Product

Naphtha Price Trend and Forecast

Naphtha Price Trend and Forecast

Naphtha Regional Price Overview

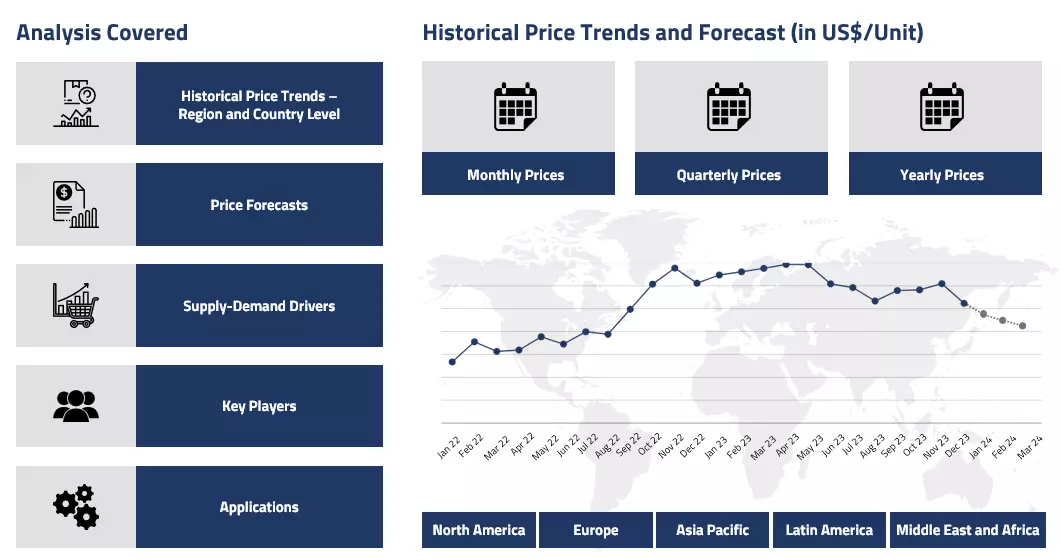

Get the latest insights on price movement and trend analysis of Naphtha in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Naphtha Price Trend for the Q4 of 2024

Asia

In Asia, the naphtha market experienced a mixed trend in the fourth quarter of 2024. Prices were initially under pressure due to weak demand for naphtha, especially in industries such as plastics and chemicals, which are key consumers of the product.

Naphtha Price Chart

Please Login or Subscribe to Access the Naphtha Price Chart Data

The downturn was further aggravated by lower crude oil prices and reduced operating rates at refineries, which led to a decline in demand for naphtha as a feedstock for cracking processes. This was also compounded by a slowdown in Asian economies, particularly in major markets like China. As a result, naphtha prices saw downward corrections, although they stabilized towards the end of the quarter as crude oil prices regained some momentum.

Europe

In Europe, the situation was somewhat similar, with naphtha prices initially falling due to sluggish demand from the downstream sector. The region faced a drop in demand from naphtha-consuming industries, including those in petrochemicals, following lower crude oil prices. However, towards the end of the quarter, there was some upward movement in prices due to geopolitical factors that impacted oil supply and led to higher crude oil prices. This resurgence in crude oil prices helped support naphtha prices in Europe, although the market remained relatively weak overall as demand did not recover significantly.

North America

In North America, naphtha prices showed a stable trend in Q4’24, following a period of price fluctuations in early November. While there were slight declines during the month due to weak demand and planned maintenance at key ethylene crackers, the market was supported by higher crude oil prices. The stability in crude oil helped prevent significant drops in naphtha prices, although demand from downstream industries, especially in plastics, remained subdued throughout the quarter.

Analyst Insight

According to Procurement Resource, Naphtha prices are expected to remain volatile, influenced by the fluctuation in crude oil prices and demand recovery in key industries. Geopolitical factors and global supply chain dynamics will likely continue to play a crucial role in shaping the market trends.

Naphtha Price Trend for the Q3 of 2024

Asia

The Asian naphtha market experienced a notable upward trend, characterized by increasing refining profit margins and dynamic market conditions. The region witnessed growth in naphtha crack spreads, reaching its highest levels since late 2023.

Market sentiment was influenced by complex factors including gasoline margins and regional trading activities. Regional market dynamics were shaped by trading patterns, with significant involvement from key players like Saudi Aramco. The market showed resilience despite tepid demand from major importers, particularly China. Gasoline and naphtha crack spreads demonstrated positive movement, reflecting underlying market strengths.

Europe

European naphtha markets navigated a complex pricing environment influenced by global crude oil dynamics. The market remained sensitive to international oil price fluctuations, with careful monitoring of supply and demand conditions. Geopolitical tensions and OPEC+ discussions about output management continued to impact market sentiments.

North America

The US naphtha market experienced substantial price increases, driven by multiple factors. Crude oil inventory declines and logistical challenges, particularly hurricane-related disruptions, contributed to pricing pressures. Refinery maintenance shutdowns and supply chain complexities further influenced market dynamics. The US Gulf Coast, a critical production hub, faced significant operational challenges. Hurricane-induced disruptions led to supply chain interruptions and production slowdowns, directly impacting naphtha pricing strategies.

Analyst Insight

According to Procurement Resource, the global Naphtha market is expected to remain volatile, closely tied to crude oil price movements. Anticipated pricing trends will be influenced by ongoing geopolitical tensions, refinery capacities, and global energy demand patterns.

Naphtha Price Trend for the Q2 of 2024

Asia

Asia's naphtha market continued to see robust demand, driven primarily by the petrochemical sector in the second quarter of 2024 as well. Despite overall economic growth remaining moderate, particularly in key consumer China, demand for naphtha remained strong throughout the quarter.

China's significant role as a driver of global petrochemical production capacity expansion supported its continued reliance on imports, including naphtha, to support its industrial, automotive, and construction sectors. Therefore, Asian naphtha prices remained comparatively high, reflecting the tight supply-demand balance and substantial imports from regions like Europe.

Europe

In contrast to the Asian countries, Europe faced challenges with a weakening demand for naphtha in Q2'24. The economic slowdown following interest rate hikes by central banks, coupled with structural shifts towards cleaner energy sources, dampened demand for petrochemical feedstocks like naphtha.

As European naphtha prices fell sharply compared to Asia, domestic traders increased export volumes of European cargo to Asia in order to keep the momentum of the market afloat. Therefore, with the price spread between European and Asian naphtha widening significantly, incentivizing European refiners to increase export volumes and sustained demand from the Asian players yielded positive results towards the end of the quarter.

North America

In the North American region, naphtha market conditions were influenced by regional trade dynamics and global price trends. The region's naphtha prices experienced fluctuations in naphtha prices and trade volumes incurred by broader global supply-demand balances.

The domestic demand for the commodity was modest at best. However, the in-house production and overseas supplies climbed gradually only to increase the volumes of stockpiles of the commodity. Further, the depreciation in the prices of raw materials reduced the overall cost of production, exerting a negative influence on the pricing trajectory of naphtha in the April-June quarter of 2024.

Analyst Insight

According to Procurement Resource, the price trend of Naphtha is expected to continue declining. The ongoing subdued market activities and limited support from the primary driving factors of the market will keep the price of naphtha in the southward direction.

Naphtha Price Trend for the Q1 of 2024

| Product | Category | Region | Price | Time Period |

| Naphtha | Chemicals | USA | 735 USD/MT | March 2024 |

| Naphtha | Chemicals | Europe | 821 USD/MT | March 2024 |

Stay updated with the latest Naphtha prices, historical data, and tailored regional analysis

Asia

The Asian naphtha markets began 2024 on a downtrend due to fluctuating crude oil pricing parameters amid geopolitical tensions in the Gulf of Aden. Also, the trading of naphtha remained inactive in the Singapore market, further hampering the overall trend of naphtha prices. Instead of naphtha, the attention of the consumers shifted to transactions involving gasoline, with Unipec and Vitol acquiring substantial quantities.

However, the oil prices surged in the New Year's first trading session, driven by concerns over potential disruptions in Middle East supply chains and optimistic expectations for holiday demand and economic stimulus in China. But this bubble of the manufacturers and traders was short lived as amid the rising geopolitical crisis and OPEC+ policy changes, the naphtha prices struggled to find stability. Therefore, the intricate interplay between geopolitical events, market dynamics, and regional demand shaped the oscillating trajectory of the naphtha price trend during the first quarter of 2024.

Europe

In the European regions, naphtha prices experienced a decline towards the end of the first quarter following a notable surge in the early months. Specifically, the German market saw a significant decrease as the ongoing port strikes and loss of labor raised the stockpiles of the commodity in the region, limiting the growth of the naphtha price trend. This downward trend was observed across most European countries, including the Dutch and British markets.

The decline in demand during the quarter was another factor attributed to adverse weather conditions, such as strong winds and sea swells offshore, which eventually lowered the overall dynamics of the market and resulted in depreciation in naphtha prices.

North America

Naphtha prices in North America remained relatively stable as compared to Asian and European countries despite fluctuations in crude oil prices. Even amid the struggling economic parameters of the market, the manufacturers swiftly balanced the supply and demand dynamics with the maintenance of production costs.

The market volatility coincided with fluctuations in US crude oil inventories, impacting price stability. Additionally, maintenance work on the Panamax locks by the Panama Canal Authority reduced the vessel transits, potentially affecting naphtha import volumes in the region. Additionally, firm inflation rates, particularly in housing and energy, and a suitable outlook of the consumer sector also favored the stagnancy in the naphtha prices during the first quarter of 2024. Further, the stable demand from various sectors like paints, varnishes, detergents, and chemical industries contributed to the positive outlook for naphtha prices in the domestic market.

Analyst Insight

According to Procurement Resource, the price trend of Naphtha is expected to improve in the forthcoming quarters as the rise in the momentum of downstream industries and crude oil prices will surge the overall cost of production of naphtha.

Naphtha Price Trend for the October - December of 2023

| Product | Category | Region | Price | Time Period |

| Naphtha | Chemicals | China | 1141 USD/MT | October'23 |

| Naphtha | Chemicals | China | 1143 USD/MT | December'23 |

| Naphtha | Chemicals | India | 637 USD/MT | October'23 |

| Naphtha | Chemicals | India | 602 USD/MT | December'23 |

Stay updated with the latest Naphtha prices, historical data, and tailored regional analysis

Asia

Naphtha is the immediate product of crude oil distillation, so it is a mix of very inflammable hydrocarbons and is consumed for a variety of applications in industries like petrochemicals, paints, coatings, etc. During the said period of the year 2023, the naphtha prices varied a lot in the Asian markets, yielding a very uneven price graph.

The Chinese market witnessed steady growth in the first half of the quarter as the prices increased by about 7% from October to November. However, soon the prices came back to almost the same numbers in the very next month; the monthly average prices shifted from about 1141 USD/MT in October to about 1143 USD/MT in December, exhibiting marginal quarterly fluctuations. In the Indian naphtha market the prices swiftly declined by about 5% over the three months as the prices went from around 637 USD/MT in October to around 602 USD/MT in December’23. Overall, mixed market sentiments were observed.

Europe

Since naphtha is primarily derived from crude oil, the crude oil prices determine the market trend for naphtha to a great extent. Influenced by the crude oil prices, naphtha market sentiments weakened continuously throughout the said quarter. Owing to the decline in production costs, the naphtha prices tottered at the lower end of the price curve for the majority of the said period.

North America

The North American naphtha market also replicated the European market trend during the discussed period of Q4’23. Due to the freight disturbances caused by the Panama Canal restrictions and the Israeli war, international offtakes had taken a huge hit, which resulted in a fall in the crude oil prices in America and eventually led to a downfall in the naphtha prices as well.

Analyst Insight

According to Procurement Resource, the Naphtha price trend are likely to behave similarly in the coming months as well. Fluctuations in crude oil prices will be reflected in the naphtha market trend greatly.

Naphtha Price Trend for the July - September of 2023

Asia

The price trend for naphtha exhibited mixed sentiments throughout the Asia-Pacific region during Q3’23. Initially, the prices kept low as the manufacturing sectors were still recovering from the aftershocks of COVID shutdowns and Russia-Ukraine geopolitical conflicts. The reduced confidence of buyers in the market, reflected by their cautious buying activities, prompted the naphtha price graph to waver at the lower ends.

However, Russia and Saudia Arabia, two major suppliers of oil announcing production cuts in order to stabilize the global oil economy, affected the oil supply and prices worldwide. These production cuts impacted the entire petrochemical and allied sectors. Hence, the price trend for naphtha inclined towards the end of the third quarter. Similarly, the naphtha spot prices went from around 590 USD/MT in July’23 to around 620 USD/MT in September’23 in the Indian domestic market.

Europe

The European regional market witnessed bullish sentiments for naphtha prices. The rising demands from the petrochemicals and allied sectors, coupled with supply chain disruptions, affected the naphtha price trend. The volatility in the US market affected the naphtha orders and off-trading. Moreover, with OPEC+ announcing production cuts, the supply chains got further constricted leading to heightened price patterns.

North America

The North American market witnessed high volatility in its naphtha market. Initially, the prices were weak, given the bearish demands and hiked interest rates. However, soon, the supply chains were disturbed given the production cuts in crude oil supplies by leading oil producers, which directly affected the allied markets. With the increased upstream cost pressure, demands also started reviving during September; hence, the naphtha price trend inclined towards the end of Q3.

Analyst Insight

According to Procurement Resource, the price trend for Naphtha are likely to remain volatile in the given months. Given the production cuts by OPEC+ and the rising demands during the winter months, naphtha prices will be readily impacted throughout the global markets.

Naphtha Price Trend for the First Half of 2023

Asia

The Naphtha market in the Asia-Pacific region remained anchored throughout the first half of 2023. The soaring prices were supported by the strong demand from the petrochemical sector and the rising trade/export activities. However, the trend in the second quarter was somewhat flat compared to the historical values in the high-demand season. Though the naphtha prices in the April-June quarter exceeded the January-March quarter, the incline was minimal as it was affected by the sluggishness of the naphtha market.

The downturn in economic activities and dampened demand led to a glut of products in the Chinese market, thereby actively hampering the price trend for Naphtha. In the Japanese markets, the naphtha prices averaged around 460 USD/MT in Q1 and around 497 USD/MT towards the end of June’23.

Europe

The European region was favorable in terms of the prices of Naphtha as the purchasing appetite of the buyers remained high in the first half of 2023. The prices were supported by the rising demand and improving economic activities of the petroleum market. The rising demand from the hydrocarbon-cracking industries positively affected the prices.

North America

The northward movement of the naphtha prices was supported by the inclining demand from the downstream industries and high export activities in the North American region. The prices were also influenced by the shortage of products as the crude oil costs surged. The prices also surged as the European countries actively looked to replace Russia as its leading naphtha supplier, thereby leading to a rise in exports in US domestic market.

Analyst Insight

According to Procurement Resource, the price trend for Naphtha are likely to incline in the coming quarter. The countries are actively pursuing measures to bridge the price gap between crude oil and Naphtha, which turned negative, meaning Naphtha is worth less than the crude oil it comes from.

Naphtha Price Trend for the Second Half of 2022

Asia Pacific

Naphtha saw a gradual decline in prices in the third and fourth quarters of 2022. The demand from the downstream industries such as plastic and polymer fell, and the weak margins affected the market severely. Due to the rise in covid-19 restrictions, the decline in export due to decreased demand from the petroleum industry, and high competition, the price trend of naphtha declined in the Asian Pacific region.

Europe

In the third quarter, naphtha prices increased owing to the consistent demand and strong export levels of the commodity in the region. The fourth quarter was, however, not favourable in terms of the prices of naphtha. The demand from the end-user industries plunged but the supply remained consistent and the decline in the performance of petrochemical industries led to a decline in the prices. There was a moment of relief during the mid-quarter, as the demand from the North African region increased and supported the naphtha market.

North America

The North American region saw a gradual decline in prices as the demand for natural gas plummeted. The disruption of one of the largest ports and the increase in production rates contributed to this decline in prices. The prices, however, inclined in the middle of the fourth quarter as the demand from the importing economies increased. Still, the uncertainties in the petrochemical industries continued to play a major role in the fluctuating price trend of naphtha.

Analyst Insight

According to Procurement Resource, the price of naphtha is estimated to increase in the upcoming quarter. The improving market conditions, ease in covid restrictions and expected improvement in the petrochemical sector will lead to an incline in the prices.

Naphtha Price Trend For the First Half of 2022

Asia

Naphtha prices kept on the higher end of the scale in the Chinese domestic market during Q1. The resurgence of covid-19 caused the government to impose temporary restrictions on industrial activity. This severely impacted industrial production, thereby depleting inventories and creating shortages. The robust downstream demand from the medical and pharmaceutical sector supported the higher quotations of Naphtha, averaging 1363 USD/MT.

The prices in the Indian market were stable as compared to the Chinese domestic market, as cheap raw materials were readily available from Russia via cheap imports. With Russian imports readily entering the Chinese domestic market during the second quarter, coupled with the upliftment of pandemic-related shutdowns, naphtha prices fell across the market.

Europe

The petrochemical industry was heavily impacted due to the Russian-Ukrainian geopolitical conflict. With a majority of European countries directly dependent on Russian supplies for more than 50% of their energy needs, the sanctions against Russian exports triggered a staggering energy crisis in Europe.

The solid demand from downstream polyethene and polypropylene industries further supported the high prices of Naphtha. However, these higher prices led to demand destruction giving rise to cautious wait-and-see buying activity. Hence, naphtha prices fell towards the end of the second quarter.

North America

Naphtha prices readily increased throughout the US domestic market during the first quarter, given the soaring prices of crude oil and natural gas. The manufacturers raised their respective quotations to cushion their profits amid high downstream demand. However, the second quarter couldn’t keep up with the gained momentum in prices in the first quarter per the relinquished demand surge.

Analyst Insight

According to Procurement Resource, naphtha prices will likely crash further on the back of copious supplies as OPEC+ has changed their supply policies. Moreover, the demand for downstream plastics and polymers has gone drab and feeble.

Procurement Resource provides latest prices of Naphtha. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Naphtha

Naphtha is a type of gasoline or raw petrol derived from raw materials and crude oil for use in the chemical industry. It a is a highly versatile hydrocarbon compound that is highly flammable, colourless, and highly volatile. It is made by distilling organic substances such as wood, coal tar, petroleum, and shale. Depending on its source or composition, naphtha is known by various names such as coal tar naphtha, wood naphtha, petroleum spirits, shellite, and white gas.

Naphtha Product Details

| Report Features | Details |

| Product Name | Naphtha |

| HS Code | 271012 |

| CAS Number | 8030-30-6 |

| Industrial Uses | Petrochemicals, Agriculture, Paints and coatings, Aerospace |

| Synonyms | Petroleum Naphtha, Petroleum Ether |

| Supplier Database | China Petrochemical Corporation, Reliance Industries Limited, Shell Chemicals, Exxon Mobil Corporation, Indian Oil Corporation Limited, Novatek, SABIC |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Naphtha Production Processes

- Production of Naphtha via Distillation Process

Naphtha is produced in petroleum refineries as one of the intermediate products of crude oil distillation.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Related News

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com

.webp)

.webp)

.webp)