Product

Polyphenylene Ether Price Trend and Forecast

Polyphenylene Ether Price Trend and Forecast

Polyphenylene Ether Regional Price Overview

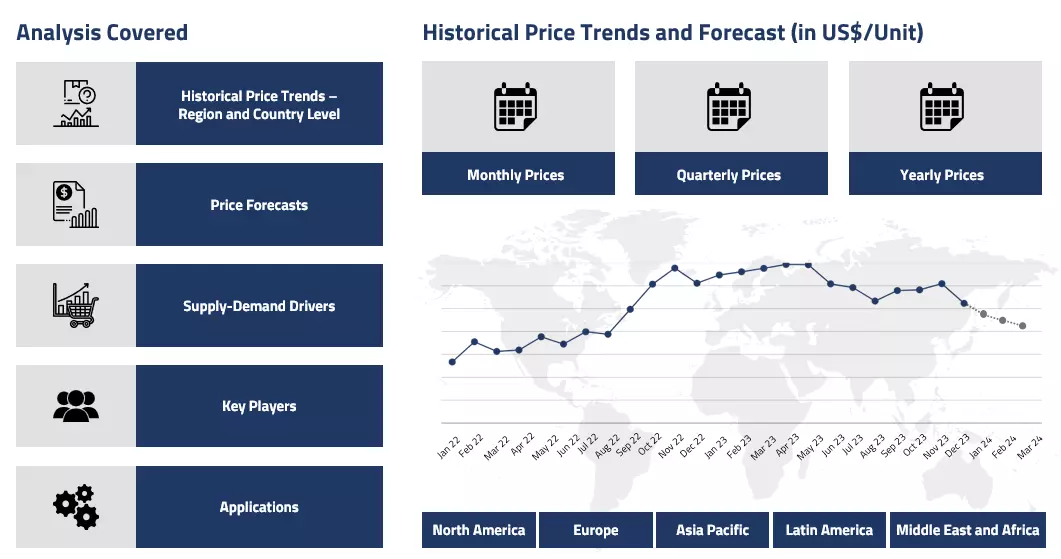

Get the latest insights on price movement and trend analysis of Polyphenylene ether in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Polyphenylene Ether (PPE) Price Trend for the First Half of 2025

Asia

In the first half of 2025, the Polyphenylene Ether (PPE) market in Asia experienced a range of trends. Early in the year, demand from key sectors such as automotive and electronics was weak, contributing to a bearish market. This was primarily due to high inventory levels and a slow recovery from the post-holiday season.

Polyphenylene Ether Price Chart

Please Login or Subscribe to Access the Polyphenylene Ether Price Chart Data

However, as the first quarter progressed, some positive signs emerged. Supply constraints, particularly from scheduled plant shutdowns and logistical disruptions, began to drive prices upward in February.

By March, the market showed noticeable improvement, with industrial activities picking up, especially after the Spring Festival. The automotive sector, in particular, showed signs of recovery, lifting PPE consumption. Despite early-year challenges, the second quarter saw a gradual improvement in demand, supported by renewed production activity and stabilizing supply chains.

Europe

In Europe, the PPE market was marked by volatility in the first half of 2025. The region faced high energy costs and carbon taxes, which exerted upward pressure on prices, even though demand remained relatively muted in the first quarter. Throughout this period, European producers struggled with production costs and overcapacity, which added to the market uncertainty.

The sluggish demand continued, particularly from the automotive and construction sectors, where purchasing activities remained cautious. While production costs were high, there were no significant disruptions in the supply chain, so prices remained relatively stable, but the market remained oversupplied. By the second quarter, demand showed signs of stabilization, but the overall outlook for PPE remained tepid as producers faced ongoing challenges in balancing supply and demand.

North America

In North America, the PPE market experienced a generally subdued trend during the first half of 2025. The year began with some temporary price increases due to cold weather disruptions in production and transportation, but the overall sentiment remained weak. By the second quarter, as temperatures stabilized, the market began to reflect the larger global trend of moderate demand.

The automotive and electronics industries, major consumers of PPE, showed slower recovery than expected, which contributed to subdued purchasing. Throughout this period, inventories built up, and price pressure from high production costs did not result in sustained upward movement. By mid-year, the market showed signs of stabilization, but prices remained relatively flat, reflecting cautious demand and stable supply.

Analyst Insight

According to Procurement Resource, the PPE market is expected to experience slow but steady growth as demand from the automotive and electronics sectors gradually recovers. However, challenges such as high production costs and supply chain bottlenecks could continue to create pressure on pricing.

Polyphenylene Ether (PPE) Price Trend for Q4 of 2024

Asia

In Q4 ‘24, the Polyphenylene Ether market in Asia, particularly China and surrounding regions, faced mild downward pressure on prices. This was largely due to weak demand from downstream industries such as automotive and electronics. Similar to the phenol market, PPE saw reduced consumption caused by seasonal slowdowns and destocking activity.

Although feedstock supply remained adequate, production rates were lowered to manage excess inventory and weakened export demand. External challenges, such as Typhoon Kong-Rey disrupting logistics and reducing shipments, added further pressure. Despite some support from the cosmetics and coatings sectors in countries like South Korea, the market overall remained subdued, mirroring the performance of related chemicals.

Europe

The European PPE market followed a stable-to-weak trend throughout Q4’24. Demand from sectors like automotive, construction, and electrical components remained soft, which in turn dampened PPE consumption. The phenol market’s sluggishness driven by high inventories, weak demand, and seasonal slowdowns had a ripple effect on PPE, given phenol’s role in its production.

Although production rates were stable, logistical issues, including storm-related rail congestion and tight shipping availability, impacted timely deliveries and added to inventory accumulation. The moderate feedstock availability and stagnant economic conditions contributed to a conservative purchasing approach across the value chain, preventing any significant upward movement in PPE prices.

North America

The PPE market in North America showed signs of stability, with a slightly positive undertone driven by strong demand in specific downstream sectors such as personal care, paints, and coatings. While the phenol market experienced bearish conditions due to oversupply and weak construction and automotive demand, PPE benefited from a more resilient demand base.

Rising interest in eco-friendly applications, including high-performance polymers and coatings, supported prices. However, operating at high production rates remained a challenge amidst feedstock pressure and a cautious demand environment, especially towards the end of the quarter.

Analyst Insight

According to Procurement Resource, Polyphenylene Ether (PPE) prices are expected to remain stable with a slightly bullish bias, supported by seasonal recovery in demand and potential restocking activities.

Polyphenylene Ether Price Trend for Q3 of 2024

Asia

In Q3'24, the Asian polyphenylene ether market demonstrated an upward trajectory, driven by strong demand from end-use industries and rising production costs.

The market gained momentum from the electronics sector, while supply chain disruptions and elevated freight rates provided additional support to prices. Chinese manufacturers implemented various price adjustments throughout the quarter in response to changing feedstock costs and domestic market conditions. The market strengthened further towards quarter-end as winter preparation began.

Europe

European polyphenylene ether prices followed a downward trend during Q3'24, influenced by sluggish demand and adequate supply levels. The market faced pressure from weakening downstream sectors, particularly in Germany. Production rates remained stable, though manufacturers grappled with high energy costs and reduced orders from key industries. The market saw some price stabilization attempts, but overall bearish sentiment prevailed due to continued economic uncertainties and moderate buying interest.

North America

The North American market maintained a stable-to-firm trend throughout Q3'24, primarily supported by steady demand from the electronics and automotive sectors. Supply conditions remained balanced, though periodic logistics challenges influenced regional price movements. The market drew support from healthy industrial activity, while manufacturers maintained steady production rates despite occasional raw material cost fluctuations. However, macro-economic uncertainties and energy cost variations created some pricing volatility during the quarter.

Analyst Insight

According to Procurement Resource, the global Polyphenylene Ether market is expected to maintain mixed trends across regions, primarily influenced by varying demand patterns and regional economic conditions.

Polyphenylene Ether Price Trend for Q2 of 2024

Asia

Polyphenylene ether (PPE) is a high-performance thermoplastic polymer known for its exceptional thermal stability, dimensional stability, and electrical insulating properties. Industrially, PPE is used in applications requiring high performance, such as automotive parts, electrical and electronic components, and household appliances. This versatility in applications continued to drive the market fundamentals during the second quarter of 2024 as well.

In Asia, the market seemed to slow down a bit this time around. A sluggishness in the feedstock materials market was being felt as the upstream cost support receded. Moreover, the inventory stocks were piling up amidst a low international interest in the purchase of more products. Domestically, too, the supply and demand dynamic showcased marginal stability throughout the said period. Overall, a stable and buoyant market run was witnessed.

Europe

In the European Polyphenylene ether (PPE) market, the sentiments were generally positive for the entire period of Q2’24. Even though the sector saw a global slowdown, in Europe, the manufacturing industry was trying hard to reclaim its global position. Therefore, the demands remained inclined. Another reason could be the regional supply crunch. Since the supply chain issues persisted over the past few years, it threatened the supply security for some commodities. Especially, the petrochemical sector saw major transformations over the course of time as the union curbed its dependence on Russian oil in the wake of the Russia and Ukraine conflict. Conclusively, a mixed market dynamic was witnessed.

North America

The American polyphenylene ether market was mostly stable during the said period of Q2’24. The supply and demand equation operated on moderate levels, and it was able to strike a balance, imparting borderline stagnancy in the pricing outlook. The suppliers were mindful of procuring sufficient quantities, which complemented the average demand dynamic of the American industries. Conclusively a stable and buoyant price performance was witnessed with minor occasional fluctuations.

Analyst Insight

According to Procurement Resource, Polyphenylene ether (PPE) prices are expected to remain positively motivated in the coming months, driven by consistent demands from consuming sectors.

Polyphenylene Ether Price Trend for Q1 of 2024

| Product | Category | Region | Price | Time Period |

| Polyphenylene Ether | Chemicals | UK | 3550 USD/MT | March 2024 |

Stay updated with the latest Polyphenylene Ether prices, historical data, and tailored regional analysis

Polyphenylene Ether Price Trend for the Second Half of 2023

Asia

The number of domestic orders from the automotive industries declined by a great margin, pushing the prices of polyphenylene ether in a downward spiral in the first three months of H2 of 2023. Even other downstream industries, such as construction etc., also showcased muted sentiments.

Along with this, the rising OPEC+ sanctions and excessive reliance of the Asian market on imports in the third quarter raised the concerns of the traders. However, the market turned out favorable in the fourth quarter as the festive demand, the onset of the winter holiday season, and some relief in inflation raised the spending appetite of consumers, reflecting a positive influence on the polyphenylene ether price trend.

Europe

In European countries, the polyphenylene ether prices were volatile throughout H2’23. Initially, the market gained momentum due to the rising cost of raw materials and crude oil. But soon, the negative effects of rising interest rates and challenging economic parameters impacted the market.

During the fourth quarter, the increased influx of expensive Chinese imports and gradually rising demand from the end-user industries worked in favor of the polyphenylene ether market and thus helped its prices to take on a northward journey. Also, the market could sustain the equilibrium of supply and demand, supporting the bullish trend in the prices of polyphenylene ether.

North America

The first month of H2 of 2023 turned the polyphenylene ether price trajectory upward due to the rising cost of feedstock materials and crude oil, which raised production costs. However, soon, the automotive and other related industries experienced a slowdown as the lending rates and inflation indicated a pessimistic nature of the market, and even the economic indicators suggested bleak financial conditions.

However, eventually, at the onset of the fourth quarter, the market trend turned bullish as the regional and overseas demand for polyphenylene ether spiked, helping the prices of polyphenylene ether to take on an inclining journey.

Analyst Insight

According to Procurement Resource, the price trend of Polyphenylene Ether is estimated to depict stagnancy in the upcoming months as after the holiday season, the demand from the downstream industries might decline.

Polyphenylene Ether Price Trend for the First Half of 2023

Asia

The market for polyphenylene ether inclined in the first and second quarters of 2023 after a slight tumbling phase during the initial days of the first quarter. In the first quarter, the polyphenylene ether market activities were supported by high demand from both domestic and international downstream industries as traders looked forward to stocking up their inventory levels.

In addition to this, the automotive industries showed positive market sentiments in the second quarter, and despite the slow economic growth of Asian markets, the price trend inclined as the feedstock prices supported polyphenylene ether prices. However, during the last days of the second quarter, the trend stabilized, given the sliding prices of crude oil and lower restocking activities.

Europe

The high rates of inflation and interest charged by banks led to the surge in the prices of polyphenylene ether in the first quarter of 2023. Further, this quarter was also supported by high demand from the automotive and related industries. The demand for polyphenylene ether remained high in the second quarter, but the adverse effects of the falling economy, declining cost of raw materials, and low rates of exports slowed down the growth of polyphenylene ether prices.

North America

High-cost pressure from the feedstock market, limited consumption of direct consumers, and a stable number of new orders from the end-user industries supported the polyphenylene ether market in the first quarter of 2023. However, in the second quarter, despite the high performance of the automotive industries, the price trend of polyphenylene ether declined.

The main cause of this sudden decline in prices of polyphenylene ether in the North American region was the poor market sentiments shown by the feedstock materials and low prices of gas. Another underlying cause of this slide in the price trend was the struggling condition of the US economy after the collapse of two major US banks. This led to an increase in interest rates and a spike in inflation, hampering the price trend of polyphenylene ether.

Analyst Insight

According to Procurement Resource, the price trend of Polyphenylene Ether is expected to showcase an oscillating trajectory as the weak position of the global economy is estimated to negatively impact polyphenylene ether prices.

Procurement Resource provides latest prices of Polyphenylene Ether. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Polyphenylene Ether

Polyphenylene ether is a high performing thermoplastic polymer that has excellent electrical insulating properties, thermal stability, and chemical resistance. It is thus used in the applications that require electrical insulation, heat resistance such as electrical connectors, automotive components, water filtration systems, and various industrial applications. PPE is known for its durability and reliability in harsh environments, making it a valuable material in a wide range of industrial and commercial applications.

Polyphenylene Ether Product Details

| Report Features | Details |

| Product Name | Polyphenylene Ether |

| Chemical formula | C15H11O |

| Industrial Uses | Electrical and electronics, Automotive, Water filtration, Medical Devices, Aerospace, Consumer goods, Industrial equipment |

| CAS Number | 9041-80-9 |

| Molecular weight | 446 g/mol |

| HS Code | 39089090 |

| Supplier Database | Sumitomo Chemical Co Ltd, Tokai Rika Create Corporation, Guangzhou Engineering Plastics Industries Co Ltd, Asahi Kasei Corp., ROMIRA GmbH, Kingfa Science & Technology Limited, Mitsubishi Chemical Corporation, SABIC |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Polyphenylene Ether Production Processes

- Polyphenylene ether production by oxidative polycondensation reaction: The preparation of polyphenylene ether begins with the polycondensation of 2,6-dimethylphenol with oxygen in the presence of a catalyst. In this reaction, copper-amine-complex catalyst is used for polycondensation of 2,6-dimethylphenol and produce polyphenylene ether as the end product.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com