Product

Uncoated White Paper Price Trend and Forecast

Uncoated White Paper Price Trend and Forecast

Uncoated White Paper Regional Price Overview

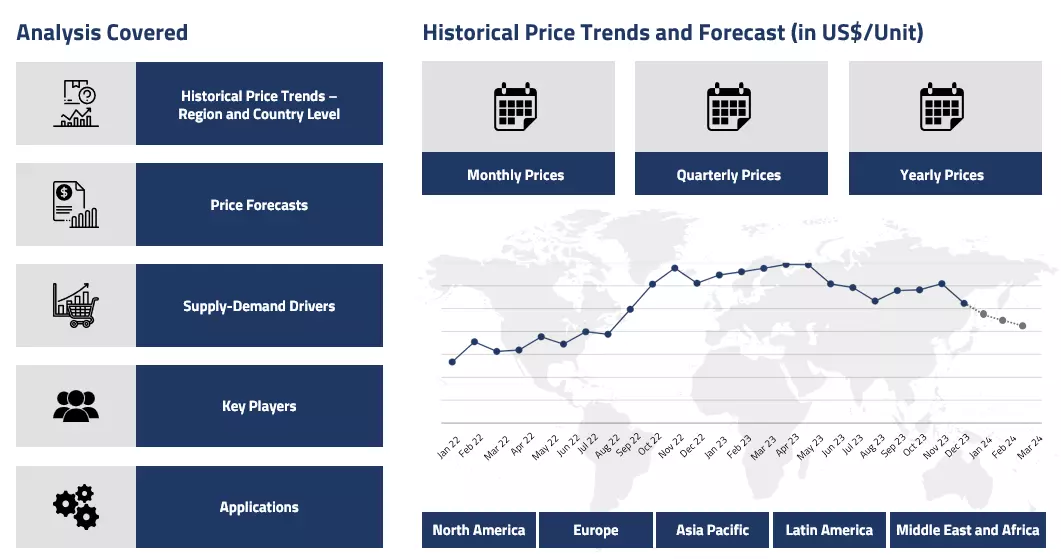

Get the latest insights on price movement and trend analysis of Uncoated white paper in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Uncoated White Paper Price Trend for the First Half of 2024

In the first half of 2024, uncoated white paper prices in India experienced a notable upward trend, driven by rising international pulp prices and escalating freight costs due to geopolitical tensions in the Red Sea region. The increased cost of raw materials, including wood pulp and imported pulp, compelled major producers like Emami, Shreyans Industries, and JK Paper to implement price hikes across various virgin grades, including uncoated white paper.

Uncoated White Paper Price Chart

Please Login or Subscribe to Access the Uncoated White Paper Price Chart Data

The surge in input costs, exacerbated by disrupted trade routes and ongoing global supply chain challenges, created substantial cost pressures for paper mills. Despite attempts to absorb these rising expenses internally, producers found it necessary to pass on some of the increased costs to maintain operational sustainability. As the industry continued to face significant challenges with higher inventories and tepid demand in the first quarter, price increases were implemented to mitigate the long-term value erosion facing the sector. Additionally, larger integrated mills with strong operational efficiency were better positioned to protect their margins during this period of price correction.

Analyst Insight

According to Procurement Resource, with the increasing reliance on domestic manufacturing, Indian mills are seeing an addition in capacity utilization. This might lead to some struggle for the Indian Uncoated White Paper sector in the coming times.

Uncoated White Paper Price Trend for the Second Half of 2023

In the second half of 2023, the uncoated white paper prices experienced upward momentum in most global markets driven by growing demand across multiple sectors. The increased focus on sustainability and eco-friendly practices, alongside regulatory pressures to reduce plastic packaging, boosted the use of uncoated paper in packaging applications, including food containers and e-commerce packaging. The rapid expansion of e-commerce further fueled demand for uncoated paper in various packaging materials, such as corrugated boxes and wrapping paper.

However, in the third quarter of 2023, North American printing and writing paper prices faced significant downward pressure due to weak demand and excess inventory throughout the supply chain despite this period typically being the strongest for sales. Mills operated at historically low capacities, with inventory levels around 15% higher year-over-year. While some paper merchants and printers worked through their excess inventories, others remained overstocked, delaying market recovery.

Despite slight improvements in demand, the overall market remained soft, and industry contacts did not anticipate significant recovery until the first quarter of 2024. Some mills, such as Billerud and Sylvamo, postponed or canceled planned price increases, citing unfavorable market conditions. Globally, the rise in personalized and custom printing options spurred demand in the stationery and advertising segments. Despite digitalization, there remains substantial demand for uncoated paper in the printing industry for books, newspapers, and educational materials.

Analyst Insight

According to Procurement Resource, with the geopolitical uncertainties howling and the recent commencement of war between Israel and Hamas, the supply chains are expected to get further disturbed. This will further pressurize the Uncoated White Paper markets going forward.

Uncoated White Paper Price Trend for the First Half of 2023

The price trend of uncoated white paper oscillated in the first and second quarters of 2023 globally. In the Asia-Pacific countries, the southward trajectory of prices was majorly due to the slow movement of the economy, weak industrial production in Russia, and falling trading sentiments.

In addition to this, the demand from the downstream industries and consumption rates of consumers also seemed to be declining, keeping the price trend of uncoated white paper in the negative zone. In addition to this, the influx of overseas imports reached new heights, which increased the competitiveness of the market and further impacted the domestic prices of uncoated white paper in the first two quarters.

In the North American markets, the weak demand and high level of inventories proved to be a problem for the prices of uncoated white paper. In addition to this, the rates of production in this region also suffered due to the shutting down of several production plants, which, in turn, influenced the overall market sentiments of uncoated white paper negatively.

Analyst Insight

According to Procurement Resource, the price of Uncoated White Paper is expected to showcase a fluctuating trend as the demand from the downstream industries and globally weak sentiments will likely keep the prices of uncoated white paper in the negative zone.

Procurement Resource provides latest prices of Uncoated White Paper. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Uncoated White Paper

Uncoated white paper has a matte finish and a bright white color. It is made from wood pulp and other sources of cellulose fibers that do not have any additional coatings to distort its natural texture or appearance. It is used in several printing and writing industries as it has the ability to absorb ink effectively and has a clean, readable surface for texts and graphics. This type of paper is also often chosen for its recyclability and eco-friendly characteristics, as it can be easily recycled and is biodegradable.

Uncoated White Paper Product Details

| Report Features | Details |

| Product Name | Uncoated White Paper |

| Industrial Uses | Office printing, Newsprint, Art and craft, Packaging, Books and publications |

| Supplier Database | Appleton Coated, Asia Pulp & Paper, Case Paper, Domtar, Finch Paper |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com