Product

Fluorspar Price Trend and Forecast

Fluorspar Price Trend and Forecast

Fluorspar Regional Price Overview

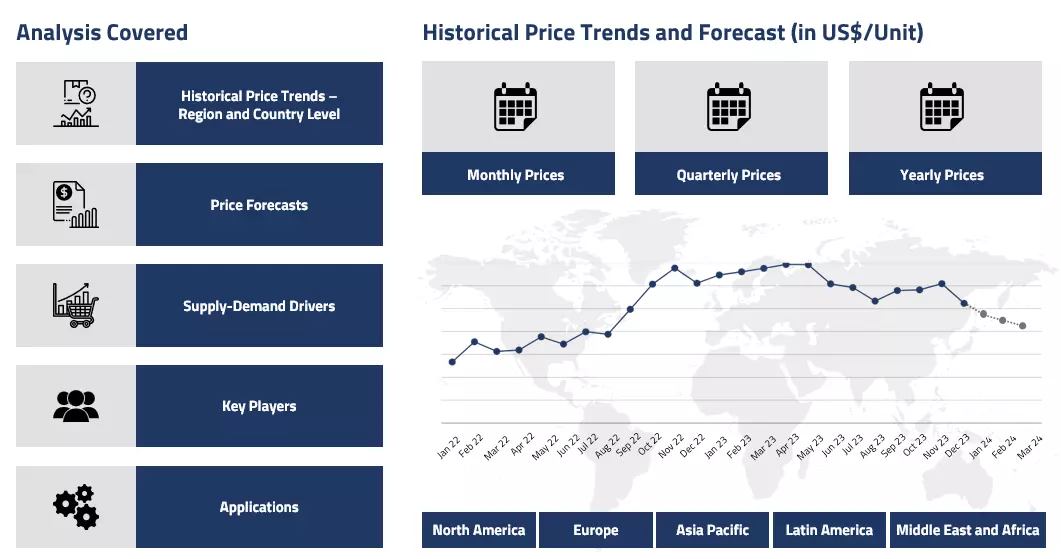

Get the latest insights on price movement and trend analysis of Fluorspar in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Fluorspar Price Trend for the Q3 of 2024

Asia

The fluorspar market in China experienced a consistent downward trend throughout the third quarter of 2024. Prices fell steadily as domestic production remained stable, and demand from key downstream industries, such as steel and aluminium, softened. Manufacturers were able to secure ample supply from Chinese mines, putting downward pressure on prices and limiting the need for higher-priced imports.

Fluorspar Price Chart

Please Login or Subscribe to Access the Fluorspar Price Chart Data

The decrease in fluorspar prices in China was further exacerbated by the country's economic slowdown, which dampened industrial activity and reduced overall demand for the mineral. Additionally, the Chinese government's ongoing efforts to curb emissions and promote environmental sustainability resulted in stricter regulations on certain industrial processes, leading to a decline in fluorspar consumption.

Europe

In contrast to the situation in China, the European fluorspar market experienced a more volatile price trend during the third quarter. While prices initially dipped due to weaker demand, they later stabilized and even showed signs of recovery towards the end of the period. This was driven by tighter supply, as European producers struggled to keep up with the region's requirements, particularly for high-grade fluorspar used in specialized applications.

North America

The North American fluorspar market mirrored the price dynamics observed in Europe, with initial price declines followed by a gradual recovery. Factors such as logistics challenges and supply chain disruptions contributed to the volatility, as buyers sought to secure reliable sources of the mineral. However, the overall trend in the region was less pronounced than the consistent downward movement as seen in Asia.

Analyst Insight

According to Procurement Resource, the fluorspar market is expected to remain subdued in Asia, with prices likely to continue their gradual decline in the near future. In contrast, the European and North American markets may see more fluctuations, as producers work to address supply constraints and adapt to shifting demand patterns.

Fluorspar Price Trend for the Q2 of 2024

Asia

The refrigerant sector which is the primary driver of fluorspar market extended ample support to the market during the early phase of the second quarter of 2024 in China. Although, the region experienced a period of sluggish recovery post-Dragon Boat festival. The market resumption was slow, with on-site merchant inventories remaining low and sales being average. The cautious purchasing behavior of downstream hydrofluoric acid manufacturers, who bought based on immediate needs, led to a slight decline in hydrofluoric acid prices.

This cautious approach further dampened fluorspar market activity. Additionally, ongoing vessel shortages and congestion issues significantly impacted the region. Spot prices for Asia-Europe routes were pushed higher due to the Red Sea crisis and increased nautical miles, leading to elevated transportation costs for fluorspar. These logistical challenges, combined with limited operating rates and stringent environmental inspection guidelines, exacerbated market conditions in Asia.

Europe

The overall global fluorspar market in Q2 2024 was influenced by a mix of economic conditions, logistical challenges, and strategic industry moves. Environmental inspection guidelines and limited manufacturing operating rates added pressure to the market, while vessel shortages and congestion issues increased transportation costs, particularly on Asia-Europe routes.

However, the introduction of new projects by companies like Tivan and Ares Strategic Mining indicates a future increase in production capacity and new sources of supply. These initiatives are crucial as global demand rises, especially from the semiconductor and electric vehicle battery sectors. Consequently, despite current challenges, the long-term outlook for fluorspar prices appears to be on an upward trend as these new projects come online and address supply constraints.

North America

In North America, strategic developments in the fluorspar market had a notable impact. Ares Strategic Mining Inc. completed a significant non-brokered private placement, raising substantial funds to support the development of the only fluorspar mine in the U.S. The capital will be used to install new mining infrastructure and a processing plant, as well as for the construction of a new manufacturing facility.

This initiative aims to transition the company from mining to manufacturing, which is expected to stabilize and potentially increase fluorspar supply in the region. Additionally, Commerce Resources Corp.'s sale of its Blue River assets in British Columbia to focus on the Ashram Rare Earth and Fluorspar Deposit in Quebec indicates a strategic shift towards enhancing regional fluorspar production capabilities.

Fluorspar Price Trend for the Q1 of 2024

| Product | Category | Region | Price | Time Period |

| Fluorspar | Chemicals | USA | 400 USD/MT | March 2024 |

| Fluorspar | Chemicals | MEA | 500 USD/MT | March 2024 |

| Fluorspar | Chemicals | China | 468 USD/MT (FOB) | March 2024 |

Stay updated with the latest Fluorspar prices, historical data, and tailored regional analysis

Asia

The fluorspar market in China is undergoing significant changes driven by government policies, market demand, and international trade dynamics. While some major fluorspar producers have increased their production quotas, aiming to reduce the supply shortages, strict mining policies and safety inspections, however resulted in the tight supply of the commodity in the first quarter of 2024.

China's efforts to consolidate small-scale mines and enforce environmental regulations further impacted production. Meanwhile, strong demand from the new energy and materials sectors, particularly in lithium-ion battery production for electric vehicles, drove the momentum of the market efficiently. China's Ministry of Finance also planned to reduce import tax rates for fluorspar in 2024 to boost imports and increase stockpiles. This move, coupled with China's designation of fluorspar as a strategic mineral resource, raised the peculiar interest of overseas suppliers, particularly from countries like Mongolia, and improved the overall trade dynamics of the market.

Europe

In the first quarter of 2024, the fluorspar market faced challenges due to weak demand from the construction sector, particularly in Germany. However, as the quarter progressed, market conditions improved greatly and helped the resurgence of the fluorspar market trend.

Destocking sentiments prevailed as downstream manufacturers hesitated to accumulate inventories, prompting suppliers to reduce offers to stimulate new shipments. Additionally, the weak momentum carried forward from the previous quarters presented a bleak outlook for the market in the first half of the quarter, particularly in the refrigeration industry. However, additional challenges extended by the global central banks' tightening policies also contributed to oscillating fluorspar demand, leading to a fluctuation in its prices in the first half of the quarter.

North America

In North America, ARES established the first fluorspar plant in the US, aiming to improve the supply and drive up the region's economy. With Fluorspar currently, 100% imported into the country, ARES plans to produce 100,000 tonnes per year, reducing its dependence as the struggling trading sector offers only limited support to the Fluorspar price trend.

The battery plant projects also improved significantly, which escalated North America's battery manufacturing capacity, driving up fluorspar demand in the first quarter of 2024. Additionally, the domestic automotive industries also bloomed in the aforementioned period, with a sudden incline in its sales figures, further supported by the uptick in the pricing patterns of fluorspar.

Analyst Insight

According to Procurement Resource, the price trend of Fluorspar is expected to be driven by the rise in production activities and demand for commodities across the globe in the forthcoming quarters.

Fluorspar Price Trend for the October - December of 2023

Asia

The Asian region, particularly China, invested a huge amount in its mining initiative, causing a surge in the overall dynamics of fluorspar price trend. In the past quarter, the underwhelming performance of the mining sector and the reduced influx of fluorspar in the market affected the prices of fluorspar negatively.

However, the dynamics in the fourth quarter shifted significantly as the Chinese government accumulated small mining firms into one to streamline its production of fluorspar. The mineral industry or the fluorspar sector further benefitted from the rise in demand for EVs and the revival of the automotive industry.

Europe

The European countries were not untouched by the wave of rise in production and usage of EV and mineral based batteries. The advent of new mining projects and the rise in the production capacity of existing ones exerted a positive influence on fluorspar prices. The region looked forward to catering to its domestic demand without the support of exports, but at this time, it looks like a farfetched goal. On the other hand, the direct consumer of fluorspar only showed moderate interest in the sector as their spending appetite is limited by the rise in inflationary pressure.

North America

The rise in investments in the EV sector raised the expectations of the mining industries. As a result, the US imported a significant amount of fluorspar in order to uplift its in-house production of EV batteries. However, the rate of procurement from the downstream industries was only mild, given the imports from China were at much cheaper rates than the domestic fluorspar, and thus, the fluorspar price trend registered fluctuations throughout the fourth quarter of 2023.

Analyst Insight

According to Procurement Resource, the price trend of Fluorspar are expected to be driven by the market dynamics of the automotive and mining sector along with the balance of global imports and exports.

Fluorspar Price Trend for the July - September of 2023

Asia

Fluorspar price trend exhibited mixed market sentiments during the third quarter of the year 2023. At the beginning of the quarter, the construction sector was still struggling in China since people were cautious about large investments after the economic havoc the pandemic brought. So, the first half of Q3'23 showcased underwhelming numbers at the fluorspar price index. However, the supplies started constricting soon as the mining activities subsided across the Asian region.

The industrial rebound was also in full swing since the market stakeholders were trying hard to lift the Chinese markets back again. So, the demands rose substantially from mid-August after a long slump, and along rose the fluorspar prices in the region. The price trend were largely mixed; however, the market sentiments were observed to be mostly positive throughout the said period.

Europe

The European fluorspar price trend remained afloat during the third quarter of the year 2023. The downstream consumption from the metal and concrete industries mostly drove the market dynamics. However, the fall in processing costs because of consistent relaxation in the regional inflationary pressure also influenced the overall fluorspar market dynamics. The general market outlook remained anchored for the entire span of Q3'23.

North America

The difficult economic situation in the region, along with a struggling banking sector and low industrial activities, kept the fluorspar demands at a bare minimum throughout the said period. As a result, the suppliers cut down on their selling prices to stimulate buyers' sentiments. Overall, sluggish market trend were observed.

Analyst Insight

According to Procurement Resource, the Fluorspar price trajectory is projected to head upwards in the coming months, since the constricted supplies amid rising demands will influence the market dynamics strongly.

Fluorspar Price Trend for the First Half of 2023

Asia

In the first and second quarters of 2023, the price trend of fluorspar fluctuated. In the initial months of the first quarter, the fluorspar market boomed with the return of manufacturing activities to their normal levels after the removal of covid-related restrictions. But the spring holidays again pushed production rates into a negative zone. Due to slow demand, the manufacturers had to reduce their production output which in turn reduced the prices of fluorspar.

In the second quarter also, the initial months witnessed a hike in the prices after the regaining of market momentum after the spring holidays. However, soon enough, the sluggish demand from construction industries, low energy production costs, and low cargo rates and volumes forced the price trend of fluorspar to follow a negative trajectory.

Europe

In the first two quarters of 2023, the price trend of fluorspar remained volatile in the European region. The region actively looked to reduce its dependence on China and related countries in terms of fluorspar production. After the invasion of Ukraine by Russia and the ban on gas imports, the region struggled to keep its market activities afloat, which led to fluctuations in the price trend of fluorspar.

North America

The price trend of fluorspar in the first two quarters of 2023 was affected by the low demand from the downstream industries and reforms adopted by the government to restrict unfair mining activities. To curb the loss of demand, especially from the construction sector, a reduction in the number of offtakes led to cuts in prices by the manufacturers. Along with this, the hike in interest rates and rising inflation in North America also caused the price trend of fluorspar to showcase a falling trajectory.

Analyst Insight

According to Procurement Resource, the price trend for fluorspar are expected to incline in the coming quarter as the demand from the end-user industries is improving.

Procurement Resource provides latest prices of Fluorspar. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Fluorspar

A mineral made of calcium fluoride (CaF2) is known as fluorspar, commonly referred to as fluorite. It is a vibrant mineral that can be found in a range of hues, such as purple, green, yellow, and blue. Due of its luminous characteristics under ultraviolet light, fluorspar is highly valued. It is utilized in a variety of industrial processes, including those that produce steel, aluminum, hydrofluoric acid, ceramics, glass, and as a flux in metallurgy. Due to its special qualities, fluorspar is also used in lithium-ion batteries and dental items.

Fluorspar Product Details

| Report Features | Details |

| Product Name | Fluorspar |

| Chemical Formula | CaF2 |

| Industrial Uses | Steel and aluminium production, Cement production, Ceramic and glass industry, Refrigerants and air conditioning |

| HS Code | 25292100 |

| Molecular weight | 78.07 g/mol |

| Synonyms | Calcium difluoride |

| CAS Number | 7789-75-5 |

| Supplier Database | Mexichem Fluor SA de CV, China Kings Resources Group Co Ltd, Mongolrostsvetmet LLC, Minersa Group, Masan Resources |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Fluorspar Production Processes

The procedure starts with the extraction of the fluorspar-containing mineral ore from the veins of other ores, including slate, gneiss, limestone, etc. The recovered material is subsequently processed through crushers to get fine powder-like materials. The next part is the flotation stage, which is the most important step. When water and a flotation agent are added to the powdered extracted material, the flotation agent causes the fluorspar to float to the top while the impurities sink to the bottom of the vessel. The essential material is gathered and dried in preparation for further packaging and delivery.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Related News

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com