Product

Methyl Isobutyl Ketone Price Trend and Forecast

Methyl Isobutyl Ketone Price Trend and Forecast

Methyl Isobutyl Ketone Regional Price Overview

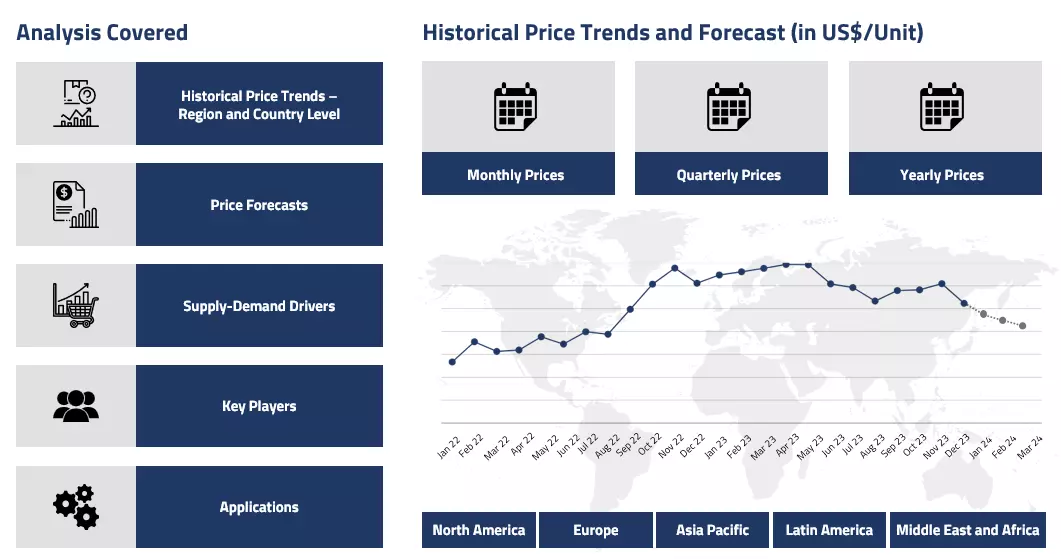

Get the latest insights on price movement and trend analysis of Methyl Isobutyl Ketone in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Methyl Isobutyl Ketone Price Trend for the Q2 of 2024

Asia

In Q2 2024, Methyl Isobutyl Ketone (MIBK) prices in China saw a significant upward trend driven by various factors. The increasing demand from downstream sectors, particularly the paint and coatings industries linked to construction and automotive activities, supported the price rise against the backdrop of elevated crude oil costs and supply chain disruptions. China's economic growth, fueled by strong export performance and manufacturing expansion, further bolstered the demand for petrochemicals like Methyl Isobutyl Ketone.

Methyl Isobutyl Ketone Price Chart

Please Login or Subscribe to Access the Methyl Isobutyl Ketone Price Chart Data

Additionally, geopolitical tensions in the Middle East and rising crude oil prices, along with positive demand signals from the US, contributed to this upward price movement. Despite stable feedstock availability, MIBK prices were influenced by disruptions in southern China's supply chain caused by severe weather and production facility shutdowns. In India, Methyl Isobutyl Ketone prices followed a similar trend, driven by strong overseas demand and increased industrial activity.

Europe

In Europe, Methyl Isobutyl Ketone prices were similarly supported by rising downstream activities and limited production output. Although the quarter started with subdued market conditions due to weak inquiries and limited cost support from crude oil, OPEC+ output cuts led to a rise in crude oil prices in the latter half of the quarter, which was reflected in Methyl Isobutyl Ketone price trends. Geopolitical tensions further strained supply chains and raised transportation costs, hampering market growth. The trade exchange between the key markets, especially Asia and Europe, was also hampered because of these long-stretched supply chain hindrances.

North America

In North America, Methyl Isobutyl Ketone prices were pressured by high inventories and moderate demand initially. Early in the quarter, falling crude oil prices affected the market, but a mid-quarter boost in offtakes from the automotive and coatings sectors provided some relief. However, global shipping costs and rising freight charges led to cautious market behavior, causing fluctuations in Methyl Isobutyl Ketone prices throughout Q2 2024. The crude oil market also started improving significantly as the quarter concluded. Conclusively, a varying price trajectory was observed.

Analyst Insight

According to Procurement Resource, Methyl Isobutyl Ketone prices are expected to improve in the coming months as the petrochemical sector has started to pick up.

Methyl Isobutyl Ketone Price Trend for the Q1 of 2024

| Product | Category | Region | Price | Time Period |

| Methyl Isobutyl Ketone | Chemicals | USA | 1623 USD/MT | March 2024 |

Stay updated with the latest Methyl Isobutyl Ketone prices, historical data, and tailored regional analysis

Asia

Methyl isobutyl ketone observed a mixed price trend during the first quarter of 2024. The first half of the quarter was more downward tilted compared to the latter half of the quarter. Chinese market started the year on a lower note in January as the prices were dwindling down. Supplies were tight; a lackluster customer interest compelled suppliers to keep the prices confined.

However, as days progressed, and the demands started rebounding the price trend also started to ascend up in the latter phase. A varying price trajectory was seen; the prices mostly remained muted in January’24 till the downstream demands again started motivating the market in the middle of the quarter.

Europe

In the European markets, the methyl isobutyl ketone prices closely followed the market behaviors of its feedstock materials, acetone, and isobutylene. For the majority of the discussed time span, the methyl isobutyl ketone prices were found to be wavering within a very narrow range. The feedstock costs were plunging, pushing the prices down along with them. The rise in crude oil and energy rates in the region pushed up the manufacturing upstream costs for methyl isobutyl ketone too. With this, the concerned market remained buoyant and vacillated within a limited spectrum.

North America

The methyl isobutyl ketone demand trajectory was witnessed to be modest in the US market as well. A decline in the acetone market also exerted downward pressure. This kept methyl isobutyl ketone prices swinging for the most part since the production costs were on an incline in the American markets, too, just like the European markets. With various market drivers acting differently, the Methyl Isobutyl Ketone market remained anchored in the American region. Conclusively, a moderate performance was experienced during Q1’24.

Analyst insight

According to Procurement Resource, the Methyl Isobutyl Ketone price trends are likely to remain fluctuating for some time. The market projections present an optimistic outlook for the coming times.

Methyl Isobutyl Ketone Price Trend for the October - December of 2023

Asia

In the last quarter of 2023, there was a general downturn in the Methyl Isobutyl Ketone market in China. The overall market decline was fueled by the upswing in operating rates, conservative downstream purchasing, and the wait-and-see approach of the consumers. A pessimistic outlook for the market also reflected the trader’s lack of enthusiasm for shipping and little demand for goods. The reduced downstream restocking, rising inventories, and further decline in the domestic acetone market had a significant share in the downturn of Methyl Isobutyl Ketone Price Trend.

Europe

The European countries also functioned on a similar trend as seen in the Asian countries. The prices of Methyl Isobutyl Ketone faced southwards in this region as the major influencing factors had registered rough momentum in the last quarter of 2023. The loss of exports and downfall of feedstock prices, along with the rise in the inventory levels, made the trading of Methyl Isobutyl Ketone difficult, which was eventually translated into the Methyl Isobutyl Ketone Price Trend. Further, the ongoing sanctions rift with Russia blocked a huge market of Methyl Isobutyl Ketone, and this further contributed to the downward spiraling of Methyl Isobutyl Ketone Price Trend.

North America

The US chemical market has struggled with a number of challenges since the past quarter, and thus, the Methyl Isobutyl Ketone Price Trend showcased only slight movement throughout the quarter. Firstly, the dip in the cost of feedstock materials and crude oil pushed the manufacturers to lower their production costs and, in turn, the quoted prices of Methyl Isobutyl Ketone. The Methyl Isobutyl Ketone price graph momentum was also hindered by the cautious purchasing activities of consumers as their spending budget declined under inflationary pressure.

Analyst Insight

According to Procurement Resource, the price trend of Methyl Isobutyl Ketone are estimated to waver in the upcoming quarter as the overall global market dynamics, such as demand and cost of raw materials, are difficult to assess.

Methyl Isobutyl Ketone Price Trend for the July - September of 2023

Asia

The methyl isobutyl ketone price history suggested escalation in its price trend, but the initial months of the third quarter performed exactly opposite to these expectations. During this phase, the level of inventories surpassed the demand for methyl isobutyl ketone. However, after August, the conditions of the methyl isobutyl ketone market seemed to improve. The trading activities improved consistently while the inventories depleted. Further, the surge in the cost of production pushed the Methyl Isobutyl Ketone Price Trend in the positive direction.

Europe

In European countries, the performance of the downstream paints and coatings sector declined, negatively affecting the demand for methyl isobutyl ketone. The supply chain remained strong throughout the quarter and gradually exceeded demand. The purchasing sentiments of the consumers were also affected by the rise in inflationary pressure and in view of this, the traders had to reduce their profit margins.

North America

The slump of Methyl Isobutyl Ketone Price Trend in North America was a consequence of high production output and low rates of procurement from the consumer sector. The surge in the inventory levels and slow movement of the region’s economy also escalated the fall in the Methyl Isobutyl Ketone Price Trend. The downstream solvent sector majorly suffered from sluggish demand and lower appetite of the consumers leading to the fall in the Methyl Isobutyl Ketone Price Trend.

Analyst Insight

According to Procurement Resource, the price trend of Methyl Isobutyl Ketone are estimated to face southwards as the demand from the end-user sectors seems bleak.

Methyl Isobutyl Ketone Price Trend for the First Half of 2023

Asia

The first quarter of 2023 was favorable for Methyl Isobutyl Ketone (MIBK) prices. The prices in this quarter inclined as the activities of the supply chain were not apt according to the demand from the end-user sector. This, in turn, led to the depletion in the level of inventories, and as a result, the manufacturers were able to increase their profit margins.

The feedstock prices and rising cost of air freight raised the overall production costs, and thus, the price trend of Methyl Isobutyl Ketone soared. But at the onset of the second quarter, the outlook of the market became weak as the consumption of downstream sectors declined, which caused a problem of oversupply in the region that ultimately led to the decline in the prices of methyl isobutyl ketone.

Europe

The PEG prices escalated in the first quarter of 2023 in the European region. It was supported by the low level of inventories and elevated demand from the adhesives and paints industries. But this trend was short-lived, and the prices nosedived in the second quarter. Several factors contributed to this decline, collectively impacting the Methyl Isobutyl Ketone market. The feeble demand, weak production costs, and oversupply of Methyl Isobutyl Ketone in the region were the leading causes of this decline.

North America

The trend of Methyl Isobutyl Ketone prices in North America was similar to that observed in the Asia Pacific region. In the first quarter of 2023, the price trend inclined with the support from the high consumption appetite of the market and the inability of the traders to keep up with the rising demand.

This increased the stress on manufacturers and ultimately led to the rise in the price trend of methyl isobutyl ketone. However, the second quarter was not favorable for the rising price trend. The market struggled with the gradually declining demand and high levels of inventories. Along with this, the uncertainties in the energy prices and excessive pilling of the stocks led to the decline in the prices of methyl isobutyl ketone.

Analyst Insight

According to Procurement Resource, the price of Methyl Isobutyl Ketone is expected to showcase a declining trend in the upcoming quarter. The market sentiments are slow in their recovery, and the demand from the end-user sector also seems weak, which will negatively impact the Methyl Isobutyl Ketone.

Procurement Resource provides latest prices of Methyl Isobutyl Ketone. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Methyl Isobutyl Ketone

Methyl Isobutyl Ketone (MIBK) is an organic molecule with the chemical formula CH3COCH2CH2CH(CH3)2. It is a transparent, colorless liquid. It smells strongly like sugar and is highly combustible. In many industrial applications, including paints, coatings, adhesives, and chemical processes, it is predominantly employed as a solvent. It is suited for applications that call for controlled drying and great solvency for a variety of substances due to its characteristics, which include a high solvency power, low water solubility, and a relatively slow evaporation rate.

Methyl Isobutyl Ketone Product Details

| Report Features | Details |

| Product Name | Methyl Isobutyl Ketone |

| Chemical Formula | C6H12O |

| Industrial Uses | Paints and coatings, Adhesives and sealants, Printing inks, Extraction |

| Molecular Weight | 100.16 g/mol |

| CAS Number | 108-10-1 |

| HS Code | 29141300 |

| Synonyms | 4-Methylpentan-2-one, MIBK |

| Supplier Database | Sasol, Dow, Shell plc, Mitsui Chemical, Inc,KUMHO P&B CHEMICALS, INC |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Methyl Isobutyl Ketone Production Processes

In the first step of production of Methyl Isobutyl Ketone via aldol condensation, barium hydroxide is used to transform acetone into diacetone alcohol, which is then further dehydrated to produce mesityl oxide. The resulting mesityl oxide is then hydrogenated, saturating the double bond to provide methyl isobutyl ketone.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com