Product

Linear Alkylbenzene Sulfonate Price Trend and Forecast

Linear Alkylbenzene Sulfonate Price Trend and Forecast

Linear Alkylbenzene Sulfonate Regional Price Overview

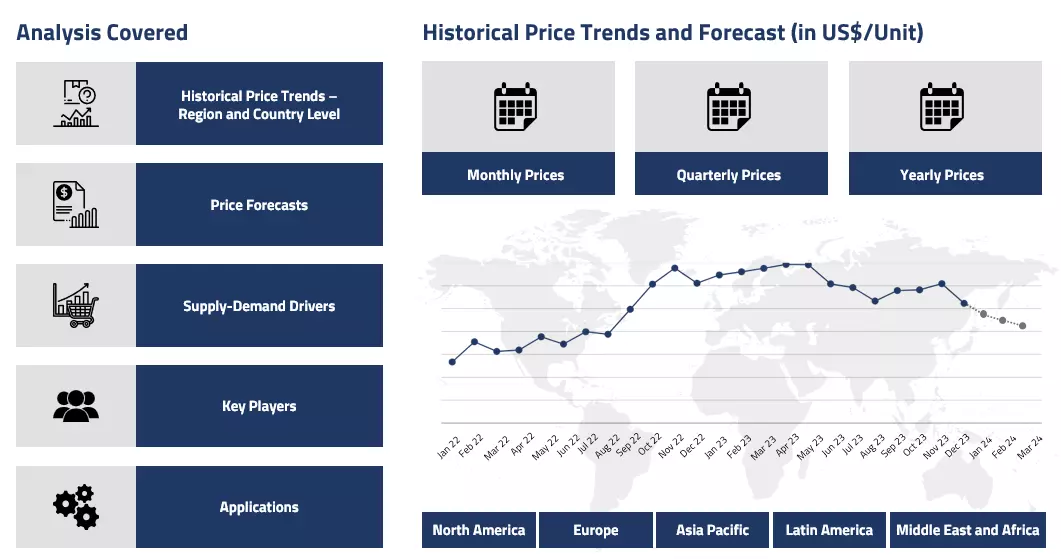

Get the latest insights on price movement and trend analysis of Linear Alkylbenzene Sulfonate in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Linear Alkyl Benzene Sulfonate Price Trend for the First Half of 2024

Asia

In the first half of 2024, the price trend of linear alkyl benzene sulfonate in Asia displayed notable fluctuations. During the first quarter, the market remained relatively stable, supported by balanced supply and demand dynamics, particularly in Saudi Arabia. However, the Chinese and Indian markets experienced upward pressure on prices due to an increase in demand from the surfactant industry, especially with the arrival of warmer weather.

Linear Alkylbenzene Sulfonate Price Chart

Please Login or Subscribe to Access the Linear Alkylbenzene Sulfonate Price Chart Data

The high demand from the surfactant sector, which is a key user of linear alkyl benzene sulfonate, pushed prices upward, particularly in the latter part of the quarter. Initial supply chain constraints in China raised concerns early in the quarter, but as the Chinese market rebounded after the holiday season, linear alkyl benzene sulfonate prices surged. In the second quarter, linear alkyl benzene sulfonate prices continued their gradual ascent, driven by sustained demand from surfactant manufacturers. The warmer weather and the approach of major festivals boosted production, while steady imports and optimized supply chains helped maintain price stability.

Europe

In Europe, the linear alkyl benzene sulfonate market saw an increase in prices during the first quarter of 2024, driven primarily by rising costs of feedstock linear alkyl benzene (LAB) and upstream benzene. These increases were compounded by disruptions in trade routes due to geopolitical tensions, particularly the crisis in the Red Sea. The cost of petrochemical inputs like crude oil and natural gas further supported the upward trend in linear alkyl benzene sulfonate prices. Additionally, the European market faced reduced inflows of new business despite a slight improvement in manufacturing activities. During the second quarter, the price trend remained bullish as warmer weather spurred demand for surfactants used in cleaning and personal care products. The recovery in European manufacturing activities, coupled with increased consumer demand, contributed to higher prices.

North America

In North America, the linear alkyl benzene sulfonate price trend in the first quarter of 2024 was heavily influenced by rising feedstock costs and fluctuations in crude oil prices. The US market saw increased demand for linear alkyl benzene sulfonate, particularly from overseas markets like Europe and Mexico, which, along with disruptions in global trading routes, contributed to a bullish price trend.

The stability in upstream markets, particularly for LAB, further supported rising linear alkyl benzene sulfonate prices during this period. In the second quarter, linear alkyl benzene sulfonate prices in North America continued to follow an upward trend, driven by warmer weather and increased demand for surfactants from the cleaning and personal care sectors. Despite a bearish trend in upstream feedstock benzene, linear alkyl benzene sulfonate prices remained aligned with LAB, supported by strong domestic and international demand. Outdoor activities, construction, and rising consumer spending also played a role in maintaining a high demand for surfactant products, ensuring that linear alkyl benzene sulfonate prices stayed on an upward trajectory throughout the second quarter.

Analyst Insight

According to Procurement Resource, the price trend of Linear Alkyl Benzene Sulfonate is estimated to move northwards in the quarters ahead with ample of support from the downstream as well as the consumer sectors.

Linear Alkylbenzene Sulfonate Price Trend for the Second Half of 2023

Asia

The market for linear alkylbenzene sulfonate depicted a positive momentum in the third quarter of 2023 as the international offers grew gradually and existing rates of production and inventories were not sufficient to cater to this, widening the gap between supply and demand. Moreover, the hike in the cost of naphtha and crude oil raised the cost of production and, in turn, the price trend of linear alkylbenzene sulfonate. However, in the fourth quarter, the sentiments turned pessimistic due to the decline in international prices of crude oil. Additionally, the feedstock market also registered significant losses, tossing the linear alkylbenzene sulfonate price trend in the negative direction.

Europe

In Europe, the primary causes of the rise in the prices of linear alkylbenzene sulfonate were the inclination in demand and the higher cost of upstream materials. The rise in the momentum of linear alkylbenzene sulfonate prices was further fueled by the upward direction of benzene prices and persistent inflation. The lending rates set by the banking sector also witnessed a consistent rise, which increased the cost of production and, in turn, the prices of linear alkylbenzene sulfonate. However, significant challenges were encountered by the linear alkylbenzene sulfonate market in the fourth quarter as the economic slowdown and depletion in consumer spending budget brought the growing momentum of the linear alkylbenzene sulfonate prices to a halt.

North America

The rise in the number of export orders and elevation in the global cost of crude oil escalated the prices of linear alkylbenzene sulfonate during the third quarter of 2023. But similar to the Asian and European countries, this dynamic of the market was not carried forward in the next quarter and as a result, the prices of linear alkylbenzene sulfonate dipped continuously. This depreciation in the market outlook was based on limited rates of procurement from the downstream industries and an unexpected fall in the prices of benzene.

Analyst Insight

According to Procurement Resource, the price trend of Linear Alkylbenzene Sulfonate is expected to trace the trajectory guided by the downstream industries and feedstock market.

Linear Alkylbenzene Sulfonate Price Trend for the First Half of 2023

Asia

Asian Linear Alkylbenzene Sulfonate market witnessed fluctuating price trend during the first half of 2023. Prices rose steadily till the first month of the second quarter and then declined for the rest of Q2. As trade activities started increasing in China after Covid 19 lockdown got lifted, manufacturing activities paced up. Buying sentiments also improved among people. However, soon the demand started declining, leading to huge stockpiles of products in the market. Hence, as a result, the prices became stagnant towards the end of Q2.

Europe

A blended behaviour was expressed by Linear Alkylbenzene Sulfonate prices in the said period. The economic turmoil of 2022 took its toll on Europe as manufacturing and other industrial activities decreased. Hence, the Linear Alkylbenzene Sulfonate market downsized under pressure. The after-effects persisted and altered consumer behaviour immensely. The decrease in end consumer demands kept pulling the prices down. Some temporary rebound was witnessed at the shift of quarters, but the prices again declined by mid-Q2. Overall, dull and muted price trend for Linear Alkylbenzene sulfonate were observed.

North America

The North American Linear Alkylbenzene Sulfonate market almost replicated the behaviour of its Asian counterpart. Prices rose till the first month of the second quarter and declined rapidly after that.

Downstream demands from surfactants and petrochemical industries rose at the start of 2023, but the inventories were running low as the supplies were curtailed because of port congestions and supply chain disruptions. But as the manufacturing started pacing and freight issues were resolved, supply and demand dynamics improved in Q1 2023. These trend continued till April’23, and then a dip in price trend was witnessed as the stocks started overflowing. Overall, a fused price curve was observed for Linear Alkylbenzene Sulfonate.

Analyst Insight

According to the Procurement Resource, the Linear Alkylbenzene Sulfonate prices are expected to continue fluctuating in the upcoming months, given the current uncertainties in the supply-demand dynamics.

Linear Alkylbenzene Sulfonate Price Trend for the Year 2022

Asia

Asian Linear Alkylbenzene Sulfonate market fluctuated throughout 2022 as several intrinsic and extrinsic factors drove the market trend. Prices started high in January 2022 as the downstream demands from cleaning and surfactant products were high. As the Covid 19 restrictions were implemented in China, manufacturing activities halted, creating a serious supply constraint.

Demands persisted as cleaning products were essential in fighting Covid 19, so the prices increased. By the third quarter, the lockdown got lifted in China, and the manufacturing sector started thawing. As the supplies started increasing, the prices started sipping as well, and the year ended with Linear Alkylbenzene Sulfonate price trend facing southwards in the Asian market.

Europe

The year 2022 was one of the biggest economic nightmares for the European market attributed to the Russian invasion of Ukraine. Prices rode high for most of the year as the unprecedented fuel and energy prices dominated the market fundamentals. Prices kept rising and demands from downstream sectors also supported the inclined trend. But by Q4, the prices had risen to a level that caused demand destruction in the market and crashed the Linear Alkylbenzene Sulfonate prices towards the end of 2022.

North America

Linear Alkylbenzene Sulfonate observed mixed price sentiments throughout 2022 in the North American market. Prices rose gradually for the first half of the year as the upstream and manufacturing costs inclined throughout the said period because of supply chain curtailments. But as the feedstock prices and downstream demands started declining from mid-Q3, the Linear Alkylbenzene Sulfonate prices were set on a declining trajectory and continued till the rest of the year.

Analyst Insight

According to the Procurement Resource, the Linear Alkylbenzene Sulfonate prices are expected to fluctuate further in the coming months as market demands and upstream costs will likely remain unsettled.

Linear Alkylbenzene Sulfonate Price Trend For the Fourth Quarter of 2021

Asia

Under the influence of strong-getting benzene feedstock on the basis of decreasing upstream crude oil supplies, talks for LAB in the Asian market remained steady until mid-November.

The downstream cleaning and detergent business intensified their purchase patterns around November-end in order to fill their stockpiles and avoid any delays in catering to customer requests due to a modest decrease in pricing on the capped upstream market.

The boost in import activity, as well as the year-end stock-clearing trend among Indian manufacturers, helped to keep LAB prices in check in December, with prices ranging from 1718 USD/MT to 1908 USD/MT.

North America

The North American LAB market showed signals of bullishness in October and November, with prices constantly climbing. The price increase was primarily driven by a scarcity of benzene supplies in the face of soaring upstream crude oil prices, as well as reduced production in the US plants recovering from hurricane Ida-related damage, affecting LAS prices as well.

Traders were also concerned about the spot market's stifled activity. The increase in raw material supply towards the end of November and December resulted in lower prices in the US market. Furthermore, the reduced port congestion allowed for increased offtakes in the foreign downstream industries, allowing December prices in the United States to hover around 1840 USD/MT FOB Louisiana. Meanwhile, demand for domestic cleaning and personal care products remained stable in the local market.

Europe

For the majority of the quarter, high volatility in upstream crude oil prices and sluggish demand from downstream industries kept LAB prices buoyant in Europe. Despite improved feedstock availability, LAB prices in Germany fell marginally in December to 2430 USD/MT FOB Hamburg, owing to a jump in demand fundamentals due to increased cleansers and detergent usage as a result of the resurgence in Coronavirus infections. As a result, LAS prices and demand followed a similar trend.

Linear Alkylbenzene Sulfonate Price Trend For First, Second and Third Quarters of 2021

Asia

During the first quarter, the Asian market had conflicting attitudes, with demand from downstream detergent segments being steady but varying by nation. The price of LAB was boosted throughout this quarter by strong crude oil prices and lower spot availability of benzene. As a result, LAB prices in the region rose, increasing LAS prices also.

Despite stable demand fundamentals in the Indian market, the value increased from 1383.7 USD/MT in January 2021 to 1467.5 USD/MT in March 2021. In Q3 2021, the general market outlook for LAB saw a sustained rise in pricing trend across the Asia Pacific region.

Following a lull in early August, discussions about LAB turned optimistic in India, owing to a steady rise in crude oil prices and increased use for the downstream LABSA. Furthermore, because LAB deliveries in India were insufficient to meet overall demand, buyers were eager to refill cargoes at higher prices to minimise any negative impact on consumer sentiment during the next festive season. During the third quarter, the price of LAB increased from 1967 USD/MT to 2154 USD/MT. This price volatility of LAB also affected LAS prices.

North America

Devastated production activities along the Gulf Coast of the United States halted total LAB output in the region. Several large refineries, including ExxonMobil, Total, and Shell, experienced unanticipated turnarounds due to the cold weather, reducing the supply of all prime upstream chemicals, including feedstock benzene. During this time, it is estimated that more than 74% of total benzene production was suspended, causing LAB and hence LAS prices to skyrocket.

The prices increased dramatically in North America in Q3 2021, owing to steady demand from downstream industries. During Q3 2021, supply side difficulties in the manufacture of LAB were exacerbated by a lack of upstream benzene due to decreasing inventory levels and rising raw material costs. In the third quarter, increased demand from the downstream surfactant business pushed LAB pricing upward. Regional traders were concerned about hampered transportation activity and high freight expenses.

Europe

Benzene prices in the European region, unlike those in Asia and North America, were trending downward, owing to ample supply and weak demand. The second wave of COVID-19 had an influence on downstream industries' functionality, keeping the LAB demand low. However, the region's export prices were supported by high freight costs and a shipping container shortage.

During the third quarter of 2021, the European domestic market had conflicting sentiments. In terms of supply, the region's upstream benzene supplies remained tight, affecting LAB supply fundamentals. Due to lower operations at downstream plants throughout the quarter, demand for LAB from the surfactants industry remained muted.

Linear Alkylbenzene Sulfonate Price Trdnd For the Year 2020

Asia

For the quarter ended September 2020, the market for raw material Linear Alkyl Benzene (LAB) was quiet. Although there was little change in demand fundamentals as a result of the epidemic, the contract prices due were obscured by negotiations spurred by dealers to commence better offtakes.

Despite this, the detergent and cleaning industry's increasing demand failed to generate significant gains, as manufacturers saturated the market with surplus supply. The lingering prognosis of LAB was expected to bounce back by the fourth quarter, owing to sustained growth in market sentiments of feedstock benzene.

Europe

The LAB market in Europe was strong in the third quarter, with continued demand for surface cleaning solutions under tight industrial hygiene norms. The reappearance of the coronavirus in some sections of the region further increased the consumption of LAB in surfactants and derivatives, increasing the demand for LAS as well. With no signs of a turnaround in the near future, market participants were wary of supply outstripping demand, resulting in lower profit margins.

North America

The demand for LAB in the region expanded significantly as a result of increasing usage of surfactants and cleaning products as a preventive measure against the global pandemic. The market fundamentals of LAB stabilised significantly as a result of reduced panic purchase and hoarding of the product. Manufacturers witnessed a drop in profit margins due to rising product inventories and lack of a significant reduction in operating rates.

Procurement Resource provides latest prices of Linear Alkylbenzene Sulfonate (LAS). Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Linear Alkylbenzene Sulfonate

Linear Alkylbenzene Sulphonate (LAS), is an anionic surfactant. In 1964, it was introduced as a biodegradable alternative to highly branched alkylbenzene sulphonates (ABS). LAS is a combination of isomers and homologues with an aromatic ring sulphonated at the para position and coupled to a linear alkyl chain, all of which are closely related.

Linear Alkylbenzene Sulfonate Product Details

| Report Features | Details |

| Product Name | Linear Alkylbenzene Sulfonate |

| Industrial Uses | Household Detergents and Cleaners, Personal Care Products, Industrial Cleaners |

| Chemical Formula | C18H29NaO3S |

| Synonyms | Sodium 4-(2-dodecanyl) benzene sulfonate, Alkylbenzene Sulfonate, Benzenesulfonic acid, alkyl derivs. |

| Molecular Weight | 348.47 g/mol |

| Supplier Database | BASF SE, Stepan Company, Croda International Plc, Hansa Group AG, Clariant |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Linear Alkylbenzene Sulfonate Production Processes

- Production of LAS from LAB

Industrial production LAB includes the sulfonation of linear alkylbenzene (LAB) using sulfonating agents such as oleum and sulfuric acid.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com