Product

Zinc Ingot Price Trend and Forecast

Zinc Ingot Price Trend and Forecast

Zinc Ingot Regional Price Overview

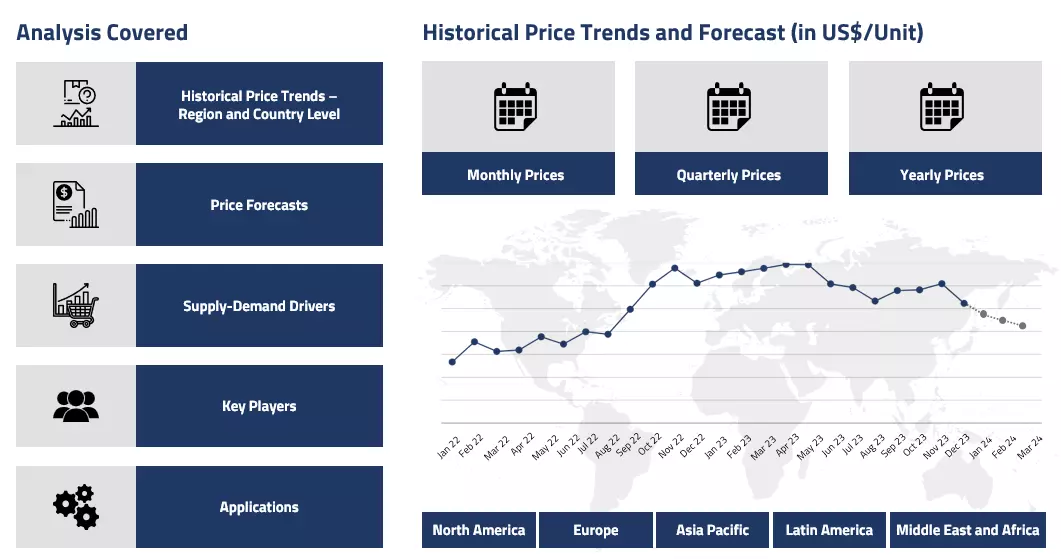

Get the latest insights on price movement and trend analysis of Zinc Ingot in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Zinc Ingot Price Trend for the Q3 of 2024

Asia

In China, zinc ingot prices exhibited fluctuations due to changes in both supply and demand. Early in the quarter, the market was weighed down by high inventory levels, particularly in the Shanghai Bonded Zone, and the suspension of operations at Australia's Dugald River zinc mine. Additionally, weak demand from the construction sector, along with ongoing debt issues, contributed to price declines. However, by the end of Q3, investor focus shifted toward potential stimulus measures from Beijing, which helped stabilize prices.

Zinc Ingot Price Chart

Please Login or Subscribe to Access the Zinc Ingot Price Chart Data

The Asian markets, particularly Korea and Japan, experienced strong price growth during Q3 2024. In Korea, Zinc Ingot prices were driven by robust demand from the construction sector, boosted by government initiatives aimed at stabilizing real estate costs. Corporate restructuring in key zinc smelting companies also supported market growth. In Japan, economic recovery and increased industrial activity, especially in the automotive and semiconductor sectors, drove Zinc Ingot prices higher.

Europe

Germany's zinc ingot market saw a gradual recovery, despite earlier declines driven by weak demand from the automotive sector, particularly in hybrid and electric vehicles. As the quarter progressed, there was renewed interest in zinc ingot for industrial applications. Government initiatives to support the domestic zinc industry helped bolster prices, though challenges in downstream sectors remained a concern.

North America

In the USA, zinc ingot prices displayed volatility as supply chain issues persisted. The market was impacted by high interest rates, which contributed to raw material availability and market saturation. Rising freight costs and proposed import tariffs also weighed on the sector, resulting in lower purchasing activity. However, there were signs of recovery towards the end of the quarter, with improved demand from the construction sector offering some price support.

Analyst Insight

According to Procurement Resource, the price trend of Zinc Ingot is expected to exhibit a volatile trend in the quarters ahead as well with limited support from both domestic and overseas markets.

Zinc Ingot Price Trend for the Q2 of 2024

Asia

In Chinese markets during Q2 2024, zinc ingot prices experienced fluctuations driven by increased refined zinc production in China during May 2024. This excessive rise in the feedstock commodity contributed to a slight decline in prices by the end of the quarter. The production ramp-ups following maintenance activities and output expansions at smelters across various Chinese provinces influenced this southward movement of the market. However, some regions faced challenges such as raw material shortages and equipment maintenance, which impacted output levels.

Despite these production developments, the global zinc market remains in surplus as reported by the International Lead and Zinc Study Group, depreciating the export volumes. Although the demand for the commodity was on par with the expectations of the market players, supply exceeded the previous market projections, leading to the settlement of the prices on the lower end of the pricing spectrum.

Europe

In Q2 2024, zinc ingot prices in Europe saw oscillations influenced by supply dynamics and market developments. Nyrstar's decision to reactivate the Budel zinc smelter in the Netherlands after a period of maintenance signaled improved market conditions and restored the confidence of investors. This followed Glencore's reopening of its Nordenham smelter in Germany improved the supply chains of the commodity.

Despite these restarts, European zinc ingot prices were supported by investment flows into base metals, pushing them to quarterly highs. The market sentiments also shifted from smelter constraints to concerns over mine supply, escalated by plummeting smelter treatment charges indicative of tight concentrate availability. Despite these marginal increases in mine supply, constraints in raw material availability limited the refined production growth in Europe, as forecasted by the International Lead and Zinc Study Group.

North America

North American zinc ingot markets were much more similar to the Asian countries as compared to European. The trend was modest at best with prices constraining under the excessive supply of the commodity. The resurgence of major production units after maintenance shutdowns in the first quarter further intensified supply issues. The export volumes of zinc ingot were also pressurized by the high freight charges while import volumes inclined, disrupting the supply-demand equilibrium of the zinc ingot, reflected in its fluctuating price quotations.

Analyst Insight

According to Procurement Resource, the price of Zinc Ingot is estimated to be subdued under the influence of excessive demand as global operations are expected to work most efficiently in the next quarters as well while the procurement rates are not likely to grow parallel with it.

Zinc Ingot Price Trend for the Q1 of 2024

Asia

The zinc ingot prices observed a downward wavering trend during the first quarter of 2024. The primary reason behind these slumping trends was a consistent rise in the output quantities. Zinc output is seeing a rise globally, and Chinese zinc output is expected to rise by about 500 KMT by the next year. Though there are various factors guiding zinc ingot prices in both positive and negative directions, however, the oversupply condition remains dominant over others. Previous year too zinc performed worse among all other base metals.

The Indian zinc market depreciated by around 14% in the last year. During this time, the leading Indian zinc miner, Hindustan Zinc, reported a fifth consecutive fall in profits. A disturbed supply-demand balance has been detrimental to the regional zinc ingot industry. So, amidst global economic uncertainties, the dumb downstream demands in China from the construction and automotive industries and overflowing inventory levels are exerting downward pressure on the zinc ingot price trend. This trend has been even more rampant in the sluggish post-COVID economic recovery in China.

Europe

The European zinc ingot market also felt the sluggishness in the global market. However, the prices rose slightly in January in London as Nyrstar, a key global zinc producer, halted production at its Budel, Netherlands plant until further notice. The company called it a maintenance shutdown because of high input energy costs and weakening market conditions. This created a little gap for suppliers amidst an already grappling supply chain crisis. However, the demand deficit quickly made up for it, and the prices started plunging again in the European markets.

North America

Zinc ingot’s performance in the American markets was no different from its Asian and European counterparts; prices were observed to be struggling here as well. The subdued demands and glutted inventory situation was pushing the price graph down. Even though the energy and processing costs were inclined during this time, the demand deficit was overpowering it. Apart from this weak domestic performance, the international markets were also equally disappointing.

Analyst Insight

According to Procurement Resource, the Zinc Ingot price trends are likely to remain on the same downhill trajectory in the next quarter, too. The downstream consumption is not exhibiting very positive projections.

Zinc Ingot Price Trend for the October - December of 2023

| Product | Category | Region | Price | Time Period |

| Zinc Ingot | Energy, Metals and Minerals | Europe | 3755 USD/MT | December 2023 |

Stay updated with the latest Zinc Ingot prices, historical data, and tailored regional analysis

Asia

The zig-zaw movement of zinc ingot prices in the last quarter of 2023, especially in the Chinese market, was based on a number of factors. The start of the fourth quarter was smooth for the zinc ingot prices as the consumer dynamics and efficient manufacturing activities equally balanced out each other.

However, the number of exports from the Asian ports increased, particularly to the US, as the US Department of Commerce released sanctions on one of the major zinc producers globally, which in turn raised the demand for Asian zinc ingot and helped its price trend to climb. On the other hand, the limited mining activities and serious environmental impacts of increasing mining projects caused ripples in the zinc ingot market.

Europe

The fires in the Russian Ozerny mine rattled the European zinc ingot price trend in the last quarter of 2023. As the company was still assessing the losses, the delay in the zinc import and export timetable caused the zinc ingot price trend to oscillate. Just after the news broke out, the prices of zinc ingot shot up but soon retreated to their normal levels. This quick bounce back of the zinc ingot prices was based on the back of high supplies from overseas industries and curtailed raw materials segments in the supply chains.

North America

The sharp fall in the US currency pushed the trajectory of zinc ingot prices in a downward spiral. The region also acquired the ill effects of the declining cost of crude oil and other related commodities.

Additionally, excessive supplies of raw materials shifted the market conditions from a deficit to a surplus gradually as the end of the year approached. By the mid of December, the zinc inventories had surpassed the demand by 295,000 MT which was thus evident in the downturn in the zinc ingot price trend.

Analyst Insight

According to Procurement Resource, the price trend of Zinc Ingot are estimated to struggle with limited production as the new mining expenditures around the globe will now have to adhere to environmental regulations.

Zinc Ingot Price Trend for the July - September of 2023

Asia

The zinc ingot price trend in Asian countries became stagnant and observed a stunted growth rate as the falling economic parameters and rising inflationary pressure dictated its trajectory. The reduction in consumption, especially from the downstream automotive industries and the availability of cheap imports, raised the bar of uncertainty in the region. The later months of the third quarter, however, benefited from the rise in sales of the automotive sector and the depletion in inventories.

Europe

The European countries' feeble momentum of automotive and battery industries struggled with a rise in competitiveness from the Chinese manufacturers. Additionally, the rise in the concerns amongst the manufacturers due to financial constraints in the region also had an adverse effect on the rates of production and imbalanced the supply-demand equilibrium, thus resulting in the downfall of the zinc ingot price trend.

North America

Stable production rates supported the inventories, which in turn were sufficient to cater to the existing demand for the zinc ingot in the third quarter. Similar to the European countries, the rise in competition in the market due to the influx of Asian imports and soaring inflation rates affected the market dynamics for zinc ingot. Amid the economic crisis, the downstream industries were also forced to lower their rates of procurement of zinc ingot, thus hampering the zinc ingot price trajectory.

Analyst Insight

According to Procurement Resource, the price trend of Zinc Ingot are estimated to witness significant turmoil with consistently falling demand and excessive inflationary pressure.

Zinc Ingot Price Trend for the First Half of 2023

Asia

The zinc ingot market depreciated in the second quarter of 2023 in the Asia Pacific region; however, the trend in the first quarter was supported by the hike in demand from the downstream industries, especially in the Chinese market. The holiday season, uncertainties in the banking sector, and sliding economic conditions proved to be challenges for the zinc ingot market, but the purchasing capacity of buyers supported the overall zinc ingot trend.

The second quarter was negatively impacted by the rise in the level of inventories due to enhanced mining activities resulting in the high influx of material in the market, while the number of inquiries and overall demand from the downstream industries remained muted amid the struggling economic conditions.

Europe

The demand for zinc ingot in the first quarter of 2023 inclined as the level of imports slumped. However, some month-on-month disruptions were also observed. Demand from coil-related products supported the rise in the price trend, but limited trading activities and receding confidence of buyers in the market due to fluctuating economic conditions continued to be a problem for the zinc ingot market. Due to this, the trend ultimately declined in the second quarter.

The mining activities also surged globally that led to an influx of high volumes of the product in the region, but the consumer demand was not sufficient to cater to the rising inventories due to the declining trajectory followed by the construction and automobile industries that ultimately led to the fall in the prices of zinc ingot.

North America

Unlike the European and Asia Pacific regions, the first quarter was not favorable for the zinc ingot market. The price trend was stagnant due to steady demand and rising rates of inflation. This continued to be a problem in the second quarter also.

The market of galvanized steel was adversely affected by the reduction in construction activities due to the onset of the monsoon season. In addition to this, the North American market was also adversely affected by declining economic conditions, rising inflation rates, and a halt in the consumption of natural gas and fuels, leading to a drop in their prices.

Analyst Insight

According to Procurement Resource, the price trend of zinc ingot is estimated to follow a declining trajectory. The price trend will be negatively impacted by the subdued demand from the construction sector and falling global economic conditions.

Procurement Resource provides latest prices of Zinc Ingot. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Zinc Ingot

Refined zinc metal in the form of a solid block is called zinc ingot which is produced via smelting and purification of zinc. This ingot is bluish white in color with high malleability and ductility and low melting point. In addition to this, zinc ingot also has high corrosion resistance as it forms a layer of oxide over its surface, that protects the core material. Zinc's ability to alloy with other metals makes it valuable in various industrial applications, from galvanization to alloy production, owing to its unique combination of properties.

Zinc Ingot Product Details

| Report Features | Details |

| Product Name | Zinc Ingot |

| Industrial Uses | Cathode protection, Paint and coating industry, Rubber and plastic industry, Die-casting, Battery production |

| CAS Number | 7440-66-6 |

| HS Code | 7901.11.00 |

| Supplier Database | REAZN S.A., Henan Yuguang Zinc Industry Co Ltd, Yifengxin (Hebei) Metal Production Co Ltd, Siyaram Impex Pvt Ltd, Phoenix Industries Ltd |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Zinc Ingot Production Processes

In this multi-step process, the zinc ore is first melted in a furnace along with several other alkali metals to form an alloy. The molt is cooled and shaped into ingots in the subsequent steps to get zinc ingot.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com