Product

Polyolefin Plastomer Price Trend and Forecast

Polyolefin Plastomer Price Trend and Forecast

Polyolefin Plastomer Regional Price Overview

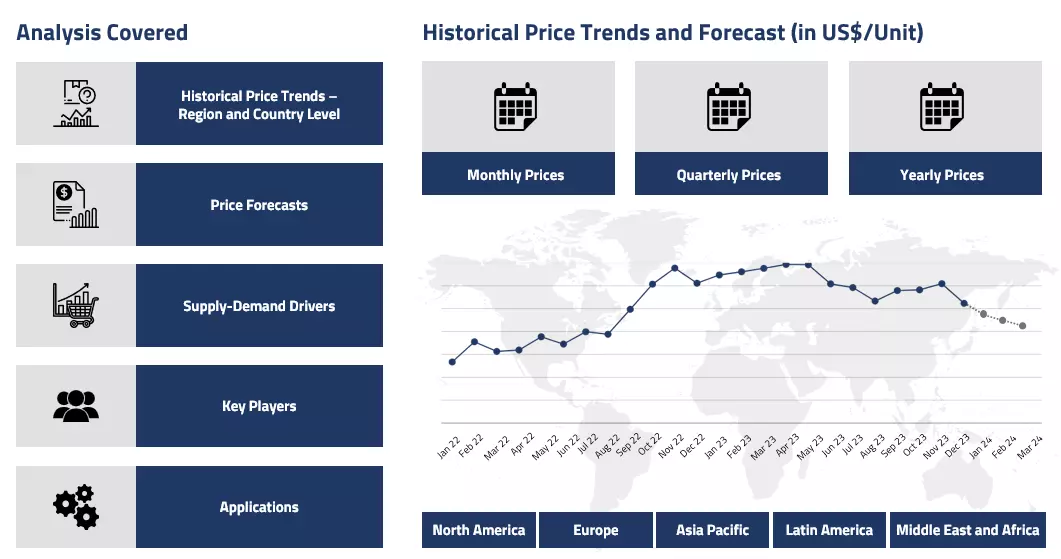

Get the latest insights on price movement and trend analysis of Polyolefin Plastomer in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Polyolefin Plastomer (POP) Price Trend for the Q3 of 2024

Asia

In Q3'24, the polyolefin plastomer market in Asia demonstrated a downward trend, influenced by weakening demand fundamentals and market conditions. The packaging and automotive sectors showed reduced buying activity amid economic uncertainties.

Polyolefin Plastomer Price Chart

Please Login or Subscribe to Access the Polyolefin Plastomer Price Chart Data

Manufacturing activities in major economies like China and South Korea experienced slowdowns, leading to decreased demand for POP in flexible packaging applications. The market faced additional pressure from high inventory levels and regional production capacities, resulting in oversupply conditions throughout the quarter.

Europe

The European polyolefin plastomer market in Q3'24 exhibited mixed price movements, characterized by initial stability followed by downward adjustments. The market experienced headwinds from sluggish downstream demand, particularly in the construction and automotive sectors. The escalations in the Middle East influenced feedstock costs, while the broader economic environment impacted consumer spending patterns. European producers continued to manage high energy costs and operational expenses, though this was partially offset by feedstock price movements during the quarter.

North America

In Q3'24, the US domestic market recorded moderate price declines amid prevailing market conditions. The region witnessed reduced demand from key end-use sectors, including packaging and consumer goods. Despite stable production rates, manufacturers faced pressure from rising inventory levels and import competition. The automotive sector's performance impacted demand for POP in vehicle components. The increase in US commercial stocks and broader market fundamentals contributed to the pricing trends observed during the quarter.

Analyst Insight

According to Procurement Resource, the prices of Polyolefin Plastomer is expected to continue their current momentum, primarily driven by demand-supply dynamics and broader economic factors affecting key end-use industries.

Polyolefin Plastomer Price Trend for the Q2 of 2024

Asia

The advent of the second quarter of 2024 did not bore fruitful results for the polyolefin plastomer market as the prices of the commodity depreciated gradually. This market trend was supported by the inadequate demand for the commodity and exceeding inventory pressure on the market. Although the major sectors, such as construction and automotive, presented modest procurement rates, the small enterprises lowered their inquiries significantly, reflected in the southward turn of the polyolefin plastomer industry.

After the May Day holiday season, the number of orders declined at a faster pace as the industries struggled to sustain their ace. Additionally, the growing concerns over Asia-European exports and the cautious stance of international players further prompted the traders to reduce their price quotations of polyolefin plastomer.

Europe

In Q2'24, the polyolefin plastomer market in Germany experienced significant fluctuations, reflecting broader manufacturing sector trends. After slight fluctuations in the early phase, the price trend of the commodity was later driven by a surge in purchasing activity as manufacturers anticipated a recovery in demand. This increase coincided with stabilizing inventory levels following a prolonged destocking cycle. However, the wider economic context saw a setback with the reduced purchasing activities and a slight decline in new orders, influenced by weaker domestic demand and reduced new work from European markets and China, impacting the Polyolefin Plastomer market.

Export sales also declined, although less sharply than overall new orders. Despite upward price pressure, reduced input costs and factory gate charges mitigated some impacts, with a slight easing in the rate of input cost decline. However, supplier delivery times improved, extending the limited support to the market. The manufacturer's sentiment showed slight optimism, with growth expectations driven by potential export recovery and better investment prospects.

North America

During the second quarter of 2024, the price trend of polyolefin plastomer in North America experienced moderate gains. This gradual stabilization was primarily driven by the continued improved demand from the automotive and construction sectors. The increased cost of feedstock chemicals, as previously announced by major chemical companies, persisted into Q2, further contributing to the higher production costs and subsequently pushing prices upward. However, the geopolitical disruptions that had impacted maritime trading routes in the first quarter continued to pose challenges, although the market showed signs of adapting to these conditions. Despite the ongoing disruptions, the regional supply chain began to stabilize, partially alleviating the impact on trading activities.

Analyst Insight

According to Procurement Resource, the price of Polyolefin Plastomer is expected to be driven by improving dynamics of the downstream industries globally; however, the weak position of feedstock commodities and increasing trading challenges might hinder the growth rate.

Polyolefin Plastomer Price Trend for the Q1 of 2024

| Product | Category | Region | Price | Time Period |

| Polyolefin Plastomer | Chemicals | USA | 2908 USD/MT | March 2024 |

| Polyolefin Plastomer | Chemicals | Europe | 2755 USD/MT | March 2024 |

Stay updated with the latest Polyolefin Plastomer prices, historical data, and tailored regional analysis

Asia

In Asian countries, the changing dynamics of the trading sector asserted a significant influence on the prices of polyolefin plastomer during the first quarter of 2024. Indonesia and Brazil, along with India, opted for new trading measures, leading to an alternation in the prices of polyolefin plastomer.

The market was further affected by the loss of exports to Europe amid its consideration of carbon border adjustment measures and redirection of China’s interest in carbon capture technologies. These initiatives slightly boosted the demand for polyolefin plastomer in the first quarter; however, they were not sufficient in keeping the polyolefin plastomer prices northwards.

Additionally, the advent of the Chinese New Year holidays and the maintenance shutdown of several production plants raised the skepticism of overseas players, which was evident in the number of inquiries presented by the sector. Further, the depreciation in export profit margins due to the ongoing geopolitical tensions and shift in maritime routes also presented a dim outlook for the polyolefin plastomer market.

Europe

In European countries, the pricing patterns of polyolefin plastomer followed a mixed trend, particularly under the influence of several drivers of the market. The dominance of Chinese imports in the region lightly trailed off during the first quarter of 2024 due to low production activities amid the New Year holiday season. Initially, the sentiments of downstream automotive industries were also sluggish, raising the concerns of traders and manufacturers. However, with the revival of US markets and their rising appetite for polyolefin plastomer, the prices of polyolefin plastomer moved northwards.

The situation of domestic manufacturing units was also not much favorable, depleting the inventories quickly, intensifying the gap between supply and demand sectors of the market, and giving the polyolefin plastomer traders room to raise their price quotations of polyolefin plastomer. Further, the rise in the prices of feedstock chemicals additionally raised the total cost of production and also the prices of polyolefin plastomer.

North America

In North America, the prices of polyolefin plastomer registered only a marginal rise during the first quarter of 2024. The rising interest of downstream automotive and construction industries in the region favored the uptrend in the prices of polyolefin plastomer. Also, the surge in the cost of feedstock chemicals, as per the announcements by the chemical giants, raised the overall cost of production of polyolefin plastomer. The trading activities of the region, however, declined with the rise in geopolitical disruptions of maritime routes, somehow depreciating the momentum of the polyolefin plastomer market in the first quarter of 2024.

Analyst Insight

According to Procurement Resource, the price trend of Polyolefin Plastomer is expected to improve in the forthcoming quarters as the rising downstream demand and the surging cost of feedstock are expected to support the polyolefin plastomer price trend.

Polyolefin Plastomer Price Trend for the October - December of 2023

Asia

Asian crude oil and naphtha markets were defeated in terms of prices as their supply surpassed their demand by a great margin. However, through the lenses of economic advisors, this could be a sign of ease in inflationary pressure on the markets, but this worked opposite to the required trend of polyolefin plastomer prices.

The domestic demand showed some improvement as compared to the previous quarter but remained largely bearish, restricting the growth rate of the polyolefin plastomer price graph.

Europe

A slowdown in the momentum of the chemical sector of the European countries forced some of the industrial giants to shut their operations. The backlash for the polyolefin plastomer and its feedstock materials came in the form of subdued demand, which in turn was affected by the rigid downfall of European economic indicators. The market further lost its charm as the tensions between Israel and Hamas accelerated and the sanctions on Russian imports intensified.

North America

Throughout the fourth quarter of 2023, polyolefin plastomer prices remained volatile in the US markets. The macro and microeconomic indicators suggested a contraction in the purchasing activities of the automotive consumers, which in turn reduced the rate of procurement of polyolefin plastomer. Along with this, a considerable fall in the cost of raw materials and energy production lowered the entire cost of production and compelled the traders to reduce their quoted prices of polyolefin plastomer.

Analyst Insight

According to Procurement Resource, the price trend of Polyolefin Plastomer are expected to face a downturn as the consumer demand and overall overview of the market do not look in favor of the polyolefin plastomer market.

Polyolefin Plastomer Price Trend for the July - September of 2023

Asia

Polyolefin plastomers are plastics just like polyethylene and polypropylene with more flexibility and elasticity. Since this class of chemicals largely belongs to the petrochemical group, the price trend closely align with the crude oil price trajectories. During the three-month period of Q3’23, the polyolefin plastomer (POP) prices were observed to be inclining throughout.

Since the crude oil prices rallied, the polyolefin plastomer also rose on the price index. The biggest impact on the region came from the narrowing of European oil imports. The edge that the import of Russian oil had given to the Indian and Chinese markets had already diluted. So, the prices were observed to be inching higher during the third quarter of the year 2023. Overall, positive market sentiments were observed in Q3’23.

Europe

The European polyolefin plastomer market was heavily influenced by the Asian trend. This reestablishes the import dependency of the European market and, at the same time, also reflects the growth of crude oil prices in the region. Since the Black Sea deal between Russia, Ukraine, Turkey, and the United Nations came to an end the trade dynamics in the region were disturbed. This created a supply constraint for polyolefin plastomer in the market and led to an inclination in the price trend.

North America

The North American polyolefin plastomer market was more muted than the other major global markets. The economic uncertainties in the country, especially after the collapse of two major banks, affected regional trade immensely. Overall, borderline stagnancy was observed in the American polyolefin plastomer market.

Analyst Insight

According to Procurement Resource, the Polyolefin Plastomer price trend are likely to falter in the coming months; the current supply and demand dynamics suggest a little slowing down of the concerned market.

Polyolefin Plastomer Price Trend for the First Half of 2023

Asia

Polyolefin plastomer prices oscillated in the first two quarters of 2023. In the Asia-Pacific region, the trend was affected by the depletion of demand from the automobile sector, and the pricing war with Tesla hampered the prices of polyolefin plastomer in the first quarter of 2023. The rising level of inventories overshadowed the strong demand for the product in the second quarter and thus caused a downfall in the price trend of polyolefin plastomer.

Europe

A fluctuating price trend of polyolefin plastomer was observed in the first and second quarters of 2023 with a huge surge in the month of March. The spike in the trend was supported by the semiconductor industries that, in turn, gained momentum from the sales of automobiles. This rising trend continued till May, but the prices dipped in June. This striking downfall was attributed to the fall in the number of new registrations in the automobile sector, indicating a slowing of demand and overall industrial activities.

North America

The polyolefin plastomer market oscillated in the first and second quarters of 2023 due to the shifting equilibrium sentiment of supply-demand dynamics. In the first quarter, initially, the price growth was stable, but the economic disturbances caused by the failure of two major banks in this region adversely affected the polyolefin plastomer market. In the second quarter, the prices initially rose exponentially due to support from the recovering economy, but this trend could not be sustained. The polyolefin plastomer prices faced south ultimately due to the falling demand, excess availability of the product in the region, and abrupt fall in the number of new orders.

Analyst Insight

According to Procurement Resource, the price trend of Polyolefin Plastomer is expected to showcase a mixed trend as the global economy is showcasing a fluctuating trajectory that is negatively impacting the demand for polyolefin plastomer.

Procurement Resource provides latest prices of Polyolefin Plastomer. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Polyolefin Plastomer

Polyolefin plastomer combines the qualities of plastics and elastomers and belongs to the same family as polyethylene and polypropylene. The unique combination of flexibility, toughness, and processability that polyolefin plastomers possess makes them ideal for applications requiring elasticity, sealing, and impact resistance. They are valuable in sectors including packaging, automotive, and consumer products because they have a semi-crystalline structure and perform better than traditional elastomers.

Polyolefin Plastomer Product Details

| Report Features | Details |

| Product Name | Polyolefin Plastomer |

| Industrial Uses | Packaging, Toys and sports equipment, Automotive industry, Adhesives and sealants, Wires and cables |

| HS Code | 39029000 |

| Supplier Database | Dow, Mitsui Chemical, ExxonMobil Chemical, SABIC SK Nexlene Company, LG Chemical |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Polyolefin Plastomer Production Processes

In this process, the monomers such as but-1-ene, oct-1-ene, hex-1-ene, etc., in the presence of metallocene catalyst polymerizes. The ratio of monomers decides whether the polymer will be a polyolefin elastomer or polyolefin plastomer.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com