Product

Magnesium Sulfate Price Trend and Forecast

Magnesium Sulfate Price Trend and Forecast

Magnesium Sulfate Regional Price Overview

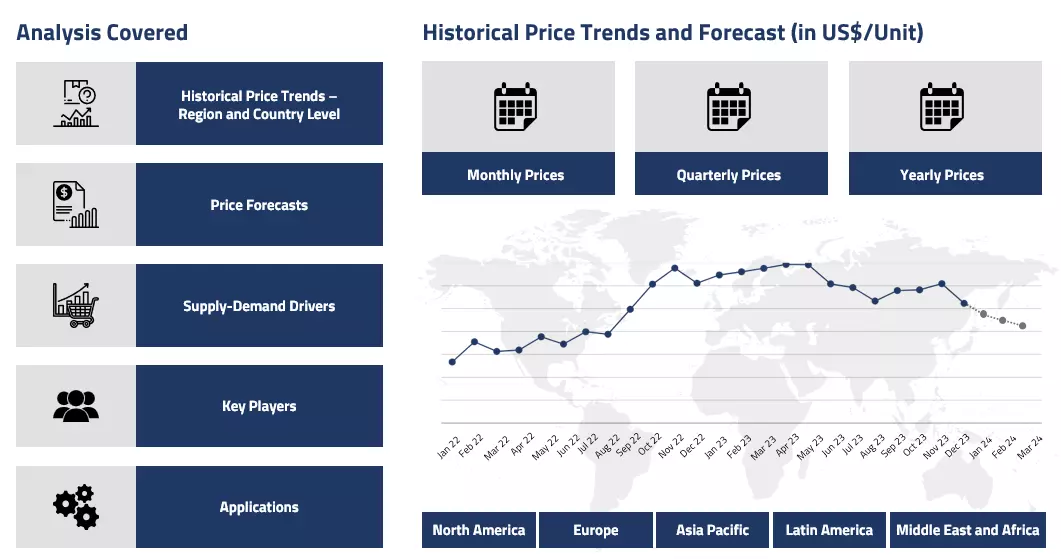

Get the latest insights on price movement and trend analysis of Magnesium Sulfate in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Magnesium Sulfate Price Trend for the Q3 of 2024

Asia

The prices of magnesium sulfate showed a fluctuating trend, influenced by the prices of key feedstocks, magnesium and sulfuric acid. Magnesium prices mostly wavered in China with minor fluctuations during the quarter, offering limited support to magnesium sulfate prices. However, rising sulfuric acid prices, a key feedstock, contributed to the positive push. The primary demand for magnesium sulfate came from the agrochemical and fertilizer sectors.

Magnesium Sulfate Price Chart

Please Login or Subscribe to Access the Magnesium Sulfate Price Chart Data

Procurement in the fertilizer industry remained cautious due to seasonal changes, and exports declined as a result of restrictions imposed by the Chinese government to protect domestic farmers from higher fertilizer prices. While the short-term demand outlook appeared gloomy, prices continued their conflicted trend with support from upstream feedstocks. Overall, the market maintained a dicey outlook.

Europe

The price trajectory of magnesium chloride showed a mixed trend, influenced by various factors. In the third quarter of 2024, the sulfuric acid market in Europe faced supply constraints due to plant outages and reduced production rates. This limited availability pushed the graph up, offering support to magnesium sulfate prices. Demand from the downstream agriculture and food processing sectors remained steady, and market dynamics appeared stable. However, as the quarter progressed, demand failed to catch up and started pushing the prices down.

North America

The magnesium sulfate market in North America followed similar trends to other global markets, maintaining a tugged outlook throughout the quarter. Prices responded to the bleak demand and the rise in feedstock prices. However, the market faced supply chain disruptions due to the peak hurricane season, which led to supply shortages. While the hurricanes impacted fertilizer demand by disrupting crop fields, the effect was limited and not significant.

Analyst Insight

According to Procurement Resource, the prices of magnesium chloride are expected to fluctuate in the coming quarter depending on the prices of feedstocks and demand from the downstream sectors.

Magnesium Sulphate Price Trend for the Q2 of 2024

Asia

In Q2'24, the prices of Magnesium Sulphate in the Asian region showed significant fluctuations. The Magnesium Sulphate price analysis showed that the limited availability of the feedstock magnesium in China drove the prices upward. This was worsened by production disruptions resulting from the planned maintenance shutdown of major plants, which reduced production capacity and constrained the availability of magnesium, while demand from the agrochemical and pharmaceutical sectors remained strong.

Additionally, the prices of sulphuric acid showed stable fluctuations, which had a minimal impact on magnesium sulfate prices. Overall, the Magnesium Sulphate price chart showed a rising trend amid the limited supply of the commodity.

Europe

In the second quarter of 2024, many buyers and downstream industries in European countries experienced longer delivery times for magnesium sulfate shipments from Asian countries. Production disruptions at key suppliers, such as Fugu Jinchuan in China and Shaanxi Zhongxin, fueled the supply-demand imbalance, leading to higher prices. Additionally, rising feedstock prices in major exporting nations further contributed to the increased commodity prices in European markets. Geopolitical challenges, including disruptions in shipments due to Houthi attacks and changes in traditional delivery routes, also had a notable impact on the trajectory of the European Magnesium Sulphate market.

North America

In the second quarter of 2024, the prices of Magnesium Sulphate in the North American markets showed an oscillating trend. According to the Magnesium Sulphate price database, the price chart indicated notable fluctuations, with an upward movement driven by strong demand from downstream sectors. The limited availability of feedstocks, coupled with supply chain disruptions, contributed to the price increase during this period. Overall, the Magnesium Sulphate price graph reflected higher prices due to restricted supply and sustained demand from downstream sectors.

Analyst Insight

According to Procurement Resource, Magnesium Sulphate prices are expected to incline further as the demand from agrochemical and other sectors will likely witness a rise in the upcoming months.

Magnesium Sulfate Price Trend for the Q1 of 2024

| Product | Category | Region | Price | Time Period |

| Magnesium Sulfate | Chemicals | USA | USD 500/MT | March 2024 |

| Magnesium Sulfate | Chemicals | Europe | USD 400/MT | March 2024 |

Stay updated with the latest Magnesium Sulfate prices, historical data, and tailored regional analysis

Asia

In China, the magnesium sulfate price trend bore a southward trajectory as the downstream industries were skeptical of the current market dynamics. First and foremost, the global supply of magnesium declined by a great margin due to the disruption of trade routes. This raised the pricing quotations of raw materials by several folds and as the quarter progressed, the hike in crude oil prices further raised the cost of production.

This limited the production capacities of the manufacturers throughout the first quarter of 2024. Additionally, the onset of the Chinese New Year holiday season and spring festivities in China reduced the industrial growth and appetite of downstream industries, contributing to the frail outlook of the magnesium sulfate market. However, post-holidays, the industries revamped their production processes, but the magnesium sulfate price trend did not show any improvement in its trajectory.

Europe

During the initial phase of the first quarter, magnesium sulfate prices experienced a slight decline in Europe due to subdued demand and production challenges influenced by the limited availability of feedstock magnesium. Amid the global supply crunch, the Chinese suppliers refrained from selling magnesium at subsidized rates, additionally contributing to moderate magnesium supply levels. However, escalating prices of feedstock magnesium, driven by increased stocking activities before the Lunar New Year and supply chain disruptions due to geopolitical tensions, further raised the concerns of the manufacturing sector in Europe.

On the other hand, cost support from sulphuric acid was weak due to decreased sulfur prices from subdued demand in agrochemical industries. Additionally, sluggish procurement activities across various sectors, such as pharmaceuticals, cosmetics, wellness, and horticulture, depreciated any growth momentum of the market and eventually raised the inventory levels.

North America

The weak momentum of previous quarters translated well to the Q1 of 2024, and thus, magnesium sulfate prices experienced a notable decline. This downturn of the market was driven by subdued demand across various end-user industries. The ill consequences of sluggish procurement activities, particularly in sectors such as horticulture, pharmaceuticals, and personal care products, were compounded by the excessive rise in inventory levels.

Additionally, shipping activities in the USA faced major disruptions due to reduced water levels in the Panama Canal caused by dry weather conditions linked to the El Niño effect. Additionally, weakened demand for fertilizer from the horticulture sector in the US market further contributed to the overall subdued dynamics of the magnesium sulfate price trend.

Analyst Insight

According to Procurement Resource, the price trend of Magnesium Sulfate is estimated to face the consequences of a sudden decline in magnesium inventories and exceeding demand from the downstream industries.

Magnesium Sulfate Price Trend for the October - December of 2023

Asia

The manufacturing sector of magnesium sulfate performed fairly well in the last quarter of 2023. China is one of the major exporters of magnesium sulfate, and the expansion of its manufacturing and industrial sectors hinted towards the fast recovery of the market. As a result of this positive outlook, the demand for magnesium sulfate showed some improvement, not much as expected but enough to give the trading sector a ray of hope. The export number of magnesium sulfate from China to the US, however, declined as a result of increasing tension in the sea routes due to the Isarel-Hamas conflict.

Europe

In European countries, the adverse weather conditions and slowing down of the downstream fertilizer industries resulted in the downfall of magnesium sulfate price trend. The end-user industries suffered from the ill consequences of poor economic growth and rising inflationary pressure. Further, the blocking of the Red Sea route and the increased number of sanctions on Russia made the international trading of magnesium sulfate difficult, as could be seen in the southward movement of magnesium sulfate prices.

North America

Due to the onset of the holiday season and sale season in the US, the magnesium sulfate price trend struggled throughout the entire end quarter of 2023. The number of shipments of magnesium sulfate reaching the US ports also declined steeply as the water levels in the Panama Canal reduced under the red zone while the ongoing Israel-Hamas tensions restricted the movement of cargo through the Red Sea route. Additionally, the consumers also seemed uninterested in the magnesium sulfate sector, partially due to the holidays and partially due to the heavy rains, which postponed agriculture activities.

Analyst Insight

According to Procurement Resource, the price trend of magnesium sulfate are expected to waver in accordance with the fluctuations in the downstream demand and excessive pressure of the struggling global economy.

Magnesium Sulfate Price Trend for the July - September of 2023

Asia

The initial phase of the third quarter witnessed a surge in the magnesium sulfate price trend. This trajectory of the magnesium sulfate price graph was supported by high demand and escalating inflation in the global food market. Further, the agricultural industries suffered from the alteration in the rain patterns and depletion in the inventory levels. In addition to this, the supply of feedstock material also remained restricted in the region, which also helped in the growth of magnesium sulfate price trend.

Europe

The third quarter of 2023 brought positive momentum in the magnesium sulfate prices as the fertilizers and horticulture sector improved their consumption rates. Further, the decline in the level of imports from Russia decreased the availability of stockpiles of the product in the region.

In addition to this, the abrupt surge in the cost of food products and disruptions in the supply chains also supported the positive trajectory of the magnesium sulfate price graph. During the middle of the third quarter, the prices began to stumble as the number of offtakes and interest of consumers began to decline but this momentum was short-lived as market sentiments improved again towards the end of the quarter.

North America

The magnesium sulfate price trend experienced fluctuations during Q3 of 2023 but overall registered an incline. The main driver of the magnesium sulfate market was its demand from the downstream fertilizer and agriculture sectors. There was a slight reduction in the magnesium sulfate prices in the month of August as a significant reduction in the cost of production and a hike in inflation and interest rates charged by banks was registered. However, with the limited availability of feedstock and the rise in demand, the magnesium sulfate price trend soon surged.

Analyst Insight

According to Procurement Resource, the price trend of Magnesium Sulfate are expected to follow a northward trajectory as its demand is driven by the forward movement of the fertilizer sector.

Magnesium Sulfate Price Trend for the First Half of 2023

Asia

The first quarter of 2023 suffered a decline in the demand from the downstream agriculture industries that affected the price trend of magnesium sulfate negatively. In addition to this, the upstream sulphuric acid prices also showcased weak growth that only led to the rise in the inventories of magnesium sulfate.

The stockpiles of magnesium sulfate also inclined due to the rise in production activities in China after a silent period due to the spring festivals, while the procurement of the product remained slow throughout the first two quarters of 2023.

Europe

The prices of magnesium sulfate witnessed an uneven trajectory in the first quarter. Initially, the agrochemical industries failed to maintain their market momentum, which was evident in their sales rates that, in turn, hampered the growth of magnesium sulfate prices.

The declining costs of production and upstream industries also proved to be a challenge for the growth of magnesium sulfate prices. However, in the second half of the first quarter, the shortage of skilled workers, tight monetary restrictions, and rise in cost inflation led to the rise in prices of magnesium sulfate. The second quarter failed to follow in the same trend as the weak economic conditions and fall in trading activities led to the decline in the magnesium sulfate price trend.

North America

In North America, the market trend of magnesium sulfate fluctuated throughout the first quarter of 2023 due to the decline in freight charges and demand for magnesium sulfate. In addition to this, the imports from China and Europe flooded the market amid weak demand scenarios. However, the lower availability of labor and high pressure of inflation caused the prices of magnesium sulfate to move in a positive direction. The second quarter, however, followed a bearish trend with a reduction in the number of offtakes from the downstream sectors, rising inventory levels, and logistics costs.

Analyst Insight

According to Procurement Resource, the price trend of Magnesium Sulfate is estimated to struggle with the declining interest of the agriculture sector and falling global trading sentiments.

Magnesium Sulfate Price Trend for the Second Half of 2022

Asia Pacific

An oscillating trend in the prices of Magnesium Sulfate was observed in the third quarter of 2022. The prices suffered majorly due to the fluctuating prices of feedstock material and uncertainties in the demand. The imposition of Covid-19 restrictions aided in these declines and as a result, the downstream market retracted. This also led to a rise in inventories and a strong supply that struggled with the reduced number of offtakes, hence weak economic conditions were prevalent during the concerned period.

Europe

The market for Magnesium Sulfate declined initially in the third quarter, but the prices soared significantly towards the end of the quarter. This price trend was majorly attributed to the persistent energy crises due to the Russia-Ukraine war as it also hampered the trade of raw materials in this region. After an incline in the third quarter, the prices stumbled in the fourth quarter. High rates of energy production, a depreciating currency, and rising inflation rates negatively influenced the price trend for Magnesium Sulfate.

North America

A fluctuating trend in the prices of Magnesium Sulfate was seen in North America. The prices oscillated due to the weak demand from the end-user agriculture industry, raising the inventory levels. The demand somehow improved in the middle of the third quarter with a simultaneous positive impact on the inventories. The fourth quarter was favourable in terms of Magnesium Sulfate prices. The availability of high-priced products from the exporting nations amid uncertain feedstock supply caused the prices to incline in the domestic market.

Analyst Insight

According to Procurement Resource, the prices of Magnesium Sulfate are likely to follow an oscillating trend in the upcoming quarter as the demand from the end-user industries and cost of energy production seems to be uncertain in the foreseeable future.

Procurement Resource provides latest prices of Magnesium Sulfate. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Magnesium Sulfate

Magnesium Sulfate, popularly known as Epsom Salt, is an ionic salt. Epsom salt is used to neutralise soil in agriculture. In the cosmetics sector, it's also used. Other uses include pharmaceuticals, alcohol, and the tofu industry.

Magnesium Sulfate Product Details

| Report Features | Details |

| Product Name | Magnesium Sulfate |

| Industrial Uses | Chemicals, Agriculture, Food additives, Pharmaceuticals |

| Chemical Formula | MgSO4 |

| Synonyms | Heptahydrate Magnesium Sulfate, Magnesium Sulfate, Heptahydrate, Sulfate, Magnesium |

| Molecular Weight | 120.37/mol |

| Supplier Database | PQ Corporation, Umai Chemical Co. Ltd., Laizhou Guangcheng Chemical Co., Giles Chemical |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Magnesium Sulfate Production Processes

- Production of Magnesium Sulfate from Magnesium Carbonate

In this method, magnesium carbonate is treated with sulfuric acid to produce magnesium sulfate.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com