Product

Gum Rosin Price Trend and Forecast

Gum Rosin Price Trend and Forecast

Gum Rosin Regional Price Overview

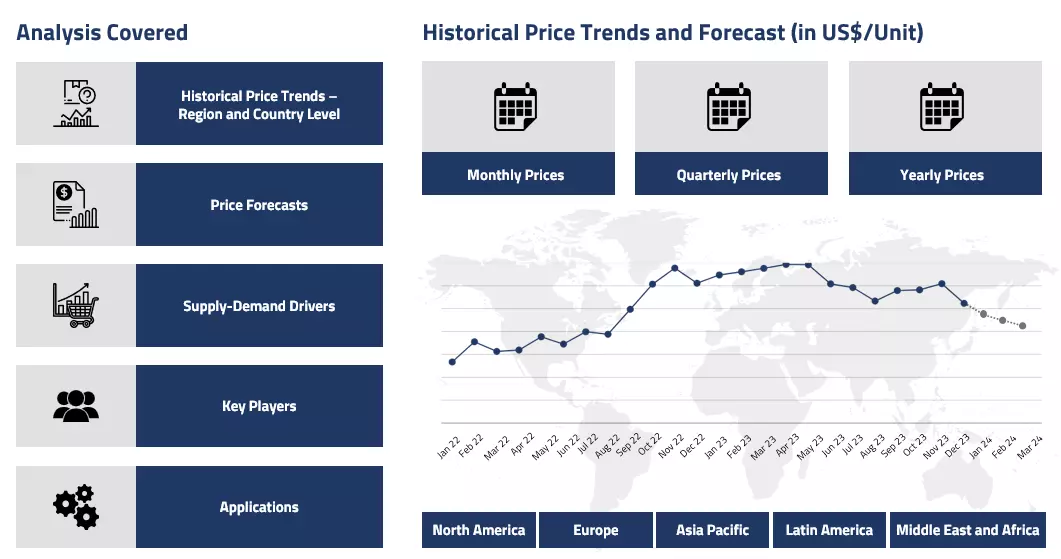

Get the latest insights on price movement and trend analysis of Gum Rosin in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Gum Rosin Price Trend for the Q4 of 2024

Asia

The Asian Gum Rosin market showed mixed trends throughout Q4'24. Chinese producers maintained steady production rates, while demand from packaging and adhesive industries remained moderate. Market activity in India and Southeast Asia was driven by regular procurement from the printing ink and adhesive sectors.

Gum Rosin Price Chart

Please Login or Subscribe to Access the Gum Rosin Price Chart Data

The packaging industry's demand provided consistent support to the market, though buying patterns became more cautious towards the end of the quarter. Regional manufacturers adjusted their production strategies to match the moderate demand levels, while keeping an eye on export opportunities.

Europe

European Gum Rosin markets faced downward pressure during Q4'24. The region experienced reduced demand from key end-use industries, particularly construction and adhesives manufacturing. The market saw increased competition from Brazilian imports early in the quarter, though this eased by December due to currency fluctuations. Manufacturing activities slowed down towards the year-end, with many buyers postponing purchases until the new year. The printing ink sector maintained steady consumption, but it wasn't enough to prevent the overall price decline.

North America

The North American Gum Rosin market followed a declining trend in Q4'24. The region initially maintained stable prices, supported by consistent demand from adhesive manufacturers and the packaging industry. However, prices began to soften as the quarter progressed, influenced by increased availability of material from global suppliers and the traditional year-end slowdown. Domestic consumers adopted a cautious buying approach, particularly in December, as they focused on inventory management during the holiday period.

Analyst Insight

According to Procurement Resource, the Gum Rosin prices are expected to incline in early 2025 as industrial activities resumes after the holiday season. The market recovery would likely be influenced by construction sector performance and packaging industry demand, particularly in developing regions.

Gum Rosin Price Trend for the Q3 of 2024

Asia

The Asian market, particularly in China, experienced a notable rebound during Q3’24. Following a period of declining prices in July, attributed to weak demand and high inventory levels, prices began to rise in August. This was driven by higher upstream costs and improved demand from the automotive sector, as well as renewed activity in paints and coatings.

The market also benefitted from increased export demand, particularly from the U.S. and India, as manufacturers rushed to fulfil orders ahead of anticipated tariffs.

Europe

The European gum rosin market mirrored the mixed trend seen in North America. After a period of price stability, the market softened due to reduced demand in key sectors, including construction and adhesives. This, coupled with high inventories and weak feedstock price support, led to a bearish outlook. However, as the quarter progressed, some signs of recovery emerged, driven by restocking activities in anticipation of increased future demand. By the end of the quarter, prices showed modest signs of improvement, suggesting a potential for stabilization.

North America

In Q3’24, the gum rosin market in North America saw mixed price movements, influenced by varying demand and production cost pressures. Early in the quarter, a decrease in demand from major industries such as paints and adhesives led to a softening of prices. Elevated inventory levels and a lack of support from feedstock costs added further downward pressure. Despite some signs of recovery in sectors like automotive and construction, these were not enough to boost prices significantly. However, as the quarter progressed, restocking efforts by downstream buyers in anticipation of future demand began to push prices upward, signalling a potential stabilization in the market.

Analyst Insight

According to Procurement Resource, the price trend for Gum Rosin are likely to remain oscillating in the coming quarter given the global economic outlook and market fundamentals.

Gum Rosin Price Trend for the Q2 of 2024

Asia

Gum rosin, a natural resin derived from the sap of pine trees, is a crucial industrial raw material known for its versatility and wide-ranging applications. Its significance lies in its use as a binding agent, emulsifier, and film-forming component in industries such as adhesives, inks, rubber, and coatings. The sticky and tacky nature of gum rosin makes it an essential ingredient in the production of pressure-sensitive adhesives and chewing gums.

During the second quarter of 2024, the gum rosin prices observed a very mixed market dynamic. In the early phase of the quarter, the prices looked up, primarily supported by the feedstock costs. Pinewood saw a flattering rise in prices amidst the limited availability of supplies. However, with the progression of the quarter, as the supply security started getting better, the demand scenario remained relatively meek. This turned down the market sentiments as the quarter concluded. Overall, a fluctuating price trajectory was witnessed.

Europe

The gum rosin prices remained positively inclined throughout the said time period. In Europe, the supply chain constraints remained pivotal despite occasionally dwindling demands. Inventories were tightened in China; therefore the import prices escalated for European markets. Suez Canal, the major maritime gateway between Asia and Europe, saw a substantial decline in the number of vessels passing through it. Demand stabilization in the mid-quarter helped mitigate the cost pressure slightly, however, the market trend remained positively anchored the entire span.

North America

In the American markets, the gum rosin prices showcased similarities with the Asian markets as the prices were found fluctuating in a similar manner here as well. The quarter started on a firm note at the beginning of April’24. Both domestic and international demands paved the way for rising prices. For the most period, the market was able to sustain its momentum. A marginal dip was noticed briefly at the change of months, however, the market quickly rebounded as the demands kept positively pulling the prices. With this, the quarter closed on a higher note in the American gum rosin market. Conclusively, the market sentiments remained positive throughout the said period.

Analyst Insight

According to Procurement Resource, given the current supply and demand situation, the market trends look positive for Gum Rosin prices going forward.

Gum Rosin Price Trend for the Q1 of 2024

Asia

Gum rosin is produced from the resin collected from the pine trees. It is rich in abietic acid and is used as an adhesive and is commonly used in the paper and packaging industry as well. The market performance of gum rosin has been underwhelming in the previous year because of lackluster demand. Disappointed with the downfall in market prices in the previous year, the suppliers cut down the available gum rosin supplies in the international market during the first quarter of 2024.

During the given period of Q1’24 the market demands did not see any significant changes and remained underwhelming and subdued for the major part of it. However, there was a supply crunch in the market this time. After such a steep downfall in the market, the suppliers lost interest and notably reduced the supply volumes. This shift in the supply outlook did counterbalance the lackluster demands a little. Thus, the price graph, though, faced southward and almost plateaued, particularly in the Chinese gum rosin market. Conclusively, a steady and stable market run was witnessed.

Europe

The situation in the European gum rosin market was also not much different from the Asian gum rosin market. The market demands were found to be largely trembling here as well. Since the Russia and Ukraine war began, the region has been hit by massive economic inflation, and the consumption patterns have experienced significant shifts. The expenditures became more necessity and experience centric. With this, the gum rosin suppliers barely received any orders, and the prices also remained southward facing for most of the said period.

North America

As discussed in the Asian and European markets the supply of Brazilian pine oleoresin decreased in the American market as well during the first quarter of 2024. Because of the tight margins and declining selling prices, many smaller producers left the market, citing poor tapping economics. In key producing regions like Sao Paulo and southern Brazil, lower prices have discouraged workers, leading to reduced availability.

Forest owners who lease areas to producers also felt the impact; some ended lease agreements due to unproductive conditions. Overall, pine oleoresin supply for the 2023-24 tapping season estimatedly dropped by 20-30%. With this, temporary and marginal price upliftment was achieved, but they were not sustainable. Additionally, declining exports of gum rosin further illustrate the challenges faced by the Brazilian pine oleoresin producers.

Analyst Insight

According to Procurement Resource, the Gum Rosin price trends are likely to remain downward tilted in the next quarter as well. Even with the current supply crunch, the market demands are way too low.

Gum Rosin Price Trend for the October - December of 2023

Asia

After stumbling throughout the fourth quarter of 2023, the gum rosin prices eventually declined as the year and quarter approached its end. It was anticipated that the seasonal fluctuations would benefit the gum rosin market, but the abundance of harvest surpassed the demand from the downstream pharmaceutical and food sectors. Along with the domestic players, the rate of procurement from the overseas industries also remained muted during most of the part of the quarter and thus resulted in the southward movement of gum rosin prices.

Europe

Europe is one of the major importers of gum rosin raw materials, for whom the fourth quarter did not yield any favorable results. The decline in the prices of gum rosin can also be attributed to the weak dynamics of the market and the lack of confidence of consumers in the market.

The downstream pharmaceutical and food & beverage industries also struggled with their internal losses as the adverse of prolonged inflation and excessive supply led to a downturn in market momentum and eventually pushed the gum rosin into a downward spiral.

North America

The scenario of gum rosin price trend in North America was similar to what was observed in the Asian and European markets. The regional demand also fell short in front of the rising level of inventories.

Along with Europe, the US is also a major importer of gum rosin and its raw materials, but in the last quarter, the import volumes had to be adjusted in accordance with the momentum of downstream industries, which eventually did not work in favor of the trading sector and thus led to the downward movement of gum rosin price trend.

Analyst Insight

According to Procurement Resource, the price trend of Gum Rosin are expected to struggle as there are minimal to no signs of revival of downstream pharmaceutical and food sector procurement rates for gum rosin and related products.

Gum Rosin Price trend for the July - September of 2023

Asia

The price trend for gum rosin registered a downward trajectory in the Asia-Pacific region during the third quarter of 2023. China still struggled to revive its manufacturing to the pre-covid levels, which was further affected by the geopolitical conflicts hampering international trade. The high inflation levels affected the purchasing capacities of the market players.

The lowering demands reflected the skeptical attitude of the buyers deeply impacted the price trend of gum rosin. Moreover, the weak demands posed by the downstream paints, coating, and adhesives sectors were being easily catered via the present inventories. Hence, the price graph of gum rosin witnessed decreased activity throughout Q3’23.

Europe

In line with its Asian counterpart, the price trend for gum rosin declined in the European regional markets. The reduced demands, coupled with overflowing inventories, caused the price graph of gum rosin to move southwards. The geopolitical conflicts in its backyard resulted in an economic backlash in the European region.

The runaway inflation, coupled with the necessary centric purchasing activities of the consumers, disrupted the market fundamentals drastically. Though some respite was seen in the market with the opening of alternative trade routes, the influx of cheap goods from China caused the suppliers to indulge in unhealthy competition, causing the price trend to dwindle further.

North America

The North American market mimicked the global trend in the gum rosin market during the discussed period. The overstocked inventories amid falling downstream demands affected the pricing fundamentals of the market. Further, the weak demands from the struggling European and Asian markets added to the downward movement of gum rosin prices. Even the maintenance shutdowns leading to output cuts did not have any affect as the inventories were well overstocked and easily catered towards any feeble demand posed.

Analyst Insight

According to Procurement Resource, the price trend of Gum Rosin are likely to remain oscillating in the coming months, given the current uncertainties in the downstream demands and global economy.

Gum Rosin Price Trend for the First Half of 2023

Asia

Gum rosin prices fluctuated in the first and second quarters of 2023 as the Asian market suffered from the problem of oversupply. In the first quarter, manufacturers were forced to cut down their operation rates due to the weak purchasing potential of buyers. In addition, the building pressure from the hiking interest rates and slow movement of the gum rosin market in both domestic and international sectors hampered the price trend.

In addition to this, the second quarter also suffered from the hike in feedstock prices along with the constriction in manufacturing activities due to labor strikes. The downstream market in this quarter also failed to produce adequate demand to support the prices, and as a result, the price trend of gum rosin fell southwards.

Europe

A stable and stagnant trend in gum rosin prices was observed in the first quarter of 2023 in the European market. The prices in this quarter were supported by the demand from the end-user industries. In addition to this, sufficient availability of inventories and imports from the Asian region helped to balance the rising demand.

However, the second quarter did not fall into these steps as the hike in the level of inventories caused overstocking of the product and thus negatively impacted the price trend of gum rosin. The demand from downstream industries also slowed down due to weak market conditions, which eventually led the price trend of gum rosin to fall down.

North America

The North American market of gum rosin showcased mixed sentiments in the first and second quarters of 2023. The weak movement of paints and coatings, adhesives, and related industries led to the downfall of the prices.

There was some slight improvement in the end months of the first quarter and initial months of the second quarter due to an increased interest of buyers, but this trend could not sustain for long as prices declined again. The automotive and construction sector saw a major reduction in demand in this quarter. Along with this, the labor strikes and shutting down of ports, and a significant rise in the level of inventories, caused the price trend of gum rosin to fall further.

Analyst Insight

According to Procurement Resource, Gum rosin prices are estimated to showcase a declining trajectory as the market sentiments of the downstream industries seem weak.

Procurement Resource provides latest prices of Gum Rosin. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Gum Rosin

Gum rosins or colophony are natural resins obtained primarily from pine trees. It is a solid, translucent with glassy appearance that is processed through distillation. They are widely employed in adhesives, paints, coatings, inks, rubber, paper sizing, electrical insulation, soap, and other related industries. Its adhesive and solubility properties make it a valuable raw material in these applications.

Gum Rosin Product Details

| Report Features | Details |

| Product Name | Gum Rosin |

| Industrial Uses | Adhesives and sealants, Soap and detergents, Rosin core solder, Musical instruments, Paper and packaging |

| HS Code | 38061010 |

| CAS Number | 8050-09-7 |

| Supplier Database | Harima Chemicals Group, GUM CHEMICAL SOLUTIONS, Forestar Chemical Co Ltd, GUILIN SONGQUAN FOREST CHEMICAL CO LTD, CV. INDONESIA PINUS, Floripinus Chemical Industries |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Gum Rosin Production Processes

In distillation, the first step involves the collection of crude gum and then rosin is separated from turpentine by heating. This is followed by purification for the removal of impurities after which the final product is obtained.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com