Product

Butyl Acetate Price Trend and Forecast

Butyl Acetate Price Trend and Forecast

Butyl Acetate Regional Price Overview

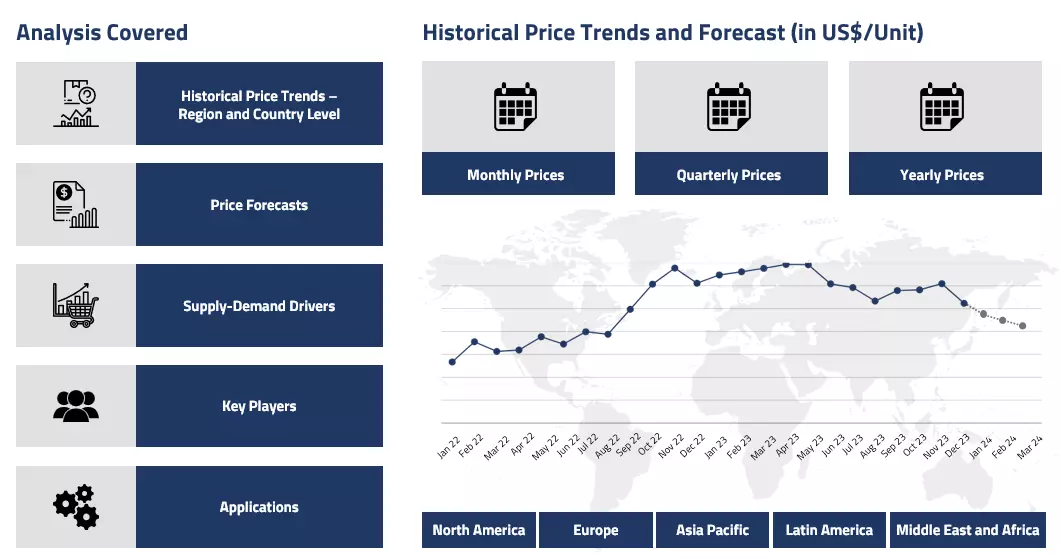

Get the latest insights on price movement and trend analysis of Butyl Acetate in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Butyl Acetate Price Trend for the Q4 of 2024

Asia

The Butyl Acetate market in Asia demonstrated notable fluctuations throughout Q4'24, heavily influenced by movements in its key feedstocks. The quarter began with upward momentum, particularly in China, as acetic acid prices showed strength in both North and South China regions. By mid-November, the market gained further support from tight n-butanol supply due to maintenance shutdowns in several facilities.

Butyl Acetate Price Chart

Please Login or Subscribe to Access the Butyl Acetate Price Chart Data

However, the latter part of the quarter saw some price corrections as n-butanol supply improved following the restart of production units. The market was characterized by varying buying patterns, with downstream industries maintaining a cautious approach, especially towards year-end when both feedstocks showed signs of stabilization.

Europe

European Butyl Acetate markets experienced a relatively stable trend during Q4'24. The market was primarily influenced by balanced supply fundamentals and moderate downstream demand from the coatings and printing ink sectors. While producers attempted to raise prices citing production costs, resistance from buyers kept price movements within a narrow range. The quarter was marked by need-based purchasing patterns, with most consumers maintaining minimal inventory levels. Competition from Asian imports continued to influence market dynamics, though logistics costs provided some protection to regional producers.

North America

The North American Butyl Acetate market showed mixed trends throughout Q4'24. The quarter started on a firm note, supported by steady demand from the construction coating sector and automotive refinish industries. However, as the quarter progressed, the market began to soften due to improved product availability and year-end inventory management by consumers. Producer margins faced pressure from volatile feedstock costs, though balanced supply-demand fundamentals helped maintain market stability.

Analyst Insight

According to Procurement Resource, the Butyl Acetate market is expected to be influenced by feedstock price movements, particularly acetic acid and n-butanol trends. While regional demand variations may persist, the market is likely to find support from anticipated recovery in key end-use sectors.

Butyl Acetate Price Trend for the Q3 of 2024

Asia

In Asia, the butyl acetate market experienced relative stability during Q3 2024, with prices largely holding steady across the region. The balance between supply and demand remained intact, with manufacturing units operating at optimal capacity. However, the market was not without its challenges. In China, one of the key consumers of butyl acetate did not bring the anticipated boost in demand. Despite this, ample supply of butyl acetate ensured that prices remained stable.

On the feedstock front, acetic acid prices in Asia saw some fluctuations, though they did not significantly impact butyl acetate pricing due to sufficient inventory levels and balanced production rates. The Asian market was also affected by global shipping disruptions, which led to increased import costs, particularly from European and North American suppliers. This, in turn, added some upward pressure on prices, though overall the market remained stable due to steady domestic production and moderate demand from the paints and coatings sectors.

Europe

In Europe, the butyl acetate market experienced a period of stability, though underlying factors signaled potential price increases in the near future. The German market, a key player in the European sector, saw stable prices throughout Q3, with manufacturing units operating at full capacity and meeting downstream demand, particularly in the paints and coatings industries. However, rising costs of upstream materials, particularly methanol, began to exert upward pressure on prices.

Market participants were bracing for a potential price increase due to the upward trend in methanol prices, which was expected to ripple throughout the value chain. Meanwhile, the construction industry in Europe continued to struggle with labor shortages and stagnant manufacturing activity, contributing to subdued demand for butyl acetate. Despite these challenges, a recent surge in housing stock across Germany and projections of more stable construction costs offered some optimism for the future demand in the downstream sector. Additionally, global shipping disruptions, particularly those caused by the Red Sea crisis, further complicated the market landscape by raising import costs and affecting price competitiveness.

North America

In North America, the butyl acetate market witnessed price declines during the quarter, largely driven by a drop in feedstock acetic acid prices. The reopening of under maintenance plants played a significant role in this trend. The resumption of normal operations alleviated supply constraints and led to an increase in acetic acid availability, which in turn contributed to lower butyl acetate prices.

Despite the steady supply, demand from the downstream paints and coatings industry remained subdued, particularly due to decreased construction activity. A rebound in construction employment towards the end of the quarter, following declines in the earlier months, offered some hope for higher demand in the coming months. However, with steady domestic production and ample supply, the North American market remained well-positioned, though it faced ongoing challenges from reduced construction spending and weak downstream demand.

Analyst Insight

According to Procurement Resource, the price trend of Butyl Acetate is expected to exhibit only moderate gains in the quarters ahead as the future trajectory of the downstream industries at present offers an opque picture.

Butyl Acetate Price Trend for the Q2 of 2024

Asia

In the initial phase of the second quarter, the prices of butyl acetate in China incurred a slight decline, and further, in the later phase, the market attained slight stability. The market's bearish tone was initially influenced by the stable supply of the commodity and fluctuating demand. The raw material industries also wavered on the lower end of the spectrum, offering only a little support to the market.

As the quarter progressed, the acetic acid prices began to decline, but the n-butanol sector supported the market trend. However, the consistent weak purchasing momentum of end-user industries in both the domestic and overseas markets eventually led to the frail momentum of the market. The traders even adopted some cautious trading practices amid the declining interest of international players.

Europe

In Europe, the butyl acetate market closely resonated with acetic acid and n-butanol during the second quarter of 2024. The cost support from these two raw materials remained minimal, hampering the overall growth of the market. Also, the imbalance of procurement rates and supply raised the concerns of traders and manufacturers, forcing them to opt for strict measures to keep the market momentum above par. Although the influx of Asian imports in the region declined, stabilizing the inventory gains a little, the end-user demand was not even sufficient to cater to the domestic production volumes.

North America

In the second quarter of 2024, the US butyl acetate market experienced a downturn due to ample inventories meeting moderate downstream demand, particularly from the acetate industry. Additionally, the limited shipments export and increased inventory levels led to continuous reductions in traders’ and manufacturer quotations. Despite some sectoral improvement indicated by the US manufacturing activities, the enthusiasm for purchasing downstream products remained weak. Additionally, domestic butyl acetate plants continued to operate at optimum capacity, meeting both domestic and international demand despite fluctuations in the upstream acetic acid market.

The demand from the construction sector, a major driver for butyl acetate, remained stable, with an overall increase in construction starts in June. The rising natural gas quotations, driven by forecasts of hotter summer temperatures and increased electricity demand, further added pressure to the market. Additionally, rising freight costs posed challenges, potentially delaying any anticipated interest rate cuts by the Federal Reserve.

Analyst Insight

According to Procurement Resource, the price trend of Butyl Acetate is estimated to oscillate in a narrow range in the forthcoming quarters as the rising uncertainties in both feedstock and downstream industries are likely to dictate the prices of the commodity.

Butyl Acetate Price Trend for the Q1 of 2024

| Product | Category | Region | Price | Time Period |

| Butyl Acetate | Chemicals | USA | USD 2300/MT | March 2024 |

Stay updated with the latest Butyl Acetate prices, historical data, and tailored regional analysis

Asia

The increasing demand from the downstream industries drove the market dynamics of butyl acetate in Asian countries during the first quarter of 2024. The Chinese market also witnessed a quick depreciation in inventory levels amid the healthy demand from the paints and coatings sector particularly.

The export volumes from the Chinese and Indian ports, however, declined due to the disruption of the Red Sea route amid the rising number of Houthi attacks. However, the profit margins from the existing number of exports inclined, especially due to the increase in the procurement rates of the European traders. The feedstock industries on the other hand, extended only a limited support to the market, raising the concerns of the traders.

Europe

In the European market, butyl acetate prices remained stable despite the oscillation in the pricing trajectory of its feedstock material, acetic acid. Additionally, the market showcased resilience amid rising interest rates, which constrained downstream consumer purchasing capacities. During the first quarter, the production costs also stayed in the green zone with the stabilization of natural gas and other raw materials.

The major support for the market came in the form of an influx of expensive Asian imports in the region, due to which the sales number of domestic products increased by a significant margin. With the return of consumer confidence in the domestic produce, the traders also noticed a steadiness in the demand-supply equilibrium of the market and a gradual depletion in inventories, favoring the uptrend in the butyl acetate market momentum.

North America

The butyl acetate prices in the first quarter of 2024 showcased a consistent downward trajectory, primarily due to the rise in low-cost imports from China in the region, however, despite some fluctuations in demand from downstream industries affecting overall market growth, short-term expansion in manufacturing activities, particularly fueled by increased demand from the construction sector.

However, the major players, such as Dow, reported a net decrease in sales figures, primarily due to reduced procurement from the paints and coatings industries and fluctuations in the region's economic indicators. Further, the upstream feedstock industries also failed to provide necessary support to the market, eventually leading to a downhill projection of butyl acetate prices in Q1 of 2024.

Analyst Insight

According to Procurement Resource, the price trend of Butyl Acetate is estimated to oscillate amid skeptical movement of the feedstock prices and economy dependent growth of the downstream industries.

Butyl Acetate Price Trend for the October - December of 2023

Asia

The dynamics of feedstock butanol had a significant impact on the price trend of butyl acetate in the fourth quarter of 2023. In China, the cost of raw materials fluctuated throughout the quarter and thus was unable to cause an uptick in the butyl acetate price trend. Further, the downstream industries, such as the construction and polymer sectors, struggled to present a consistent demand for butyl acetate, which, along with the oscillating cost of raw materials, caused month-on-month alterations in the butyl acetate prices.

Europe

The bearish trend in the butyl acetate prices carried on in the fourth quarter, too. The ill consequences of poor growth of the construction industry proved to be a hindrance in the way of the butyl acetate price trend. Additionally, the cost of feedstock acetic acid also took a southward turn and failed to provide any relief to the traders of butyl acetate, and the troubles of the market were well evident in the trend adopted by the butyl acetate price graph.

North America

There was a linear rise in the cost of raw materials required for industrial production of butyl acetate, and despite that, the prices of butyl acetate faced a downfall during the fourth quarter of 2023. It was anticipated that instead of the direct factors, such as equilibria of supply and demand, the auxiliary factors, such as a decline in the cost of crude oil and natural gas, had a major role in dictating the growth rate of the butyl acetate market. Further, the crunch in the supply chains due to the fall in Panama Canal water levels proved to be a headache for the traders.

Analyst Insight

According to Procurement Resource, the price trend of Butyl Acetate are reckoned to be dependent on the zig-zag movement of the demand from end-user industries and the overall cost of production.

Butyl Acetate Price Trend for the July - September of 2023

Asia

Butyl Acetate is synthesized using butanol and acetic acid, so the price trend closely mimic any fluctuations in the former’s market behavior. Since the Chinese industries were trying to open up and scale productions to the pre-COVID levels, the order queries for butyl acetate started to rise and pushed the prices higher on the price index.

A significant rise in the feedstock costs also strengthened the upstream cost support considerably. The rapid and wholesome expansion of economic and industrial activities in the Indian market also supported the butyl acetate price dynamics. Overall, a positive market outlook was observed for butyl acetate during the said period.

Europe

The European market behavior of butyl acetate was the complete opposite of the Asian market trend. Feeble demand from the consumption sector was the fundamental reason behind the depreciating trend. The rising inflation and interest rates were detrimental to individual buying capacities. Further, the transportation hurdles were also responsible for poor price performance. Overall, muted market sentiments were observed.

North America

The American butyl acetate market closely coincided with the European price trend. The dull and feeble demand from the utilizing units negatively impacted the pricing fundamentals. Overall, a cold market outlook was observed during the discussed period.

Analyst Insight

According to Procurement Resource, the Butyl Acetate prices will continue to fluctuate in the coming months, given the mixed consumption patterns.

Butyl Acetate Price Trend for the First Half of 2023

Asia

The Asian Butyl Acetate market observed mixed price sentiments during the first half of 2023. The market had a positive start in the first half of Q1 2023 as market offtakes from the downstream coatings and adhesive industries rose. At the same time, the supplies were still curtailed as the production facilities were trying to revive after the Covid restrictions were lifted.

But as the production ramped up, inventories started leveling up, while the demands started normalizing and eventually declined. The price trend took a downturn by the end of the first quarter and continued till the middle of the second quarter. Prices tried to rebound at the end of Q2, but low demands dominated over other factors. Overall, the market remained fluctuating during the said period.

Europe

Like the Asian Butyl Acetate market, downstream demands remained the driving factor for price trend in the first two quarters of 2023. Q1 started positively, with high demands and substantial procurements from the downstream industries.

But as the upstream facilities improved, the supply chains were restored, and the freight costs decreased, excess supplies started piling, given the falling demand by the end of Q1 2023. These declining trend continued till the end of the second quarter. Overall muted market sentiments were observed.

North America

The North American Butyl Acetate market exhibited conflicting patterns with the global market trend as the prices were on an inclining trajectory for most of the first half of 2023. Demands were consistent and stable and showed occasional rises, and feedstock prices, too, provided positive cost support. Some temporary deviations owing to regional imbalances were observed. However, overall inclined price patterns were observed for the region.

Analyst Insight

According to the Procurement Resource, the Butyl Acetate prices are expected to continue fluctuating in the upcoming months, with market demands continuing to be the driving factor controlling the Butyl Acetate market behavior.

Procurement Resource provides latest prices of Butyl Acetate. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Butyl Acetate

Butyl Acetate is a colourless liquid with a sweet banana-like odour. It is a low-viscosity volatile liquid but is flammable. It is used in manufacturing lacquers and paints.

Butyl Acetate Product Details

| Report Features | Details |

| Product Name | Butyl Acetate |

| Industrial Uses | Food flavoring, lacquer production, polishes, adhesives |

| Chemical Formula | C6H12O2 |

| HS Number | 29153300 |

| CAS Number | 123-86-4 |

| Synonyms | Acetic Acid N-Butyl ester, 1-Acetoxybutane, Butyl ethanoate |

| Molecular Weight | 116.16 g/mol |

| Supplier Database | Dow Chemical Company, BASF SE, INEOS Group, Solvent Wistol S.A. |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Butyl Acetate Production Processes

Butyl acetate is produced via esterification of n-butanol with acetic acid in the presence of strong acidic solids as catalyst.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com