Product

Glyoxylic Acid Price Trends and Forecast

Glyoxylic Acid Price Trends and Forecast

Glyoxylic Acid Regional Price Overview

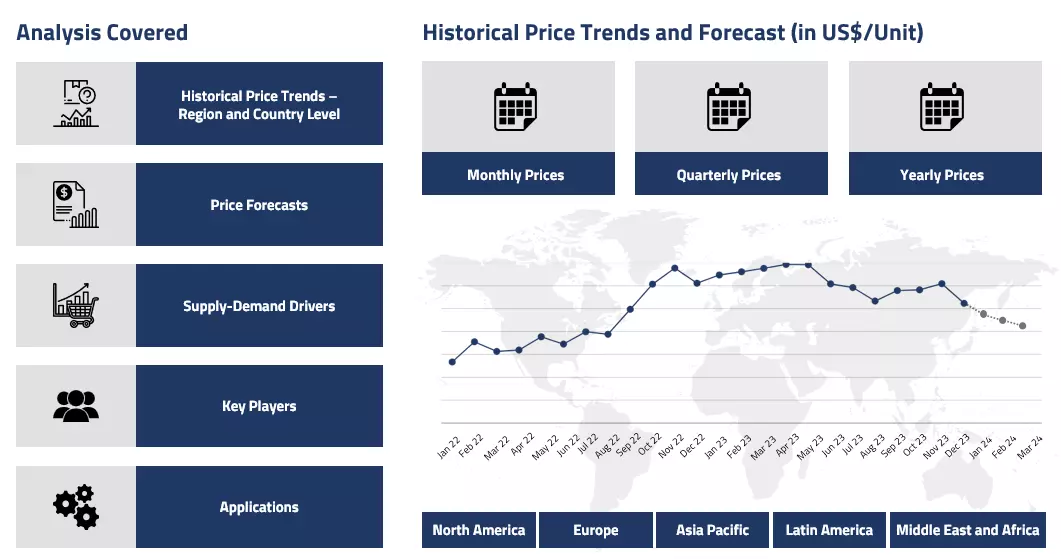

Get the latest insights on price movement and trends analysis of Glyoxylic Acid in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Glyoxylic Acid Price Trend for the First Half of 2025

Asia

During the first half of 2025, the Glyoxylic Acid market in Asia-Pacific showed a mostly upward trend, driven by consistent demand and rising input costs. In Q1, the market gained strength from strong seasonal demand, particularly from personal care and agrochemical industries. Pre-Lunar New Year stockpiling and supply tightness due to reduced operations at northern Chinese facilities added to the bullish trend.

Glyoxylic Acid Price Chart

Please Login or Subscribe to Access the Glyoxylic Acid Price Chart Data

Although prices temporarily stabilized post-holiday in February, they rose again in March with rising freight and energy costs. In Q2, the momentum slowed slightly. Demand moderated due to seasonal slowdown and easing feedstock costs, especially for Nitric Acid. However, steady consumption from the personal care segment kept the market relatively firm, even as signs of softening emerged towards the end of the half-year.

Europe

The European market for Glyoxylic Acid experienced a significant uptrend during H1’25. In Q1, prices climbed steadily following the EU’s anti-dumping duties on Chinese imports, which limited supply and tightened the regional market. Domestic producers faced challenges from high energy and raw material costs, particularly for Nitric Acid and Ammonia. This, combined with healthy demand from cosmetics and agrochemicals, kept prices elevated. In Q2, the bullishness continued, although at a slower pace.

The market remained tight due to limited imports, ongoing production hurdles, and firm demand from downstream sectors. However, logistical issues began to ease slightly, offering some relief, though prices remained on the higher side.

North America

In North America, the Glyoxylic Acid market showed a cautiously positive trend throughout the first half of 2025. Q1 saw prices rise gradually as supply was affected by weather-related production issues and transport challenges. Demand stayed steady across pharmaceuticals and personal care, supporting prices despite inflationary concerns.

In Q2, improved weather conditions led to better supply, but tariffs on imports and stable demand from core industries helped maintain price levels. While consumer spending varied, consistent industrial demand ensured overall pricing stayed firm through the first half.

Analyst Insight

According to Procurement Resource, market fundamentals suggest prices may stabilize or soften slightly in H2’25 as supply pressures ease, though steady demand will likely support overall balance.

Glyoxylic Acid Price Trend for Q4 of 2024

Asia

During the last quarter of 2024, the Glyoxylic Acid market in the Asia-Pacific region, especially in China, faced noticeable pressure. Prices declined due to a combination of reduced export opportunities and steady domestic production. Trade restrictions imposed by the European Union affected the usual flow of exports, forcing local producers to find new buyers or reduce output.

While manufacturing activity in China remained healthy, the lack of overseas demand created an oversupply situation. Inventories stayed high and with limited domestic consumption, sellers had little choice but to adjust prices downward. The market remained well-supplied, but demand didn't catch up, keeping pricing weak throughout the quarter.

Europe

In Europe, the Glyoxylic Acid market saw a sharp price rise during Q4’24. A major factor was regulatory uncertainty surrounding imports from Asia, which led to cautious buying and stockpiling in anticipation of potential supply restrictions. This nervousness among buyers drove prices higher, even as actual demand from end-use industries showed mixed signals.

Festive season buying supported consumption early in the quarter, but demand weakened toward the end. Despite softening interest from downstream sectors, concerns over tighter future supply helped sustain firm pricing through most of the quarter.

North America

The North American market experienced a mixed but ultimately positive trend in Q4’24. Initially, prices fell due to weak demand, but this phase was short-lived. Strong and steady demand from sectors like personal care and cosmetics helped support a rebound in market activity.

On the supply side, several production disruptions caused by extreme weather events tightened availability. These constraints played a crucial role in pushing prices higher as the quarter progressed, offsetting earlier declines and ending the period on a stronger note.

Analyst Insight

According to Procurement Resource, continued trade developments and regional supply issues are expected to shape pricing trends in the near term. Market sentiment remains cautious but slightly bullish.

Glyoxylic Acid Price Trend for Q3 of 2024

Asia

In Asia, particularly in China and India, the glyoxylic acid market saw consistent price increases throughout Q3. China, the largest producer and exporter of glyoxylic acid, faced production constraints due to less-than-optimal performance in its northern regions. These supply-side issues were exacerbated by rising transportation costs and logistical limitations. The shortage of cargo capacity for many manufacturers led to delays in shipping and higher transportation expenses, further tightening the availability of glyoxylic acid in the market.

Demand from the cosmetics and personal care sectors in Asia remained robust, particularly in India, where the upcoming festival season drove higher consumption of cosmetic products. Glyoxylic acid, a key ingredient in hair care and skincare formulations, was in high demand, leading to price increases as manufacturers struggled to keep up with orders. Export demand from Asia to other regions also contributed to the upward price trend, with China and India playing pivotal roles in influencing global market dynamics. Despite the strong demand, production challenges in China and logistical delays created a supply-demand imbalance, pushing prices higher.

Europe

In Europe, the glyoxylic acid market followed a similar trajectory, with prices rising steadily throughout Q3. European markets were affected by both internal and external factors. On the domestic front, energy costs continued to rise, which increased production expenses for European manufacturers. The region also faced difficulties in sourcing raw materials, with reduced imports from Asia due to ongoing port congestion and transportation challenges. Glyoxylic acid demand in Europe remained strong, particularly from the cosmetics and personal care industries, where it is widely used in formulations for skincare and haircare products.

The region also saw heightened demand from the pharmaceutical and agrochemical sectors, further driving up prices. However, the limited availability of glyoxylic acid imports from Asia, coupled with local production constraints, led to a widening gap between supply and demand. European buyers faced higher costs as they competed for limited supplies, and the market showed no signs of relief throughout Q3.

North America

In North America, the glyoxylic acid market experienced the most pronounced price increases during Q3 2024. The region faced severe shortages of material due to disruptions in supply chains originating from China. Trade uncertainties and delayed exports from major Chinese ports, including Shanghai, Ningbo, and Qingdao, exacerbated the already tight supply situation in North America. Port congestion reached record levels, leading to delays in the arrival of vessels and further straining the availability of glyoxylic acid in the market.

Demand in North America remained robust, driven by the cosmetics and haircare industries, which saw increased consumption in anticipation of the upcoming festive season. Major cosmetic companies in the U.S. reported strong sales in Q2, with expectations of continued growth in Q3, leading to heightened demand for glyoxylic acid. However, the persistent supply shortages made it difficult for North American buyers to secure the necessary volumes of glyoxylic acid, leading to significant price increases on a month-to-month basis.

Analyst Insight

According to Procurement Resource, the price trend of Glyoxylic Acid is expected to remain on the higher note with ample of cost support from the downstream as well as upstream industries.

Glyoxylic Acid Price Trend for Q2 of 2024

Asia

In the Asian market, particularly in China and India, glyoxylic acid prices experienced different trends. In India, after a stable trend in April, May saw only a modest price increase driven by a shortage of material within the domestic market, intensified by a lack of imports from China. In China, however, the strong performance of manufacturing units, despite the healthy operational rates, could not meet the revived demand from the cosmetics and haircare sectors. Several downstream industries, particularly in the cosmetics and personal care sectors, reported significant gains in their sales figures, stimulating glyoxylic acid demand.

However, by June, the market faced a downturn as the consumption rates lagged production. Despite expectations of increased consumption due to the summer season, demand remained modest. The consumer purchasing activities for the personal care sector indicated a rise, but this did not translate into substantial demand growth. Additionally, elevated freight charges further restricted international demand, contributing to a modest market scenario. However, domestic manufacturing units continued to operate efficiently, maintaining stable inventory levels and ensuring no major shortages.

Europe

In the European market, the initial half of the second quarter saw significant price escalation for glyoxylic acid. This surge was primarily driven by the high prices and scarcity of essential raw materials, particularly nitric acid. The elevated costs and shortage of nitric acid prompted increased production rates, exerting upward pressure on glyoxylic acid prices. The resurgence of demand from the cosmetics and haircare industries, fueled by the summer season, further intensified this trend.

The major cosmetic companies, such as L'Oreal, reported strong sales growth in the Western market, contributing to the heightened demand for glyoxylic acid. However, by June, the market sentiment turned bearish. The stable price of nitric acid and reduced consumer spending due to inflationary pressures led to a decline in glyoxylic acid demand. Many retailers reported challenges within the cosmetics industry, noting reduced disposable income affecting consumer purchases. Additionally, a steady supply of glyoxylic acid from the USA ensured no significant shortages, contributing to a balanced yet oversupplied market.

North America

In the USA, the glyoxylic acid market dynamics were shaped by different factors during the second quarter of 2024. The significant price escalation in May was influenced by fluctuating prices of raw materials like nitric acid and ammonia, coupled with resurgent demand from the cosmetics and haircare industries. The strong consumer interest in personal care products, driven by new product launches, intensified glyoxylic acid demand. However, similar to the Asian and European countries, the market moved southwards in June.

The anticipated surge in demand from downstream industries due to the summer season failed to showcase any significant changes in the pricing patterns of the commodity. Additionally, the stable supply conditions, coupled with reduced consumer spending due to inflation, led to a subdued demand scenario. However, despite the improved operational rates of domestic manufacturing units, the market faced challenges from elevated freight costs and global economic uncertainties.

Analyst Insight

According to Procurement Resource, the price of Glyoxylic Acid is expected to turn bearish in the next quarter amid the rising uncertainties in the downstream industries and limited support from consumer purchasing activities.

Glyoxylic Acid Price Trend for Q1 of 2024

| Product | Category | Region | Price | Time Period |

| Glyoxylic Acid | Chemicals | USA | USD 1600/MT | March 2024 |

| Glyoxylic Acid | Chemicals | Europe | USD 4000/MT | March 2024 |

Stay updated with the latest Glyoxylic Acid prices, historical data, and tailored regional analysis

Asia

In China, the price of glyoxylic acid in the first quarter of 2024 experienced a decline. Throughout the quarter, the glyoxylic acid market witnessed a downward trend, with average consumption in the terminal market and weak downstream purchasing activities.

The limited export shipments resulted in increased inventory, prompting continuous reductions in quotations to stimulate downstream market entry. However, sluggish downstream consumption and insufficient demand support led to weakened glyoxylic acid prices. Fluctuations in the upstream raw material methanol market also influenced market dynamics.

Despite the initial surge supported by downstream procurement rates, the market weakened due to average downstream procurement sentiment, focusing mainly on essential purchases. Eventually, the manufacturers also responded by lowering glyoxylic acid production and price quotations to relatively low levels.

Europe

In the European region, glyoxylic acid prices experienced a significant decline in the first phase of the Q1 of 2024. This drop was mainly driven by subdued demand after the Christmas and New Year holidays. Additionally, heightened ocean freight rates resulting from attacks on ships in the Red Sea have raised concerns about inflation and delayed goods. To avoid potential strikes by Iran-backed Houthi militants in Yemen, carriers diverted trade away from the crucial Middle East trade route, which connects the Mediterranean Sea and the Indian Ocean.

Therefore, this redirection has led to increased inventories at ports, contributing to the widening of the gap between demand and supply for glyoxylic acid in the European market. Additionally, the domestic downstream industries also offered only limited support to the glyoxylic acid market and eventually contributed heavily to keeping its prices on the lower end of the spectrum. However, as the quarter progressed, the cost of production rose gradually on the back of the rising cost of feedstock chemicals and crude oil, which might raise the price quotations of glyoxylic acid in the next quarters.

North America

During the first half of Q1 of 2024, the North American glyoxylic acid market experienced a persistent negative trend primarily due to the declining prices of essential feedstock nitric acid. This decline led to lower production costs for glyoxylic acid, exerting downward pressure on its prices. Additionally, extensive drought conditions at the Panama Canal, coupled with concerns about attacks on ocean shipments, prompted major shipping companies to seek alternative trade routes, including the Suez Canal.

However, limitations at the Panama Canal forced some shippers to reroute exports, including glyoxylic acid, through the Suez Canal to access Asian markets. These delays in shipments to the international market further intensified the accumulation of glyoxylic acid inventories within the country. Furthermore, procurement orders from downstream industries like cosmetics and haircare remained restrained following the conclusion of the peak festive season.

Analyst Insight

According to Procurement Resource, the price trend of Glyoxylic Acid is expected to face downward pressure amid limited support from the downstream industries and the rising cost of transportation.

Glyoxylic Acid Price Trend for Q4 (October - December) of 2023

Asia

A modest price increase in glyoxylic acid was observed in the Chinese market during the fourth quarter due to several causes. The increase in prices was attributed to the strong demand for glyoxylic acid in the global market as well as higher prices for upstream ammonia and critical feedstock nitric acid.

The domestic and overseas traders were highly interested in this sector, and further, the rise in demand, particularly from the cosmetics and haircare sectors on account of the impending holiday season, gave the Glyoxylic Acid market its required momentum. In addition, the region's production rates decreased as the holiday season approached, which in turn dried up the inventories.

Europe

The cost of feedstock and upstream materials increased remarkably during Q4'23, which contributed significantly to the spike in glyoxylic acid prices in Europe. The domestic European cosmetics and haircare industry demand was, on the other hand, somewhat muted. In addition, the government took action to suppress the economic impact of worldwide inflation on the market. However, in order to curtail inflationary pressure, the European Central Bank decided to increase interest rates. The traders' sector responded to this spike by raising the prices of glyoxylic acid and other related commodities in order to preserve its profit margins.

North America

The first month of the fourth quarter witnessed a significant glyoxylic acid price increase in North America. The increased demand from downstream sectors and the high cost of natural gas and feedstock nitric acid were the foremost factors that contributed to the price increase. Further, the prices for glyoxylic acid rose because of higher production rates also brought on by rising raw material costs.

During this phase of the quarter, the consumer also showed interest in the market as the number of bulk purchases went up. However, the winds did not remain favorable during the rest of the quarter, and the dip in crude oil prices, along with the loss of export traders, forced the Glyoxylic Acid price trends to fluctuate.

Analyst Insight

According to Procurement Resource, the price trends of Glyoxylic Acid are estimated to experience robust growth in the upcoming quarters as the overview of global downstream industries looks positive. However, the challenging economic conditions and strict government regulations impose to be a problem for the manufacturing sector.

Glyoxylic Acid Price Trends for Q3 (July - September) of 2023

Asia

The glyoxylic acid prices exhibited a faltering trend throughout three months of the third quarter of 2023. Even though glyoxylic acid is one of the high demand chemicals for the chemical industry itself because of its versatile applicability, the demands during the given period were highly unsatisfactory.

Both domestic and international markets responded in a very cold manner. Orders from the pharma and cosmetics industries were feeble; compared to that, the supplies available in glyoxylic acid inventories were mountainous. Slow-paced industrial recovery in China also pushed down the price graph for glyoxylic acid, and the dull international response complimented the poor performance. Overall, a slumping trend was observed for glyoxylic acid.

Europe

The European glyoxylic acid market could not behave in any different manner than the Asian market. The price trends depreciated consistently for glyoxylic acid as the downstream situation was already turbulent when the ease in inflation slid the upstream cost as well. Overall, bearish market sentiments were observed.

North America

Surrendering to the global trends, the glyoxylic acid market in America also behaved in a similar slumping manner. The industrial operations were already suffering with high interest rates in the region. To add on, the existing excess inventory stocks further pulled the glyoxylic acid prices down. Overall, a negative market outlook was experienced.

Analyst Insight

According to Procurement Resource, the price trends for Glyoxylic Acid are likely to remain volatile in the coming quarter, given the riddled downstream demands amidst the grim economic situation.

Glyoxylic Acid Price Trend for the First Half of 2023

Asia

The Asia-Pacific market mostly declined in the first and second quarters of 2023 as the demand from cosmetics and haircare industries declined significantly. However, the rising cost of energy in the first quarter provided little support, which was not sufficient to curb the pressure of declining economic conditions. In addition to this, poor purchasing sentiments of buyers and the loss of momentum of the glyoxylic acid market in both domestic and international markets caused the price trends of glyoxylic acid to fall in the first half of 2023.

Europe

A significant decline in the prices of glyoxylic acid was observed in the first quarter of 2023, but the market dynamics improved in the second quarter. The first quarter was negatively impacted by the falling cosmetic market and instability in the related industries due to rising levels of inflation. But the second quarter was favorable to the prices of glyoxylic acid. There was a significant incline in the trends as it was supported by the slowing down of supply chains, which could not suffice with the increasing demand for the product. The consumers also showcased high confidence in the market and supported the rise in prices.

North America

Unlike the European market, glyoxylic acid prices declined in North America in the first and second quarters of 2023. In the first quarter, there was a noticeable disbalance in the supply and demand equilibrium due to high rates of operations. In the second quarter, the cost of feedstock materials and buying potential of consumers also declined amid the fluctuating market conditions. The level of exports thus also declined which eventually caused the fall in the price trends of glyoxylic acid.

Analyst Insight

According to Procurement Resource, glyoxylic acid prices are expected to remain volatile in the coming months, given the current market dynamics amid rising inflation and reduced consumer confidence.

Procurement Resource provides latest prices of Glyoxylic Acid. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Glyoxylic Acid

Glyoxylic acid is a colorless pungent smelling liquid that is found in nature as well as an intermediate in various metabolic pathways. It also plays a significant role in synthesis of many chemicals such as amino acids, pharmaceuticals, and agrochemicals. It is also utilized in the textile industry as a dye-fixing agent and in domestic formulations. Due to its reactivity and versatility, glyoxylic acid is a valuable chemical building block in organic synthesis and industrial processes.

Glyoxylic Acid Product Details

| Report Features | Details |

| Product Name | Glyoxylic Acid |

| Chemical formula | C2H2O3 |

| Industrial Uses | Cosmetic industry, Agrochemical industry, Textile industry, Pharmaceutical industry |

| HS Code | 29121990 |

| CAS Number | 298-12-4 |

| Molecular weight | 74.03 g/mol |

| Synonyms | Oxoacetic acid |

| Supplier Database | Akema S.r.l, Zhinglan Industry Co Ltd, Marcelo Roberto Pressi, STAN Chemical Co Ltd |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Glyoxylic Acid Production Processes

Maleic acid solution in aqueous phase is subjected to controlled pressure conditions at constant temperature around 15-25°C that gives glyoxylic acid as its final product.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com