Product

Methylamine Price Trend and Forecast

Methylamine Price Trend and Forecast

Methylamine Regional Price Overview

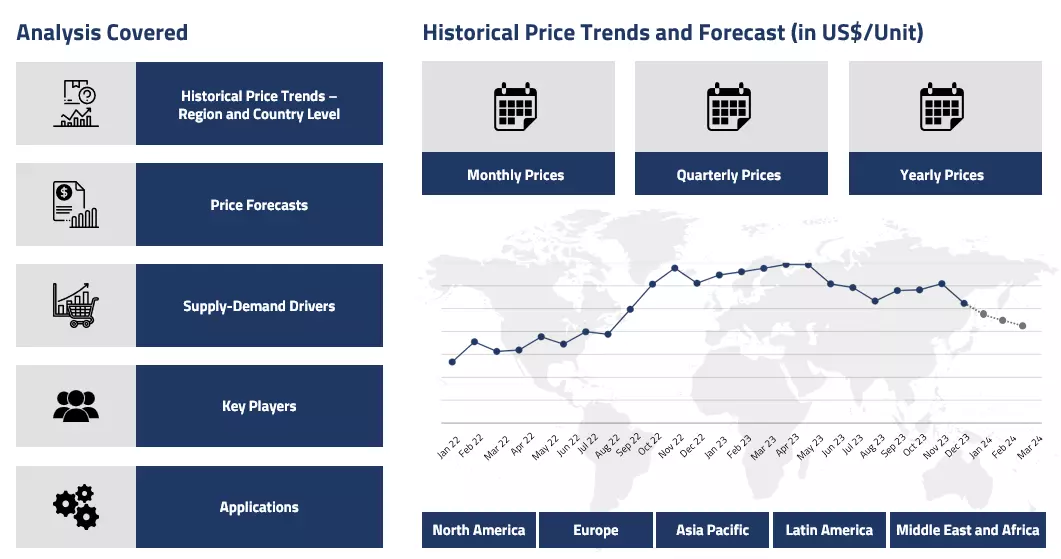

Get the latest insights on price movement and trend analysis of Methylamine in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Methylamine Price Trend for the Q3 of 2024

Asia

In the Asian market, methylamine prices maintained notable stability during July, driven by balanced supply and demand. Despite a decrease in downstream market demand, suppliers were able to keep ample inventory levels, preventing significant price shifts. The slight uptick in demand from sectors like agrochemicals and pharmaceuticals was counterbalanced by adequate supplies of feedstocks, such as ammonia and methanol, which contributed to maintaining price stability during this period. However, by the end of the quarter, the Asian market saw a significant price decline.

Methylamine Price Chart

Please Login or Subscribe to Access the Methylamine Price Chart Data

The drop was primarily influenced by reduced production activities among manufacturers responding to weakening demand from downstream industries. Even though feedstock prices remained stable, the plentiful inventories allowed for adjustments in pricing strategies. Additionally, disruptions in European supply routes led to increased freight costs, which caused some suppliers to raise export prices slightly.

Europe

In Europe, the situation was more complex as compared to the Asian countries. By the end of the quarter, methylamine prices rose slightly, attributed to inventory shortfalls and rising feedstock costs, particularly methanol, which saw an increase. This rise was supported by stronger earnings from major chemical players like BASF, although the broader industrial sector in Germany struggled. Declines in manufacturing production and economic indicators further pointed to weak industrial activity, yet the methylamine market saw price increases, likely due to supply-side constraints rather than strong demand.

North America

In North America, during the third quarter of 2024 methylamine market saw varying price trends with consistent fluctuations. Asia and India leaned towards price stability early in the quarter but experienced declines by the end of August due to weakening demand and ample inventories. A similar trend was observed in North American markets as well as the prices were dependent on broader economic challenges, driven by supply-side factors and rising feedstock costs.

Analyst Insight

According to Procurement Resource, the price trend of methylamine is expected to remain cautious for the upcoming months. The outlook for the next quarter suggests continued caution among suppliers, with further price declines anticipated in the Asian market due to subdued demand and cautious market activity.

Methylamine Price Trend for the Q2 of 2024

Asia

The Asian market, particularly in China, saw a surge in methylamine prices from mid-June after a stable trend in the initial phase of the second quarter. Despite a decline in the prices of key feedstocks methanol and ammonia, methylamine prices increased due to heightened demand and limited supply.

The international methanol market's instability led to lower import volumes, prompting suppliers to engage in strategic inventory management to stabilize prices. This tight supply situation, coupled with positive market sentiment and active supplier engagement, sustained the upward price trend for methylamine. Additionally, China's significant export activities in April, with aliphatic amine exports reaching an all-time high in comparison to the previous quarter, marked a substantial increase from March, further indicating robust demand.

Europe

In the German market, methyl amine prices fell during the second quarter amid the greater declining trend in ammonia prices as compared to a marginal increase in methanol prices. The reduced demand from downstream sectors, particularly the agrochemical and pharmaceutical industries, contributed to the price decline. Additionally, adverse weather conditions such as severe windstorms and floods disrupted agricultural operations, reducing the demand for fertilizers and, consequently, methylamine.

The European market also faced low purchasing activity, further driving down prices. The European Central Bank's anticipated interest rate cut in June 2024 added to the subdued economic environment, which impacted demand. Although the consumers improved their purchasing activities, this did not translate into higher demand for methylamine but raised the expectation of both traders and manufacturers of the commodity for the adjacent quarters.

North America

In North America, ample supply, stable production, and reduced demand for methylamine from downstream sectors contributed to the downward price trend. The market dynamics were further tampered with by the strict economic policies and external conditions, such as weather disruptions and monetary policies impacting economic activity. Additionally, the lack of clarity on the re-routing of the traditional trade routes and the rise in transportation charges, along with long lead times, further depreciated the carried-over market momentum and kept the prices of methylamine towards the lower end of the spectrum.

Analyst Insight

According to Procurement Resource, the price of Methylamine is expected to bear the ill consequences of the declining cost of its feedstock methanol and ammonia along with bearish tone of the end user industries in the next quarters.

Methylamine Price Trend for the Q1 of 2024

| Product | Category | Region | Price | Time Period |

| Methylamine | Chemicals | India | 614 USD/MT | January’24 |

Stay updated with the latest Methylamine prices, historical data, and tailored regional analysis

Asia

During the initial phase of the first quarter, the methylamine price trend followed an oscillating trajectory as in China, a variety of factors guided the pricing trajectory of the methylamine market. During the early phase, both methanol and ammonia took on a southward trend with the onset of the Chinese New Year holidays.

This depreciation was, however, limited to only the initial phase of the quarter as in the following phase, the downstream industries raised their appetite, which further stabilized the surging inventories and supported an uptrend in methylamine prices in the latter phase of the first quarter.

However, the lack of overseas support due to delays in shipments' arrival and the extension of trading time by almost 2-3 weeks resulted in a decline in the export profit margin. However, the domestic agrochemical and pharmaceutical industries stabilized the overall momentum of the methylamine price trend.

Europe

In the European market, there are promising indications of a revival in the German chemicals sector, which kept the methylamine prices on the higher end during the early phase of Q1 of 2024. However, challenges persisted, such as attacks on commercial vessels in the Red Sea by Houthi rebels, leading to longer shipping routes and substantial delivery delays, particularly impacting Asian shipments to Europe.

The demand for methylamine from downstream sectors in Europe, including pharmaceuticals, personal care, dyes and pigments, and agrochemicals, also faced southwards as the quarter progressed towards its termination. However, chemical exporters noticed signs of a turnaround in global manufacturing sector demand, partly attributed to restocking activities by consumers. In the end phase, however, a slight upturn in production and the number of new orders was observed on the back of improving economic indicators of the region, raising the hopes of both traders and manufacturers of methylamine.

North America

During the first quarter of 2024, the US market for methylamine faced turbulence amid economic challenges. The market indicators suggested a significant depreciation in manufacturing activities, altering the trajectory of the methylamine price trend. Despite this downturn, demand for methylamine remained relatively positive from downstream sectors, notably pharmaceuticals and personal care, though the agrochemical sector struggled in the initial half of the first quarter. The varying demand dynamics across downstream markets, coupled with lower raw material costs and ample inventory, therefore prevented any uptrend in the pricing patterns of methylamine during Q1 of 2024.

Analyst Insight

According to Procurement Resource, the price trend of Methylamine is estimated to turn bullish in the near quarter as the surging cost of feedstock chemicals and rising prices of crude oil and other energy products will raise the overall cost of methylamine production.

Methylamine Price Trend for the October - December of 2023

Asia

The trajectory of methylamine price trend in Asian countries was dependent on the market dynamics of its feedstock ammonia and methanol. In the last quarter of 2023, the cost of both the feedstock chemicals declined. The cause of this pessimistic behavior of the market was the loss of a number of exports from the ports of Asian countries and the delay in shipments due to the rise in Isarel-Hamas tensions. Further, as the economic recovery of Asian countries, especially China, was slow, it resulted in oscillations in the prices of methylamine.

Europe

The persistent fluctuations in the prices of feedstock materials, such as ammonia and methanol, brought the trajectory of the methylamine price graph to a standstill. The European market then found it difficult to revert to its inclining journey as the loss of trade on account of geopolitical challenges arising from the end of the Israel-Hamas war and the aftereffects of the Russian invasion of Ukraine disrupted the export-import paths. Further, the crude oil crisis intensified the struggles of the methylamine market and thus limited the growth of its prices.

North America

The fourth quarter of 2023 saw weak demand from both regional and foreign markets for methylamine. As the quarter progressed, this led to the excess availability and rising stockpiles of methylamine, which asserted a negative impact on the price trend of methylamine. Additionally, the feedstock prices were in a rough condition during this time, which prompted the dealers to concurrently reduce their profit margins and price quotes. The dealers also found it difficult to continue trading methylamine, but the feeble movement of the downstream industries caused the methylamine price trend to fall downwards.

Analyst Insight

According to Procurement Resource, the price trend of Methylamine are expected to fluctuate in the forthcoming quarters as it is less likely that the downstream industries will increase their consumption abruptly.

Methyl Amine Price Trend for the July - September of 2023

Asia

The remarkable upswing in the methyl amine prices on account of the significant incline in the feedstock material prices helped in the growth of methyl amine prices throughout the third quarter of 2023.

The rise in demand from agrochemical and pharmaceutical industries and delays in shipments widened the gap between supply and demand, creating an opportunity for the methyl amine price trend to incline. The consumption of methyl amine not only remained positive in the domestic markets, but the overseas industries also showcased interest in the product and thus gave the methyl amine market its required momentum.

Europe

The methyl amine price graph struggled to maintain its pace amid sliding demand and gradually inclining inventory levels. The cost of production also fell on account of depleting cost of feedstock materials and the performance of the downstream industries continued to remain weak throughout the third quarter of 2023. Due to this fumbling market activity, the producers had to lower their prices and offer a significant number of discounts on the purchases, hampering the overall dynamics of the methyl amine market.

North America

The methyl amine price trend in the third quarter of 2023 suffered from the surplus availability of the product as its inventories swelled up, while the demand from the overseas and domestic markets remained feeble during the third quarter of 2023.

Further, the condition of the feedstock prices was also bleak during this phase, and thus, the traders were forced to lower their profit margins and simultaneously their price quotations. The traders also struggled to maintain the trading activities of methyl amine, but the subdued demand resulted in the downfall of the methyl amine price trend.

Analyst Insight

According to Procurement Resource, the price trend of Methyl Amine are expected to face northwards in the upcoming quarters as its demand from the end-user industries is inclining but the global inventories of Methyl amine are depleting.

Methylamine Price Trend for the First Half of 2023

Asia

The problem of oversupply and reduction in demand caused the price trend of methylamine to decline in the first quarter of 2023. In this quarter, the prices were also affected by the falling market of feedstock ammonia and the declining buying potential of consumers. Additionally, the second quarter also witnessed several disruptions in the pharmaceuticals market along with a reduction in the production rates.

Europe

The cleaning and surfactants industry drove the price trend of methylamine in the first quarter of 2023, but this trend was not followed in the second quarter as the prices declined significantly.

The trading activities of the region remained weak throughout the quarter, and with the high number of imports, the level of inventories rose. In addition to this, the estimated growth of oil and gas industries came out to be lower than expected, which ultimately led to a decline in consumer confidence and their purchasing tendency, which negatively impacted methylamine prices in Europe.

North America

The North American region mirrored the price trend observed in the European region. Methylamine prices surged in the first quarter with support from the surfactants industry, but the unreasonable hike in feedstock prices negatively impacted the prices of the commodity. In the second quarter, disruptions in supply chains and reluctance in the spending ability of consumers caused the prices of methylamine to decline.

Analyst Insight

According to Procurement Resource, the price of methylamine is estimated to follow a downward trajectory as the demand from downstream industries seems silent, and with the decline in consumer confidence, the price trend is expected to go southwards.

Procurement Resource provides latest prices of Methylamine. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Methylamine

Methylamine is a chemical compound with the molecular formula CH3NH2. It is a colorless gas with a pungent odor, commonly found in nature and produced industrially. Methylamine is a vital building block in the synthesis of various organic compounds, including pharmaceuticals, pesticides, and dyes. It is also utilized in the production of rubber accelerators and explosives. In laboratories, methylamine is used as a reagent in various chemical reactions. Due to its potent odor and potential hazards, proper handling and safety precautions are essential when working with this compound.

Methylamine Product Details

| Report Features | Details |

| Product Name | Methylamine |

| Chemical formula | CH3NH2 |

| Industrial Uses | Explosives, Solvents, Dyes and pigments, Water treatment, Pesticide production |

| HS Code | 29211100 |

| CAS Number | 74-89-5 |

| Molecular weight | 31.05 g/mol |

| Synonyms | Methanamine, Aminomethane |

| Supplier Database | Mitsubishi Gas Chemical, Celanese, Alkyl Amines Chemicals, Balaji Amines, LOTTE Fine Chemical, Anyang Chemical Industry Group |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Methylamine Production Processes

In this process, vapor phase amination of methanol is carried out in the presence of solid catalyst.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com