Product

Polyolefin Elastomers Price Trend and Forecast

Polyolefin Elastomers Price Trend and Forecast

Polyolefin Elastomers Regional Price Overview

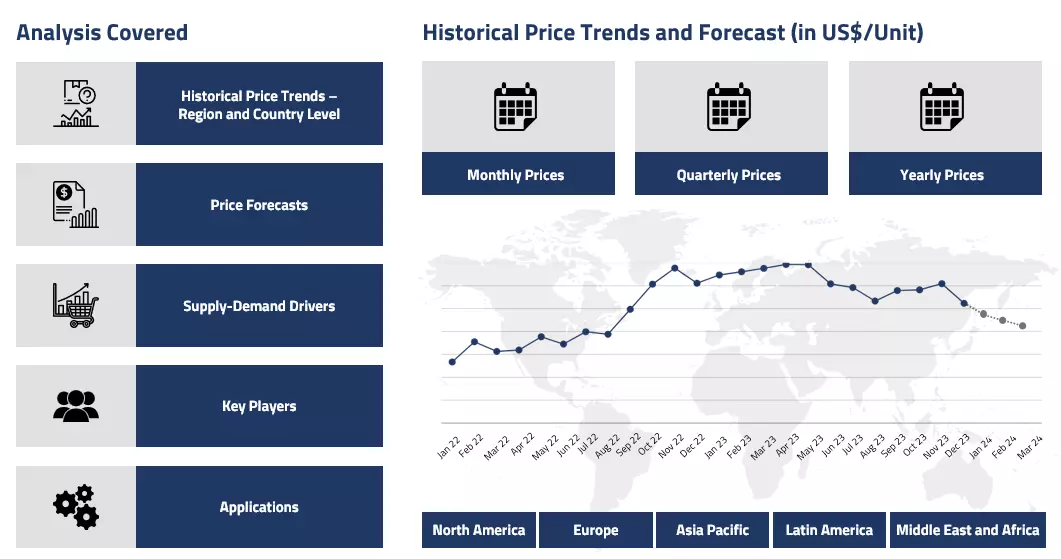

Get the latest insights on price movement and trend analysis of Polyolefin Elastomers in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Polyolefin Elastomers (POE) Price Trend for the Q3 of 2024

Asia

The prices of polyolefin elastomers (POE) in the Asian market witnessed a mixed trend throughout the third quarter of 2024. The prices maintained an oscillating trajectory amid the low demand faced in this quarter. At the start of the quarter, the inventories were high. This made the manufacturers rethink the production capacities to adjust to the demand. Some plants and production houses also went under maintenance shutdowns. Shandong Levima had temporarily shut down its Methanol-to-Olefins plant, and Petronas Chemicals had reduced run rates at its cracker in Malaysia.

Polyolefin Elastomers Price Chart

Please Login or Subscribe to Access the Polyolefin Elastomers Price Chart Data

Additionally, Wanhua Chemical, a state-owned company in Shandong, has launched its new polyolefin elastomer (POE) unit, marking China's second such facility. The company is also expanding the project to increase capacity further, with plans for additional production expected to begin in the near future. This will mark a positive effect on the supply of POE in the region.

Europe

In Europe, the prices of polyolefin elastomers resembled the price trajectory of its feedstock, ethylene. The rising prices of ethylene supported the surge in the prices of POE. Along with this, the supply constraints made the prices surge amid the low downstream demand.

The troubled construction sector in Europe reduced the demand for adhesives and coatings. Additionally, the automotive sector did not live up to the expectations of this quarter, as new car sales were below satisfactory levels. Overall, the market showed fluctuations in prices driven by the limited supply of the commodity amid the weak demand.

North America

The prices of POE in the North American market mirrored the trends of global markets. The prices of POE wavered due to temporary supply and logistical challenges. Some unplanned plant outrages, including an unplanned outage at Nova Chemicals in Louisiana, affected the supply. These supply constraints contributed to the occasional upticks in prices. However, the market stabilized after the hurricane season as the supply constraints were resolved.

Analyst Insight

According to Procurement Resource, the prices of polyolefin elastomers (POE) are expected to show an oscillating trend in the upcoming quarter, influenced by the logistical challenges in the coming winter months and fluctuation in the prices of feedstocks.

Polyolefin Elastomers (POE) Price Trend for the Q2 of 2024

Polyolefin Elastomers (POE) are a versatile family of polymers produced through the copolymerization of ethylene with alpha-olefins, resulting in materials that combine flexibility and durability. In the second quarter of 2024, the POE market in Asia exhibited mixed performance.

After showing positive momentum in the first quarter, the growth rate slowed down in the second quarter primarily influenced by fluctuations in feedstock ethylene prices. This deceleration led to a more stable price environment for POEs in the region, with market dynamics being shaped by the balance between supply and demand.

Europe

Similarly, the European Polyolefin Elastomers market mirrored the trends seen in Asia, with prices exhibiting variation largely due to ethylene price fluctuations. Ongoing market uncertainty prompted OPEC countries to extend voluntary production cuts, aiming to stabilize both petroleum and petrochemical markets globally. This step led to some correction in the Polyolefin Elastomer prices in the latter phase of the quarter. Despite challenges in upstream feedstock pricing, the manufacturing sector helped sustain demand for Polyolefin Elastomers. Consequently, the overall market for POEs in Europe remained steady, displaying only moderate price movement.

North America

In North America, the Polyolefin Elastomers market also reflected global patterns during the second quarter of 2024. The Polyolefin Elastomers market’s performance here mimicked the price variations in its Asian and European counterparts. Prices fluctuated within a narrow range, with initial sluggishness in the early part of the quarter. However, prices began to normalize in the latter half as supply and demand realigned. The overall performance of the POE market in North America was mixed, consistent with global trends.

Analyst Insight

According to Procurement Resource, the market outlook for Polyolefin Elastomers will likely remain moderate. With gradual improvement in the global petrochemical industry, POE prices are expected to strengthen as demand continues to grow across various sectors.

Polyolefin Elastomer Price Trend for the Q1 of 2024

| Product | Category | Region | Price | Time Period |

| Polyolefin Elastomer | Chemicals | USA | 2898 USD/MT | March 2024 |

| Polyolefin Elastomer | Chemicals | Europe | 2834 USD/MT | March 2024 |

Stay updated with the latest Polyolefin Elastomer prices, historical data, and tailored regional analysis

Asia

The new trade measures proposed by countries like Indonesia and Brazil, coupled with India's protectionist policies, adversely impacted the pricing patterns of polyolefin elastomer during the first quarter of 2024. Additionally, the trajectory of polyolefin elastomer prices was further influenced by Europe's consideration of a carbon border adjustment mechanism and China's efforts in the direction of carbon capture and storage technologies.

The country's transition towards renewable energy sources, particularly solar and wind power, however, raised the quotations of low-carbon polyolefin elastomers among overseas traders. However, challenges such as disruption of production volumes on the onset of the Chinese New Year holiday season and sudden maintenance shutdown of plants lowered the overall dynamics of the polyolefin elastomer market.

Further, the disruptions to global trade, including geopolitical tensions and demographic shifts in maritime trading routes, further hampered the export profit margins of polyolefin elastomers.

Europe

In Q1 of 2024, European automotive sales continued to fluctuate, and so did the pricing pattern of polyolefin elastomers. The demand for polyolefin elastomers from the Chinese import market remained subdued due to sluggishness in the new energy vehicle sector. Despite healthy demand from the US, sluggish sales of petrol and diesel cars in the European countries offset the overall positive momentum, leading to only a marginal incline in the prices of polyolefin elastomers.

The European automotive market witnessed a contraction driven by regulatory changes favoring electric vehicles, impacting polyolefin elastomers' demand negatively. On the other hand, manufacturing activities continued to decline, with shrinking factory orders and declining employment levels. However, the industry outlook of feedstock chemicals remained favorable throughout the quarter, favoring a surge in the prices of polyolefin elastomers.

North America

During the first quarter of 2024, polyolefin elastomer prices registered a marginal increase in the US market. The escalating growth of industrial drivers was observed in the US, particularly influenced by the rise in construction sector demand. In the US, polyolefin elastomers prices slight uptick was also attributed to feedstock market movements, particularly surging ethylene prices and rising crude oil costs impacting monomer and overall production costs.

Despite a sudden decline in January vehicle sales, other economic factors like increased foreign market demand contributed significantly to the price surge in polyolefin elastomer. However, the loss of trading routes and the export extracted profit margin loomed over the traders and manufacturers of polyolefin elastomers, limiting the uptrend in its prices.

Analyst Insight

According to Procurement Resource, the price trend of Polyolefin Elastomer is expected to be driven by the surge in automotive sales figures and the inclining cost of feedstock chemicals.

Polyolefin Elastomer Price Trend for the October - December of 2023

Asia

In Asia, the struggling condition of the automotive and EV sectors projected a negative influence on polyolefin elastomer price trend. The overall trend of the polyolefin elastomer market in China as well as in India remained bearish due to several factors.

The downturn in prices of crude oil, pet coke, and other energy resources, which are responsible for the supply of raw materials required in polyolefin elastomer production, affected the market trend. The concern of traders and manufacturers further escalated when Asian countries failed to maintain the export-import balance, and as a result, the polyolefin elastomer price trend eventually faced southwards.

Europe

Onto a rough start in the fourth quarter of 2023, prices for polyolefin elastomer dropped by a significant margin in Europe. The polyolefin elastomer sector demonstrated endurance only for a short while in the face of a difficult situation in the downstream vehicle market, as the percentage decline in new car registrations during the quarter was a surprise for the traders. The European polyolefin elastomer market was also affected by external variables as much as by regional market conditions. The major indicator of this was a reduction in export activities and loss of crude oil shipments from Russia.

North America

The US market for polyolefin elastomers shared similar concerns as that of European countries as the polyolefin elastomer prices dropped during the end quarter of 2023. Despite declining feedstock, crude oil, and overall production costs, the market found it difficult to register any recovery in Q4. The polyolefin elastomer market experienced a little decline due to the weak demand from major importing countries, which contrasted with the good signs for the automotive sector and is thus attributed to the most significant cause of the downfall of polyolefin price trend.

Analyst Insight

According to Procurement Resource, the price trend of Polyolefin Elastomer are estimated to struggle with the rigid outlook of downstream demand and excessive rise in inflationary pressure.

Polyolefin Elastomers Price Trend for the July - September of 2023

Asia

Polyolefin Elastomers prices were observed to be wavering low throughout the said period of the third quarter of the year 2023. Since the Polyolefin Elastomers are yielded as a result of the polymerization of ethylene copolymers and alpha-olefins, their price trend closely align with each other. So, the fall in prices of these feedstock materials primarily drove the Polyolefin Elastomers market trend for the said time period.

Since the Chinese markets were recovering slowly after the removal of COVID-19 restrictions, the downstream demands for Polyolefin Elastomers finally started rising. But, despite the rise in purchase queries the price graph continued to be downward facing. Other than the feeble upstream cost support from raw materials, all the accumulated supplies of the low-demand periods kept the prices dull and swinging. Overall, mixed market sentiments were observed.

Europe

The European Polyolefin Elastomers market saw healthier supply and demand dynamics compared to its Asian counterpart. The suppliers were already making conscious purchases here owing to the mountainous inflation that skyrocketed after the Russian invasion of Ukraine. Hence, the inventories were at their optimum level, and the regular demands of the given period further supported the moderate market trend. Overall, a largely stable price graph was witnessed for Polyolefin Elastomers during Q3’23.

North America

The Polyolefin Elastomers prices fluctuated for the most part in the American region since the downstream demands remained in the driving role for the entire period. The beginning was rather strong, however, the pace tumbled moving forward. Further, by the end of the quarter an even shortened gap was witnessed between the supply and demand dynamics of the American market. Overall, mixed market sentiments were observed.

Analyst Insight

According to Procurement Resource, the Polyolefin Elastomers prices are expected to continue to waver in the coming months as well. Feedstock prices, availability, and downstream demands will keep a tight influence on the Polyolefin Elastomers market run.

Polyolefin Elastomer Price Trend for the First Half of 2023

Asia

In the first quarter of 2023, the price trend of polyolefin elastomer faced southwards as it was adversely affected by the downfall of the automotive industry and the availability of imports from South Korea and Singapore that, caused the problem of overstocking in the region. However, the second quarter proved to be favourable for the polyolefin elastomer market.

A remarkable incline was observed in the prices as the demand from the automobile industry and related downstream sectors increased. The market was also favoured by the rising domestic and overseas orders and the strong performance of the Asian auto sector. The positive consumption rates further supported the polyolefin elastomer market and ultimately led to the surge in the prices of polyolefin elastomer.

Europe

The polyolefin elastomer prices declined in the first quarter of 2023 and struggled throughout the second quarter. In the first quarter, the prices were affected by the stumbling market and falling freight charges. The European region also suffered from soaring inflation rates and hikes in interest rates that caused a decline in consumer confidence in the polyolefin elastomer sector.

However, the trend inclined slightly in the first few months of the second quarter due to the increased number of offtakes and ample supply of the product in the region. The strong demand caused the production rates to shoot up, especially in the Spanish market. But towards the end of the second quarter, the prices of raw materials in the European region significantly declined, which adversely affected the polyolefin elastomer prices.

North America

The first quarter recorded a declining trajectory in the price trend of polyolefin elastomer. The major employer of polyolefin elastomer, i.e., the automotive sector struggled to maintain its demand throughout the quarter and with excess availability of the product, the prices of polyolefin elastomer dipped.

In the initial months of the second quarter, the market dynamics improved as it gained support from the improving automotive sector in domestic and overseas regions. In addition to this, limited stocks of the product due to labour shortages and feeble supply also supported the rising prices. However, the trend declined again in the last months with the revival of operational rates and an increased influx of products on the market.

Analyst Insight

According to Procurement Resource, the price of polyolefin elastomer is estimated to oscillate in the upcoming quarter. The automotive sector is struggling to maintain its market dynamics, and the excess number of inventories is estimated to affect polyolefin elastomer prices negatively.

Procurement Resource provides latest prices of Polyolefin Elastomers. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Polyolefin Elastomers

Polyolefin elastomers are a type of polymer that belongs to the thermoplastic polymer category. They have high flexibility and elasticity just like rubber. These polymers are composed of ethylene and -olefin copolymers and have great chemical resistance and high low temperature performance. Due to their ability to survive deformation and regain their original shape, these elastomers are widely used in seals, molded goods, wire and cable insulation, automotive components, and other areas.

Polyolefin Elastomers Product Details

| Report Features | Details |

| Product Name | Polyolefin Elastomers |

| Industrial Uses | Medical devices, Packaging, Automotives, Wires and cables |

| HS Code | 39019090 |

| CAS Number | 26221-73-8 |

| Supplier Database | Exxon Mobil Corporation, LG Chem, LyondellBasell Industries Holdings BV, Mitsubishi Chemical Holding Corporation, SABIC |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Polyolefin Elastomers Production Processes

In this process, ethylene copolymerizes with alpha olefins and gives polyolefin elastomer. This polymerization reaction takes place in the presence of metallocene catalyst.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com