Product

Diethylene Glycol Price Trend and Forecast

Diethylene Glycol Price Trend and Forecast

Diethylene Glycol Regional Price Overview

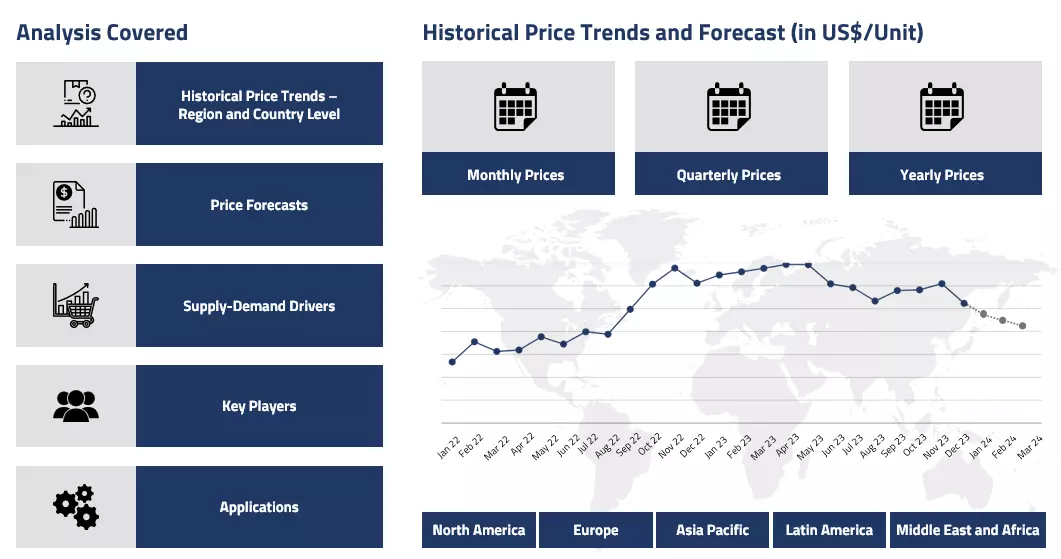

Get the latest insights on price movement and trend analysis of Diethylene Glycol in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Diethylene Glycol Price Trend for the Q3 of 2024

Asia

The price of diethylene glycol showed a lukewarm performance in the Chinese market. The pricing outlook of diethylene glycol relied on many factors but mainly mirrored the price trajectory of its feedstock material ethylene. A slight rise in ethylene prices provided some cost support to diethylene glycol. At the beginning of the quarter, the prices fluctuated in a narrow range because of borderline stagnancy in supply and demand fundamentals.

Diethylene Glycol Price Chart

Please Login or Subscribe to Access the Diethylene Glycol Price Chart Data

Inventory levels at major ports increased slightly, however, weak downstream production of unsaturated resins kept overall consumption low. with major production plant shutdowns and rising prices of ethylene dioxide the prices showed some rebound in the later days. Conclusively, quarter concluded on a hopeful note for diethylene glycol.

Europe

Diethylene glycol exhibited a favorable trend in the European markets in the third quarter of 2024, influenced by the other key global markets. Rising prices were bolstered by increasing upstream manufacturing costs. Manufacturing firms were operating at reduced production capacities, to save costs hampering the regional supply security for Europe. This tight supply contributed to a notable price elevation in the later days of the quarter. The demand from the downstream sectors was still largely underwhelming. Apart from this, increased energy and other operational expenses raised the overall production cost, which further tightened the profit margins for suppliers. Overall, prices remained tugged between slow supply and dull demands without much room for improvement a tepid market performance was witnessed.

North America

The prices of diethylene glycol in North America showed an oscillating trend reflecting the prices of its raw material, ethylene oxide. Occasional supply constraints imparted temporary peaks in diethylene glycol price graph. The North American hurricane season exacerbated existing supply challenges, with Hurricane Beryl causing logistical hindrances adding to the suppliers’ worry. Additionally, unplanned outages, including one at Nova Chemicals' ethylene cracker in Louisiana, also impacted supply levels. These factors slightly pushed the prices up, but the domestic market is expected to stabilize after the hurricane season.

Analyst Insight

According to Procurement Resource, the price of is expected to show correcting trends in the near future since the manufacturing costs are likely to ascend even more.

Diethylene Glycol Price Trend for the Q2 of 2024

Asia

In Q2 2024, the domestic diethylene glycol market in China experienced fluctuations marked by periods of stability and slight declines. In May, the market initially saw a rise due to limited supply at main ports, but weak demand, particularly from the polyester and UPR sectors, led to a subsequent weakening of market momentum. The volatility of the market was further enhanced in June as the cost support from the feedstock commodities turned frail.

Amid this bleak outlook for the demand sector, the supply side of the market also witnessed a decline in production volumes, more pronounced after the resumption of market activities after the May Day holidays. The price of the commodity, thus, remained steady with minor reductions due to balanced supply-demand fundamentals and fluctuating market sentiments. The traders, on the other hand, further anticipated that the next quarter might not turn in favor of the market and thus, by the end of Q2, started lowering their market quotations.

Europe

In the European market, particularly in Germany, diethylene glycol prices saw an upward trajectory. This increase was largely driven by supply constraints and significant logistical disruptions. The region experienced heavy rainfall and severe flooding, which caused substantial disruptions to supply chains and delayed shipment arrivals at European ports. These natural events also led to road closures and stoppages, severely affecting both import and export operations via truck and rail. Consequently, the constrained supply led to an incline in diethylene glycol prices.

Adding to the supply challenges, INEOS Group Limited reduced its operational capacity for a maintenance period, further limiting the supply of the commodity in the region and adding upward pressure to diethylene glycol prices despite the stable demand in the downstream resin industry. Although the decline in the price of ethylene oxide, diethylene glycol primary feedstock, due to falling crude oil prices, did little to offset the supply-induced price hikes for DEG.

North America

The US market experienced a declining trend in diethylene glycol prices during the latter part of the quarter after a roughly stable trend in the initial phase. The primary factors contributing to this decrease were rising domestic inventory levels and a decrease in crude oil prices. Amid the efficient supply and rapid increase in diethylene glycol production, the market observed dim demand throughout the period, particularly from the downstream resin industries, which became much more visible in the months of May and June. Moreover, the low water levels in the Panama Canal, the global surge in freight charges amid fluctuating cost of transport, and rising geopolitical tensions also played a significant role in depleting export profit margins, keeping the diethylene glycol price trend on the lower end of the pricing spectrum.

Analyst Insight

According to Procurement Resource, the price trend of Diethylene Glycol is expected to be driven by limited global production activities and expansion of the consumer base in the upcoming quarters.

Diethylene Glycol Price Trend for the Q1 of 2024

| Product | Category | Region | Price | Time Period |

| Diethylene Glycol | Chemicals | Europe | USD 1100/MT | March 2024 |

Stay updated with the latest Diethylene Glycol prices, historical data, and tailored regional analysis

Asia

During the first quarter of 2024, the domestic diethylene glycol market in China experienced a period of narrow changes. While there were limited changes in the demand dynamics of the market, the number of shipments leaving the Asian ports declined, reducing the profit margins from exports. Despite a slight decrease in inventory and ongoing maintenance of key equipment units, the overall supply also remained relatively dim.

The Chinese market also faced a slowdown amid the onset of Chinese New Year holidays and Spring festivities, which limited the procurement rates of the downstream industries. Also, the macroeconomic outlook of the region also seemed to be improving at a slower pace, offering only limited support to the ethylene glycol market.

Europe

In the first quarter of 2024, the European market experienced a similar trend to the USA, with Germany seeing a price surge of diethylene glycol. This increase was primarily due to constrained regional supply and a significant rise in local demand. At the same time, the number of international offers declined by a slight margin due to the disruption of supply chains amid the ongoing Israel-Hamas crisis.

The feedstock, ethylene oxide prices also rose adding to production costs along with the inclining prices of crude oil. Additionally, logistics hurdles, including disruptions in marine freight due to the Red Sea crisis and protests in the European region, further complicated supply-demand dynamics. The shutdown of key players like the Eastern Petrochemical Company and Yanbu National Petrochemical Company due to maintenance and loss of export volumes, respectively, reduced feedstock inventory, contributing to export price increases.

North America

The diethylene glycol prices surged by a significant margin in North America in the first quarter of 2024, driven by heightened downstream demand amid tight supply conditions. Several major players, including Dow Chemical, Indorama Venture, and Lotte Chemical Corporation, either shuttered production units or reduced operational capacities due to freezing cold weather conditions, disrupting the supply chains.

On the other hand, the demand rates from the downstream sectors like polyester and antifreeze improved significantly, fueled by the improving macroeconomic indicators. This combination of factors resulted in a significant supply-demand gap overtaken by insufficient feedstock inventory, prompting key players to raise product prices.

Analyst Insight

According to Procurement Resource, the price trend of Diethylene Glycol is estimated to depict a bleak trajectory in the forthcoming quarters as the uncertain demand from the downstream industries and feeble outlook of feedstock material might hinder the growth of the market.

Diethylene Glycol Price trend for the October - December of 2023

Asia

The Diethylene Glycol market experienced mixed behavior in the Asian region during the final quarter of the year 2023. Since the downstream demands from the plastic, paint, coating, textile, etc industries were about regular, the availability and costs of the feedstock ethylene oxide and ethylene became the primary market drivers for diethylene glycol.

The Chinese diethylene glycol market still performed better than the corresponding Indian market. The Indian diethylene glycol market experienced a slight fall in prices; however, the Chinese market saw a marginal growth in the prices owing to the development in the ethylene market trend. Overall, these variations in the diethylene glycol price patterns exuded mixed market sentiments throughout the entire discussed period.

Europe

The European market trend were observed to be struggling during the given span of Q4’23. Along with the sluggishness in the feedstock ethylene and the ethylene oxide markets, the diminished demands from the consuming industries also played their part. Further, industrial activities came to a standstill as the holiday season approached, negatively influencing the prices.

North America

The North American diethylene glycol market, too, behaved in accordance with the European market. The market prices were observed to be fluctuating at the lower end of the quarter. However, there were some short-lived and temporary upward movements in the price graph. Nonetheless, the market remained weak throughout the said period.

Analyst Insight

According to Procurement Resource, the Diethylene Glycol market prices are expected to continue to waver lowly in the coming months. Since no sudden rises in downstream demands are projected, the price trend are likely to behave in a similar way.

Diethylene Glycol (DEG) Price trend for the July - September of 2023

Asia

Diethylene Glycol (DEG) experienced mixed price trend in the Asian market in the third quarter of the year 2023. The quarter began on a lower note, with the high inventories and dull demands pushing the prices down in July’23. However, the mid-quarter period witnessed a reverse shift since the industrial demands steadily started picking up.

To the supplier’s respite, the product movement paced up a little, causing the Diethylene Glycol price graph to shift in an upward direction. The quarter ended on a more stable note as the price trend wavered at a moderate level. Cost support from the raw material ethylene was also crucial in stabilizing the overall Diethylene Glycol market outlook in the Asian region. The general market sentiments were moderate.

Europe

The European diethylene glycol market almost mimicked the Asian diethylene glycol market trend since, after an underwhelming run in the first half of the third quarter, the price trend tilted upward in the second half. Industrial consumption from paints, costings, plastics, etc. sectors drove the price trend along with the available inventory stocks. Overall, mixed market sentiments were observed.

North America

The North American price trend for diethylene glycol were no different from the global trend. After a sluggish run in the former half of the quarter, the price trend started showing improvements from mid-quarter. The oscillations in the price index largely followed the fluctuations in downstream demands from the consuming sectors. The general market outlook was observed to be mixed.

Analyst Insight

According to Procurement Resource, Diethylene Glycol prices are anticipated to strive for stabilization going forward as the gap between supply and demand dynamics is seemingly shortening.

Diethylene Glycol Price trend for the First Half of 2023

Asia

In the Asia-Pacific region, the prices of diethylene glycol followed a positive trend as the depleting level of inventories and high demand from the end-user industries supported this growth trend. The traders suffered from a reduction in stockpiles, and along with low production rates, the supply of feedstock materials also remained tight in the first two quarters. Further, plasticizers and polyester resin industries witnessed a surge in their number of sales, which in turn also elevated the prices of diethylene glycol.

Europe

In Europe, the supply of diethylene glycol was disrupted, and the stocks of diethylene glycol declined fast amid high-demand scenarios. In addition to this, the prices of crude oil faced high uncertainties, and the prices of feedstocks rose consistently.

In the second quarter, the situation overturned as the market for diethylene glycol enjoyed high demand such that the existing level of inventories was not able to fulfill it in the first half of this quarter. But soon, the conditions returned to their normal levels after a decrease in the support from the feedstock sector and a decline in the cost of production in the second half of the second quarter.

North America

In North America, the first quarter prices of diethylene glycol were the positive consequence of rising prices of raw materials and, in turn, the high cost of production. In North America, several diethylene glycol plants underwent maintenance shutdowns, leading to the depletion in existing stock levels, but the influx of imports from Saudi helped maintain the level of supply.

The trend continued its upward movement in the second quarter, too, as the low level of inventories and instability in the prices of crude oil were beneficial for the prices of diethylene glycol.

Analyst Insight

According to Procurement Resource, the price trend of Diethylene Glycol is expected to fluctuate as the rates of procurement from the downstream sectors seem to be guided by the global economic conditions.

Procurement Resource provides latest prices of Diethylene Glycol. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Diethylene Glycol

Diethylene glycol is a colourless hygroscopic liquid denser than water and can be slightly toxic if ingested. It is used to make antifreeze, brake fluids and dyes.

Diethylene Glycol Product Details

| Report Features | Details |

| Product Name | Diethylene Glycol |

| Industrial Uses | Plastic, oil, paint, coatings, natural gas industry, textile dyes |

| Chemical Formula | C4H10O3 |

| HS Number | 29094300 |

| CAS Number | 111-46-6 |

| Synonyms | 2- (2-hydroxyethoxy) ethanol, Diglycol |

| Molecular Weight | 106.12 g/mol |

| Supplier Database | CNPC, Reliance Group, SABIC, BASF, Royal Dutch Shell PLC |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Diethylene Glycol Production Processes

Diethylene glycol is obtained by the partial hydrolysis of ethylene oxide which is produced by the oxidation of ethylene.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Related News

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com