Product

Potassium Carbonate Price Trend and Forecast

Potassium Carbonate Price Trend and Forecast

Potassium Carbonate Regional Price Overview

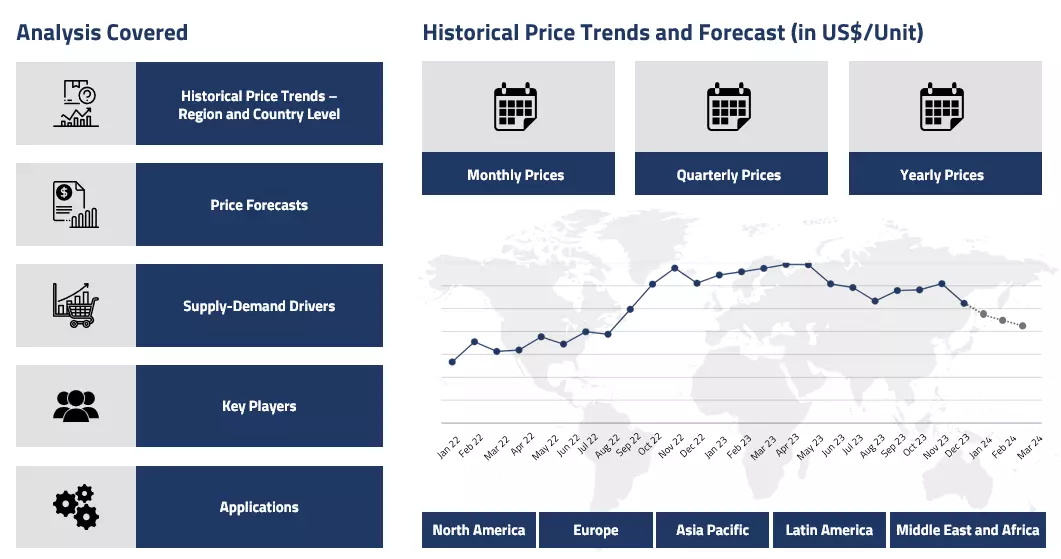

Get the latest insights on price movement and trend analysis of Potassium Carbonate in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Potassium Carbonate Price Trend for the First Half of 2025

Asia

The Asian potassium carbonate market faced significant challenges during the first half of 2025, with supply constraints becoming increasingly evident. Chinese producers encountered inventory shortages and production restart delays, which limited export volumes to international markets. The Dragon Boat Festival period further reduced production activities, creating additional supply tightness.

Potassium Carbonate Price Chart

Please Login or Subscribe to Access the Potassium Carbonate Price Chart Data

Port congestion issues, similar to those affecting the broader DMF market, disrupted logistics and extended lead times for shipments. Rising feedstock costs, particularly for potassium chloride, pressured manufacturers' profit margins. The cautious market sentiment observed in major manufacturing centres like China and India reflected broader uncertainty about demand recovery patterns and international trade dynamics.

Europe

European potassium carbonate markets experienced notable upward pressure throughout H1’25, driven by multiple supply-side constraints. Germany led regional price increases as feedstock availability tightened due to continued restrictions on Russian and Belarusian potash imports. The EU's new tariffs on Russian imports prompted fertilizer producers to engage in precautionary stockpiling, creating additional demand pressure.

Logistical challenges intensified market conditions, with poor Rhine River water levels hampering barge transportation of raw materials and finished products. North Sea port congestion, worsened by labor shortages, disrupted outbound shipments. Despite the completion of peak spring fertilization demand, industrial sectors including glass and ceramics maintained steady consumption while inventory-driven purchasing from fertilizer companies sustained price momentum.

North America

North American potassium carbonate markets showed firm price trends during the first half of 2025, influenced by supply constraints and strategic procurement activities. Import volumes remained restricted as Asian suppliers, particularly from China, curtailed shipments due to thin domestic inventories and delayed production restarts. The suspension of some tariff measures temporarily normalized trade flows, but overall supply availability continued to face pressure.

Stronger transpacific freight rates increased landed costs for imports. Weather-related port disruptions, though minimal, extended delivery times and reduced supply chain efficiency. Domestic production remained stable but faced elevated input costs, forcing producers to pass these increases through to market prices. Distributors adopted proactive procurement strategies ahead of anticipated Chinese production cuts during holiday periods.

Analyst Insight

According to Procurement Resource, Potassium Carbonate prices are expected to remain supported through the remainder of 2025, with persistent feedstock constraints and geopolitical developments likely maintaining upward pressure across all major regions.

Potassium Carbonate Price Trend for Q4 of 2024

Asia

In Q4 of 2024, the potassium carbonate price trend in Asia exhibited fluctuations, driven by feedstock cost volatility and seasonal factors. Early in the quarter, prices faced downward pressure due to declining raw material costs, directly affecting potassium carbonate production. This decline was further compounded by a typical seasonal slowdown, as industries scaled back operations ahead of the holidays.

However, by mid-quarter, some stabilization occurred as demand picked up slightly, particularly from the agricultural and chemical sectors, which traditionally rely on potassium carbonate. Towards the end of the quarter, minor price improvements were observed, supported by a slight increase in feedstock prices and tighter supply conditions.

Europe

In Q4 2024, the European potassium carbonate market followed a similar pattern, characterized by fluctuating prices and an overall downward trend early in the quarter. As in Asia, lower feedstock prices and weaker demand due to the seasonal slowdown initially pressured the market. Additionally, holiday season closures and reduced industrial activity further dampened demand. However, as the quarter progressed, a slight uptick in demand emerged, driven by end-of-year stocking from key industries. Despite these stabilization efforts, prices remained under pressure for most of the quarter. Towards the end of the year, minor price improvements occurred, though they were insufficient to offset earlier losses.

North America

In Q4 2024, potassium carbonate prices in North America followed a similar fluctuating trend, marked by an initial decline followed by a slight recovery toward the end of the quarter. Early in the quarter, the market faced downward pressure due to falling feedstock prices and weaker demand, as many industries scaled back production during the holiday season. This trend was particularly evident in industrial sectors, where potassium carbonate demand typically slows during the colder months. However, as the quarter progressed, signs of stabilization emerged, with some industries replenishing stocks in preparation for the new year. Despite these stabilization efforts, the overall price trend in North America remained under pressure, with only minor increases observed as the year came to a close.

Analyst Insight

According to Procurement Resource, price curve is expected to show slight improvements in the first quarter of 2025 as various downstream industries will likely reopen after the Holidays.

Potassium Carbonate Price Trend for Q3 of 2024

Asia

The price trajectory of potassium carbonate closely mirrored that of the upstream caustic potash market. Prices remained stable throughout the quarter, with minimal fluctuations. This stability typically occurs when supply and demand are in balance, which was the case during this period. The primary demand for potassium carbonate comes from the fertilizer sector. However, as this quarter coincided with the harvesting season for many crops, demand saw a slight decline.

Additionally, the Indian government announced a substantial fertilizer subsidy, including for potassium fertilizers, ahead of the Rabi season. This initiative aims to ensure the availability of crop fertilizers at affordable prices for farmers and is expected to help stabilize fertilizer prices further in the Indian market.

Europe

The prices of potassium carbonate fluctuated but remained rangebound during the third quarter of 2024. Upstream caustic potash prices remained steady with minimal fluctuations, offering limited cost support for potassium carbonate. Demand from the downstream fertilizer sector was moderate, and similar trends were observed in other sectors. Production plants operated at optimal capacity, and inventory levels did not place significant pressure on prices. Overall, potassium carbonate prices fluctuated within a confined range in the European region.

North America

In the third quarter of 2024, potassium carbonate prices showed mixed trends. The price movement of upstream caustic soda remained relatively stable, providing minimal cost support for potassium carbonate. Price fluctuations were primarily driven by changes in downstream demand and supply disruptions. Several hurricanes affected the region, posing risks to cultivated crops and causing notable supply chain interruptions. While some production facilities were temporarily shut down, the impact was mostly localized. Overall, the market demonstrated a stable trend, shaped by limited cost support, logistical challenges, and average demand from downstream sectors during the third quarter of 2024.

Analyst Insight

According to Procurement Resource, potassium carbonate prices are expected to fluctuate but within limited range in the near future, mirroring the prices of feedstocks. The downstream demand, mainly from the fertilizer sectors, will show regional variations as planting seasons differ regionally.

Potassium Carbonate Price Trend for Q2 of 2024

Asia

The fertilizer sector in Asia reported significant growth during the second quarter of 2024, primarily on the back of stocking activities by consumers ahead of the agriculture season. However, this was not translated into the pricing patterns of potassium carbonate during the same period.

The traders anticipate that this could be a result of the transfer of carried-over inventories into the market and destocking practices adopted by the major corporations. Further, the lack of support from the feedstock potassium sector as well contributed to keeping the momentum of the potassium carbonate market and its prices on the lower end of the pricing spectrum.

Europe

In Europe, potassium carbonate prices observed a significant decline during the second quarter of 2024. The primary cause was the fluctuating demand for potassium, particularly from the fertilizer market, which saw a notable drop in sales across the region. Adverse weather conditions, such as windstorms, floods, and excessive rainfall, disrupted agricultural activities, reducing the need for fertilizers. These conditions led to waterlogging and increased pest pressures, deterring farmers from investing in fertilizers.

Although exceptional crop growth was noted in several regions where demand for potassium carbonate could be moderate, the overall demand remained suppressed. Additionally, the market had sufficient stocks of potassium carbonate, and smooth supply chains ensured stable availability. The operational production capacities of major players like BASF and International Process Plants, capable of producing substantial quantities of potassium carbonate annually, further contributed to this bleak scenario of the market.

North America

In North America, the potassium carbonate market also saw a notable decline in the second quarter of 2024. Despite a slight increase in the cost of essential feedstock potassium chloride, its impact on potassium carbonate pricing patterns was minimal. The primary driver of the price decline was subdued purchasing activity from the fertilizer market.

The ongoing planting season for major crops such as rice, barley, and corn typically boost fertilizer demand, but extreme heat waves across the region disrupted planting activities. This unexpected climatic challenge led to a softer market for potassium carbonate. Additionally, the availability of ample stocks of potassium carbonate in the market, combined with reduced production costs and low purchasing activity, created an unfavorable environment for the potassium carbonate market.

Analyst Insight

According to Procurement Resource, the price of Potassium Carbonate is estimated to improve in the forthcoming quarters as with the shifting of agriculture season, the seasonal demand of the commodity is likely to be shifted in the next quarters.

Potassium Carbonate Price Trend for Q1 of 2024

| Product | Category | Region | Price | Time Period |

| Potassium Carbonate | Chemicals | USA | 1877 USD/MT | March 2024 |

| Potassium Carbonate | Chemicals | Europe | 1854 USD/MT | March 2024 |

Stay updated with the latest Potassium Carbonate prices, historical data, and tailored regional analysis

Asia

The potassium carbonate market exhibited stability in the end phase of the first quarter after experiencing slight fluctuations in previous months. The initial declines in the price of potassium chloride were influenced by the weak cost support and minimal changes in the potassium carbonate market. These fluctuations in the prices of domestic potassium chloride manufacturers were also a consequence of the onset of the Chinese New Year holidays and spring festivities.

Overall, the domestic potassium fertilizer market also faced the pressure of swindling production and delays in the spring sowing season, leading to slower shipments and a weak trend in the potassium benzoate market. The market also faced the dire aftereffects of the loss of European and U.S. exports due to the disruption of the Red Sea route and the extension of shipment travel times.

Europe

During the first quarter of 2024, the German potassium carbonate market experienced a notable price increase, driven by heightened demand for potassium chloride globally. During the first month, the pace of the market was slow as the decline in overseas purchases, and even the domestic downstream industries also presented dim momentum of the potassium carbonate market. The downstream industries, however, paced forward at an escalating pace, supporting the uptrend in the prices of potassium carbonate.

Additionally, the constrained in the supply chains due to loss of production volumes due to rising cost of manufacturing. Further, the agriculture industries also presented favorable market sentiments with the advent of the spring sowing season, contributing to the uptrend in the pricing patterns of potassium carbonate.

North America

In the first quarter of 2024, the U.S. potassium carbonate market experienced bullish sentiment due to constrained product supply linked to the Red Sea crisis. Initially driven by heightened demand within North American fertilizer markets was carried forward by improved weather conditions.

North America also saw increased demand during the planting season for crops like corn, cotton, and sorghum, aided by relief from prolonged drought conditions further supported the prices of potassium carbonate. However, production setbacks due to freezing temperatures and snowstorms led to the closure of major plants such as U.S. Nitrogen LLC and the BASF, depleted the inventories intensively.

Additionally, the shortage of raw materials due to the loss of Chinese imports further raised the concerns of producers and traders. The trade uncertainties intensified with rebel attacks in the Red Sea, prompting vessel reroutes and increased transportation costs globally.

Analyst Insight

According to Procurement Resource, the price trend of Potassium Carbonate is expected to incline in the near quarters as the onset of agriculture sowing season and limited availability of raw materials globally are expected to support the uptrend of potassium carbonate prices.

Potassium Carbonate Price Trend for Q4 (October - December) of 2023

Asia

The Asian Potassium Carbonate industry experienced mild oscillations during the fourth quarter of the year 2023. The price graph for Potassium Carbonate readily mimicked the variations in the feedstock potassium hydroxide or caustic potash prices; the fluctuations were confined within closed limits for Potassium Carbonate prices.

Regular market demands from the downstream mechanical, fire retardant, glass, soap, etc. industries pushed the market trend in a positive direction; however, the high stockpiles pulled the trend down. The intricate interplay between the above opposing dynamics caused the concerned Potassium Carbonate to vary during the said period of Q4’23.

Europe

The European Potassium Carbonate market trend were no different from the Asian markets. The market demands were largely underwhelming, and the supply constraints due to the freight disturbances also could not support the offshore Potassium Carbonate trade. Overall, swift variations in the Potassium Carbonate market trend were observed in the European markets during the given quarter of the year 2023.

North America

Some borderline stagnancy was observed in the North American Potassium Carbonate market as the supply and demand dynamics exuded some levels of stability during the said period. Though there were some issues in the latter half of the quarter because of various geopolitical stresses, the Potassium Carbonate market strongly followed its feedstock caustic potash market throughout the given time.

Analyst Insight

According to Procurement Resource, Potassium Carbonate price trend are likely to remain fluctuating in a similar manner going forward. The prices are likely to vary within limited ranges in the coming months as well.

Potassium Carbonate Price Trend for Q3 (July - September) of 2023

Asia

The Asian potassium carbonate market experienced wavering price trend during the third quarter of the year 2023. Since the Chinese industries started opening up at a slow pace after the COVID-19 restrictions were removed, the previous quarters have been slow for potassium carbonate. However, the market started picking up pace in the discussed span.

The steady rise was evident in the consistent incline of downstream demands during the said period. A hike in the feedstock potassium hydroxide and carbon dioxide prices, too supported the positive elevations in the potassium carbonate price graph. However, the second half of the quarter saw the price trend backtracking slightly since the overflowing inventory stocks started dominating the price patterns. So, with slight increments in the first half and decrements in the second half, the potassium carbonate price trend fluctuated within a narrow range during the given period of the third quarter of the year 2023.

Europe

The potassium carbonate prices in Europe fluctuated in a similar manner as they did in the Asian market in Q3’23. The first month of the quarter had a good start at the price graph; however, the following months slowed down. These price patterns were mostly influenced by the demand spectrum from downstream welding and glass industries. Overall, mixed market sentiments were observed.

North America

The American potassium carbonate market experienced a continuous decline during the said period. The downstream industries were in a slump primarily because of the heightened interest rates in the region. The general market outlook was observed to be regressive during the said period.

Analyst Insight

According to Procurement Resource, the Potassium Carbonate price trend are likely to remain fluctuating in the coming months given the uncertainties in the market dynamics.

Potassium Carbonate Price Trend for the First Half of 2023

Asia

In the Asian region, the Chinese market was still recovering from the lockdown after-effects, so the market was slow and posed very limited queries for Potassium Carbonate. The Chinese market didn’t get much growth; on the other hand, the Indian market had a fairly stable start.

Even with limited offtakes, the supplies were uninterrupted, so the inventories kept getting burdened with excess supplies. In order to promote inventory movement, the suppliers discounted the prices, which resulted in further depletion of the market trend. So, with varied price patterns, the Potassium Carbonate performed poorly in China and had a mo0derate run in India.

Europe

The European Potassium Carbonate market exhibited bearish sentiments throughout the discussed period. An overall economic slowdown in the region because of the war between Russia and Ukraine affected the overall industrial output. The high inflation and costs of living substantially reduced the market purchases, ultimately reducing the product demands. With limited purchases and high supplies, the prices had to be reduced to facilitate trade. Overall, Potassium Carbonate had a dull performance in Europe in H1’23.

North America

Just like Europe, the American economy was also struggling with rising inflation and living costs. With the collapse of two major US banks, the interest rates had also skyrocketed; such economic conditions limit the end-user customer base. Hence, the Potassium Carbonate market exhibited feeble sentiments in the American market as it was primarily driven by dull downstream demands.

Analyst Insight

According to Procurement Resource, the price trend for Potassium Carbonate are likely to fluctuate in the upcoming quarter, given the current market dynamics amid economic turmoil.

Procurement Resource provides latest prices of Potassium Carbonate. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Potassium Carbonate

Potassium carbonate is a dipotassium salt of carbonic acid. It is an odourless deliquescent white powder and is hygroscopic in nature. It dissolves readily in water but is insoluble in alcohol, acetone, and ethanol. It has applications in producing glass, soaps, wire or mead, etc.

Potassium Carbonate Product Details

| Report Features | Details |

| Product Name | Potassium Carbonate |

| Industrial Uses | Fire retardant, welding fluxes, buffering agent, mild drying agent, glass, soaps |

| Chemical Formula | K2CO3 |

| HS Number | 28364000 |

| CAS Number | 584-08-7 |

| Synonyms | Carbonate of potash, Dipotassium carbonate, Pearl ash |

| Molecular Weight | 138.205 g/mol |

| Supplier Database | Evonik Industries AG, UNID GLOBAL Corporation, Oxy (Occidental Petroleum Corporation), Armand products, Vynova Group, AGC Chemicals, Gujarat Alkalies and Chemicals Limited, Altair Chimica |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Potassium Carbonate Production Processes

The reaction between potassium hydroxide and carbon dioxide produces potassium carbonate. The reaction results in the formation of hydrated potash, which is further heated to give the hydrated potassium carbonate salt.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com