the bauxite market registered gradual gains as the quarter progressed towards its end. As the major bauxite-producing nations such as Guinea and Australia increased their mining outputs, the constraints over the supply chains eased out. Additionally, the industrial production of Europe increased by almost 0.5% m-o-m, and the inflationary pressure stood stagnant at around 2.4%, indicating a gradual recovery of the overall downstream markets and expansion in the demand for bauxite. Further, the stricter environmental sanctions of European countries, adoption of greener practices, and rise in demand for aluminium amid energy transition practices have further favored the positive movement of bauxite prices during Q2 of 2024.

North America

The North American market recorded a bearish run during the first quarter of 2024, and the constricted supply of bauxite made the recovery of prices in the second quarter much more difficult. Similar to the European countries, in the early phase, the market struggled with weak downstream demand, but gradually, the market rebounded under the influence of limited exports from Guinea and limited exports from Australia.

The noticeable incline in the cost of raw materials along with energy production further posed no choice for the traders but to increase their quotations for bauxite. On the other hand, the downstream industries, such as automotive and manufacturing, presented only moderate demand for the commodity, limiting the growth potential of the market.

Analyst Insight

According to Procurement Resource, the price trend of Bauxite is estimated to struggle with the limited supply from major producers, issues with the traditional trading routes, and slow demand from the downstream industries in the adjacent quarters.

Bauxite Price Trend for the Q1 of 2024

Asia

The Chinese bauxite market experienced a significant incline in the first quarter of 2024. This rise was initially prompted by an explosion at an oil terminal in Conakry, Guinea, a major bauxite supplier to China's bauxite refineries. China's growing dependence on Guinean bauxite, which accounted for 70% of its total bauxite imports in 2023, further intensified the disruption of the supply from Guinea. Additionally, tight supply conditions in the Chinese aluminium raw materials market from other players further worsened the situation.

The traders and domestic automotive and construction sectors also seemed to struggle with the loss of importing volumes, and due to the widespread usage of bauxite in these industries, the growth projection of these sectors was further hampered. In view of the scarcity of the materials, the overseas exporters quoted significantly higher prices of bauxite in the first quarter of 2024, leading to a shoot-up in its price trend.

Europe

Base metals such as bauxite prices experienced a volatile start in the new year due to global economic uncertainties, with initial optimism fueled by prospects of US Federal Reserve rate cuts and monetary policy changes in China affecting its exporting policies. However, mixed signals from the downstream industries and delayed rate cuts led to heightened price volatility in the end months of the quarter.

Additionally, concerns over the rising number of EU sanctions on Russian aluminium further raised the prices of bauxite by the end of the quarter. Additionally, an explosion in Guinea triggered a rally in aluminium, alumina, and bauxite prices, disrupting the global supply of the commodity and triggering the battle between major economies. However, despite fluctuations, the bauxite market faces a dim outlook amid a ban on Russian aluminium exports to the EU, which could further oscillate the prices and supply dynamics.

North America

In the first quarter of 2024, the bauxite prices rose due to heightened demand from downstream Aluminium industries, driven by infrastructure development projects in North America. Q1 of 2024 saw government expenditure in the mining projects rise to boost the bauxite production rates, reduce dependence on overseas imports, and stabilize the bauxite price trend in domestic markets. However, the explosion at the Guinea oil terminal constricted the functioning of global supply chains, whose effect was evident in the fast-paced northward moving trajectory of bauxite prices in North America.

Analyst Insight

According to Procurement Resource, the price trend of Bauxite is estimated to incline further upwards in the next quarters as the global supply crunch and rise in industrial growth of the automotive sector will lead to the disruption of supply-demand equilibrium in global markets.

Bauxite Price Trend for the October - December of 2023

| Product | Category | Region | Price | Time Period |

| Bauxite | Chemicals | USA | USD 1400/MT | Dec'2023 |

Stay updated with the latest Bauxite prices, historical data, and tailored regional analysis

Asia

Bauxite prices experienced a major upsurge in the Asian region during the final quarter of the year 2023. At first, the high downstream aluminum demands from the various industries were driving the bauxite price curve uphill. But later, a severe supply shortage became the primary driver for bauxite price trend.

The rise in transportation charges as ocean freight got expensive through the Panama Canal pushed the bauxite prices up initially. However, a major fuel depot explosion in Guinea, the world’s third largest bauxite producer, on December 18th sent the global bauxite market into a frenzy.

Guinea had become China’s biggest bauxite exporter after the Indonesian export ban in June. So, the explosion incident shocked the Asian bauxite market as the ore prices went up by around 7% within the week of the explosion, and a substantial dip in the aluminum inventories in the country was noticed during the same time. Overall, rising price trend were observed for bauxite during Q4’23.

Europe

The bauxite price hikes in Asia also impacted the European market, as the bauxite prices in Europe showed considerable inclination during the final quarter of the year 2023. The industrial demands were relatively lower since the market was still stabilizing. Overall, general price trend remained afloat throughout the said period.

North America

The North American bauxite market was also influenced by the price inclines in the global market. The American market, too, observed a supply curtailment for the said time period; however, the dull demands did balance out the upward push a little. Overall, market sentiments were largely positive for the US bauxite market.

Analyst Insight

According to Procurement Resource, the Bauxite market analysis suggests positive projections for the coming months as well. The automobile industries are expected to pose even higher demands for aluminum in the coming year, so the prices are expected to keep on the positive trail.

Bauxite Price Trend for the July - September of 2023

Asia

In the Asia Pacific, the bauxite regional prices witnessed a slow and gradual leap with the help of the growing automotive sector. The sales of bauxite were positively influenced by the increasing demand for electric vehicles and improvement in the supply chains with the inauguration of several mining projects.

The rates of procurement were inclined not only in the domestic region but also from the overseas players. In addition to the downstream automotive sector, the energy production and refineries industries also contributed significantly to keeping the bauxite price trend under the green light.

Europe

The European countries struggled with the effective functioning of their supply chains, which resulted in the depletion in the level of inventories of bauxite. Amid the poor performance of the supply chains, the demand for bauxite and its related commodities increased severalfold. The most significant contributor to this demand for bauxite was the electric vehicle sector. In view of this, the government looked forward to supporting its bauxite storehouses with the imports from Russia. Thus, with limited availability of raw materials, restricted movement of supply chains, and exponentially inclining demand, the bauxite price trend followed a bullish trend.

North America

The growth of renewable sources of energy, such as solar panels and electric vehicles, resulted in the high demand for bauxite during the initial phase of the third quarter of 2023. However, North America’s mining sector showcased only feeble movements, and along with the ban on Indonesian exports, the inventories of bauxite dried up. As the quarter progressed, the demand from the downstream industries began to slow down, and with high economic uncertainties, the bauxite price trend struggled to maintain their momentum.

Analyst Insight

According to Procurement Resource, the price trend of Bauxite is estimated to follow an oscillating route as the ineffective functioning of the supply chains and uncertainties in the downstream industries sectors are supposed to dictate the bauxite prices.

Bauxite Price Trend for the First Half of 2023

Asia

The bauxite market in the first and second quarters of 2023 fluctuated in the Asia-Pacific region as trading activities slumped due to the onset of the Chinese New Year holiday season. The slow movement of the market led to the rise in the level of inventories and accumulation of the product in the market. The manufacturers also struggled with the decrease in demand from the associated aluminum industries and the electronics market. A slight incline in the later months was seen as the high-priced imports from international markets flooded the region.

Europe

A mixed price trend for bauxite was observed in the first two quarters of 2023. The region was adversely affected by the volatility in the supply chains and inconsistent purchasing of consumers. Sanctions on the supply of metal from Russia and the reduction in domestic production rates negatively impacted the bauxite prices. However, towards the end of the first quarter and in the second quarter, the price trend inclined as it gained support from overseas buyers and an increased number of inquiries from traders and refiners.

North America

In North America, the bauxite prices declined in the initial months of the first quarter of 2023 as the market had sufficient availability of products. But in the subsequent months of the first and throughout the second quarter, the market gained momentum as soon the level of inventories depleted, and the levels of extraction declined.

Analyst Insight

According to Procurement Resource, the price trend of Bauxite is estimated to showcase a volatile trend. The demand from end-user industries and the level of inventories in the market will guide the bauxite market in the upcoming quarter.

Procurement Resource provides latest prices of Bauxite. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Bauxite

Bauxite is a sedimentary rock composed primarily of aluminum oxide minerals, like gibbsite, boehmite, and diaspore, along with various impurities. It is the primary source of aluminum metal and extensively mined worldwide. Through the Bayer process, bauxite is refined to extract alumina, which is then smelted to produce aluminum.

This lightweight and corrosion-resistant metal finds numerous applications in industries such as aerospace, transportation, construction, and packaging. Bauxite is also used to manufacture refractories, abrasives, and chemicals. Despite its industrial significance, bauxite mining and processing can have environmental challenges, requiring sustainable practices to mitigate impacts.

Bauxite Product Details

| Report Features | Details |

| Product Name | Bauxite |

| Chemical Formula | Al2O3.2H2O |

| CAS Number | 1318-16-7 |

| Molecular weight | 119.977 g/mol |

| Industrial Uses | Aluminium production, Refining, Refractories, Cement, Abrasives |

| HS Code | 26060020 |

| Supplier Database | Alcoa Corporation, Aluminium Corporation of China Limited, Norsk Hydro ASA, NALCO India, Hindalco Industries Ltd, Emirates Global Aluminium PJSC |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Bauxite Production Processes

The ore is first washed and then crushed into smaller parts. These particles are then mixed with used liquor to create a slurry that is simple to pump. Desilication, which takes the silica out of the content, follows the procedure. After that, the mineral mixture is added to a tank containing caustic soda, which will react with the mixture to produce sodium aluminate and other materials.

Alumina would then precipitate on the solution as the final product is allowed to age. The alumina is next cleaned, refined, and calcined to remove any remaining impurities before being sent for smelting to produce aluminum metal.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com