Product

Linear Low-Density Polyethene (LLDPE) Price Trend and Forecast

Linear Low-Density Polyethene (LLDPE) Price Trend and Forecast

LLDPE Regional Price Overview

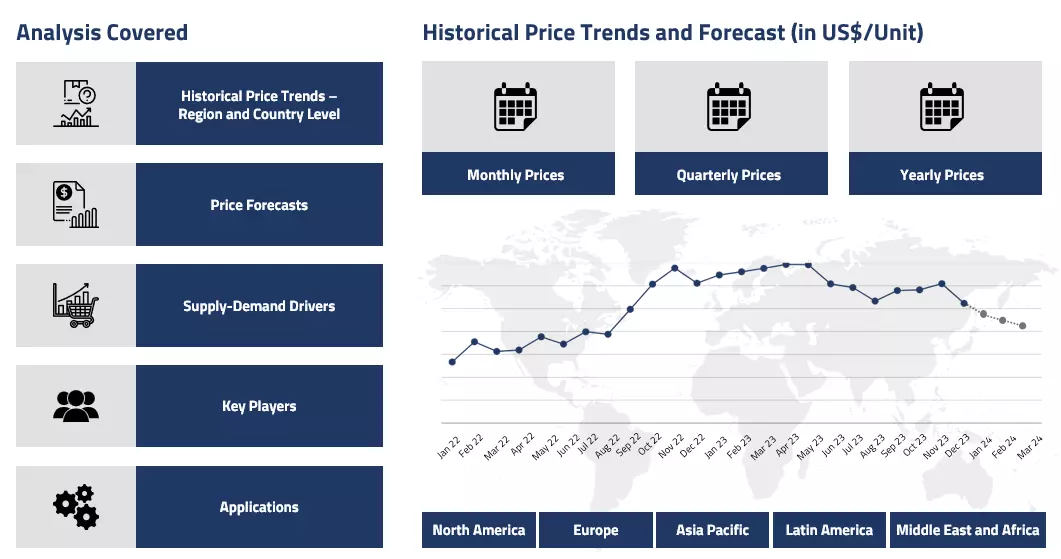

Get the latest insights on price movement and trend analysis of Linear Low-Density Polyethene (LLDPE) in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

LLDPE Price Trend for the Q4 of 2024

Asia

In Q4 2024, in China, demand remained stable, with packaging and agriculture being the leading sectors, as buyers increased their procurement before the year-end. In Thailand, prices remained stable due to robust industrial output, following a similar trend.

Linear Low-Density Polyethene (LLDPE) Price Chart

Please Login or Subscribe to Access the LLDPE Price Chart Data

The stability of supply was largely attributed to strong trading and production levels, which kept supplies flowing smoothly. Although demand remained strong, buyers were cautious, closely monitoring feedstock costs and external market conditions as they planned their purchases.

Europe

The situation in Europe was quite different. A quieter market was observed as prices fell over the quarter. Despite the year-end, LLDPE was being used mainly by two major consumer groups—the construction and automotive industries—which were also struggling, leading producers to stockpile excess stocks.

Germany, one of Europe's major markets, was affected by low housing activity and inflation, which reduced the demand for building materials, including LLDPE. Even though feedstock prices were lower, demand didn’t increase enough to stabilize the market. Sellers faced the dilemma of managing an oversupplied market with little hope of recovery.

North America

In North America, the story was one of stability. Prices remained steady throughout the quarter, thanks to a balance of supply and demand. Material availability was sufficient to meet demand in the U.S. market, despite logistical challenges such as delays at Canadian ports. However, supply continued uninterrupted. Packaging and construction, two key industries, saw a degree of activity, while the automotive sector experienced some positive sales.

The careful handling of inventories by producers prevented oversupply, which helped keep prices stable. The North American market was characterized by steady but cautious movements, with supply chain management playing a crucial role in maintaining balance.

Analyst Insight

According to Procurement Resource, the prices of LLDPE are expected to maintain a similar trend moving forward into the next year as the demand patterns remain supportive.

LLDPE Price Trend for the Q3 of 2024

| Product | Category | Region | Price | Time Period |

| LLDPE | Packaging | China | 1170 USD/MT | July'24 |

| LLDPE | Packaging | China | 1159 USD/MT | August'24 |

| LLDPE | Packaging | Europe | 1174 USD/MT | July'24 |

| LLDPE | Packaging | Europe | 1146 USD/MT | September'24 |

Stay updated with the latest Linear Low-Density Polyethene (LLDPE) prices, historical data, and tailored regional analysis

Asia

In the third quarter of 2024, linear low-density polyethylene (LLDPE) in China followed a declining price trend initially, after which prices became steady for the rest of the quarter, showing only marginal fluctuations. The prices were around 1170 USD/MT in July and around 1159 USD/MT in August. The decline, which had started in the previous quarter, continued until mid-August.

Several factors contributed to the drop, including a weak polyethylene market and a downturn in downstream demand as the sector entered its off-season. This quarter saw a low-demand period for agricultural films and other polyethylene products, limiting market transactions. Additionally, the volatility in oil prices kept the upstream polyethylene market weak, offering limited cost support to the LLDPE market. The lack of new inquiries also dampened production enthusiasm.

However, as the quarter progressed, prices steadied as traders offered discounts to maintain shipments and production enterprises aimed to clear their existing inventories. Domestic demand saw a temporary pick-up during the Mid-Autumn Festival and National Day holidays, but this surge had a limited effect on prices.

Europe

In contrast to the Asian market trend, the prices moved slightly upward in the European markets in the initial phase as the existing trade instability in the region continued to impact the prices. However, the slowdown in the sector stabilized them for the rest of the quarter. The prices of LLDPE were around 1174 USD/MT (FOB NWE) in July and around 1146 USD/MT (FOB NWE) in September. Overall, mixed market sentiments were witnessed.

North America

The prices for LLDPE resembled the global trends in the North American region. The prices showed an overall downward trajectory as the prices of Chinese exports declined primarily because of the overcapacity in the producing Chinese markets. Also, the slowdown in the downstream polyethylene sector during the quarter pressured the prices of LLDPE in the region, leading to a decline in the domestic LLDPE prices. Conclusively, the market lacked serious enthusiasm during the said time period.

Analyst Insight

According to Procurement Resource, the prices of linear low-density polyethylene (LLDPE) are expected to show a steady trend with marginal fluctuations in the near future as the upcoming holiday season will probably see an increase in demand from the downstream packaging sector.

Linear Low-Density Polyethylene (LLDPE) Price Trend for the Q2 of 2024

Asia

The Asian linear low-density polyethylene (LLDPE) market saw a price surge despite declining raw material and energy costs. This increase was driven by higher shipping costs and supply shortages, worsened by vessel congestion. China, however, managed to maintain price stability due to firm demand. The rising container shipping costs from Asia, coupled with strong US demand for polyethylene, kept prices elevated despite market players' efforts to reduce their quotations.

However, the domestic converters and distributors responded to an unexpected tightening of linear low-density polyethylene supplies by restoring to bulk purchases, further straining the market. Additionally, significant delays in import shipments, primarily due to severe vessel congestion at the Singapore transshipment port since May, contributed to the supply shortage and price rise in the Asian market. These supply chain disruptions and logistical challenges, combined with global demand dynamics, played a crucial role in influencing linear low-density polyethylene market behavior during this period.

Europe

Europe experienced stable linear low-density polyethylene prices despite the overall market pressures. The stability was largely due to consistent feedstock ethylene contract prices, which maintained a balance between supply and demand. However, the European market faced weak demand and supply constraints. At the beginning of June, suppliers were under pressure due to low demand and reduced costs, leading distributors to anticipate potential price declines in the upcoming weeks.

This outlook was influenced by ongoing challenges in the European chemical industry, including weak global demand, sluggish economic growth in the US, and an economic slowdown in China. Further, severe weather conditions, such as rain and flooding along the River Rhine, caused significant disruptions in logistics and transport stoppages, exacerbating supply constraints and affecting market dynamics.

North America

In the United States, linear low-density polyethylene prices saw an upward trajectory primarily due to escalating domestic demand driven by the summer peak and the onset of hurricane season. This period of high demand prompted increased activity in the linear low-density polyethylene market, with processors placing substantial orders to meet short- to mid-term needs and resellers buying truckloads to mitigate delays in automotive deliveries. The demand was notably strong from key industries such as construction, automotive, and packaging, which typically see a surge in their market activities during summer months. Additionally, the hurricane season led traders to stock up on LLDPE to ensure supply continuity, further boosting prices.

Analyst Insight

According to Procurement Resource, the price of Linear Low Density Polyethylene (LLDPE) is estimated to be driven by the rising demand from the global automotive industries and limited production, particularly in the Asian countries.

Linear Low-Density Polyethene (LLDPE) Price Trend for the Q1 of 2024

| Product | Category | Region | Price | Time Period |

| LLDPE | Packaging | Asia | 1171 USD/MT | January 2024 |

| LLDPE | Packaging | Asia | 1182 USD/MT | March 2024 |

| LLDPE | Packaging | Europe | 1225 USD/MT (FOB, NWE) | January 2024 |

| LLDPE | Packaging | Europe | 1382 USD/MT | March 2024 |

| LLDPE | Packaging | India | 1182 USD/MT | March 2024 |

Stay updated with the latest Linear Low-Density Polyethene (LLDPE) prices, historical data, and tailored regional analysis

Asia

In the Asian polymer market, LLDPE prices remained steady due to weak upstream crude prices and tepid downstream demand in the first quarter of 2024. The producers faced resistance from buyers when attempting to raise prices, as demand remained sluggish, and the trading sector held an excess of inventories. However, plant maintenance activities in China initially impacted LLDPE production capacity due to the onset of Chinese New Year and spring festivities in the region.

In China, the LLDPE price trend experienced an oscillating trend during the first quarter of 2024 as the inventories dried up quickly while the production was slow, creating a disbalance between supply and demand sectors of the market. The purchasing sentiments, however, improved only in the later stages of the quarter with the rebound of the industrial sector post-Chinese New Year holiday season.

Further, the escalating costs of upstream crude oil and naphtha also supported the uptrend in the market. The favorable outlook of the downstream construction and automotive industries further propelled the market of LLLDPE in an upward direction.

Disturbances in the supply chains and on crucial sea routes further complicated the trading practices of the Asian countries, supporting an uptick in the prices of LLDPE. In India, LLDPE prices were stable, with domestic producers offering incentives to stimulate purchases amidst limited trading activity. Therefore, the prices showcased minimal movement as they rose from an average of 1171 USD/MT in January to 1182 USD/MT in March’24.

Europe

In the European countries, during the first quarter of 2024, the LLDPE price trend experienced a notable price surge driven by supply shortages and increased market demand. As a result of suitable market conditions, the prices inclined from approximately 1225 USD/MT (FOB, NWE) to 1382 USD/MT.

Delays in cargo arrivals from the Middle East and limited material quantities from the US intensified the constrained supplies, leading to the above stated visible uptick in the LLDPE price trend. Additionally, reduced output rates and regional shutdowns further compounded these challenges. Despite stable overall demand, subdued activity in end-user industries like construction contributed to fluctuations in the market during the middle of the first quarter. However, limited import alternatives and reduced allocations prompted suppliers to prioritize margin expansion.

North America

During the initial phase of Q1, LLDPE prices surged at a quicker pace in the United States due to supply shortages and heightened demand. The increased demand from sectors like construction and packaging drove prices higher in the US region during the aforementioned period.

The escalating costs of feedstocks like ethylene, naphtha, and crude oil further elevated production expenses, intensifying price pressure. Disruptions in crucial shipping routes, such as the Panama Canal and the Red Sea, added to market instability. The tightening of domestic supplies and exponentially growing freight charges further supported the price increase of LLDPE.

Analyst Insight

According to Procurement Resource, the price trend of LLDPE is expected to be driven by the rising cost of ethylene, naphtha, and crude oil along with improving appetite of the downstream industries in the forthcoming quarters.

Linear Low-Density Polyethene (LLDPE) Price Trend for October to December 2023

Asia

In the fourth quarter of 2023, Asia's Linear Low-Density Polyethylene (LLDPE) price trend experienced a mixed trend. The market initially faced challenges due to disruptions in the supply chain, including shipping backlogs and geopolitical tensions. However, towards the end of the quarter, demand from downstream sectors like packaging and construction showed signs of improvement.

Feedstock prices, such as Ethylene and Crude oil, fluctuated, impacting LLDPE prices. Overall, the Asian LLDPE market navigated through a period of volatility with periods of both increase and decrease in prices, reflecting the complex interplay of regional supply-demand dynamics and global economic factors.

Europe

In Europe, the LLDPE price trend in the fourth quarter of 2023 continued to grapple with high inflation and fluctuating raw material prices, leading to an overall bearish sentiment. The demand remained subdued across key downstream sectors, and manufacturers faced cost pressures due to the high prices of feedstock Ethylene and Crude oil. The European LLDPE market also contended with supply chain disruptions, including challenges in the Red Sea region. These factors collectively led to a decrease in LLDPE prices, although there were occasional upticks due to short-term demand fluctuations.

North America

The North American LLDPE price trend in the fourth quarter of 2023 saw a depreciation in prices, largely due to weak global demand and an oversupply situation. The market was influenced by lower feedstock Ethylene and Naphtha costs and was further impacted by supply chain disruptions, including issues in the Panama Canal and geopolitical tensions in the Middle East.

Despite a stable start to the quarter, the demand from downstream sectors like packaging and construction waned, leading to a reduction in LLDPE prices. Export demand also remained unsteady, contributing to the overall downward pricing trend in the region.

Analyst Insight

According to Procurement Resource, the global price trend for LLDPE is anticipated to witness a miscellaneous trend and a net downward trend in the initial months of 2024. The prices might see optimism in terms of downstream demand dynamics.

Linear Low-Density Polyethylene (LLDPE) Price Trend for the July - September of 2023

Asia

The linear low density polyethylene (LLDPE) exhibited variations in the price trend during the third quarter of the year 2023. The first half of the quarter was observed to be wavering on the lower side of the price curve, while the second half of the quarter witnessed a significant rise in the linear low density polyethylene price graph.

The quarter began with overflowing inventories with limited sales queries from the consumers. However, as time progressed, the inventories started depleting gradually, and because of the cold customer response, the suppliers didn’t make bulk purchases to prevent revenue losses. But, as the middle of the quarter passed, the demand started rising, especially from the sheets, lining, flooring, etc. industries. This shifted the market momentum in the suppliers’ favour as the price trend gradually started picking up. Eventually, the third quarter concluded on a higher note for the Asian linear low density polyethylene market.

Europe

The European linear low density polyethylene industry too followed the Asia market as the prices were mostly noted to be on the lower side for the first couple of months and then rode high at the end of the quarter. The gap between the supply and demand dynamics gradually shortened as time passed, which shifted the LLDPE price graph upwards. Overall, mixed market sentiments were observed.

North America

The North American linear low density polyethylene market struggled more compared to the other major global markets as here, the prices remained low swinging for the majority of the discussed period. Some minor upward fluctuations were seen during the mid-quarter, but a consistently tepid demand trajectory kept the prices dull throughout. Overall, wavering market dynamics were witnessed.

Analyst Insight

According to Procurement Resource, the Linear Low Density Polyethylene market is likely to continue behaving in a similar fluctuating manner going forward as well. The demands from consuming sectors will continue to drive the market sentiments.

Linear Low-Density Polyethene (LLDPE) Price Trend for the First Half of 2023

Asia

LLDPE prices witnessed a very mixed price trend in H1 2023. Given the poor offtakes and overflowing inventories, the LLDPE prices in the Asian domestic market fell. This declining trajectory continued for most parts of H1’23, with prices averaging around 8014 RMB/MT towards the end of May’23. However, the pricing started inclining steadily during June as the market sentiments turned positive. A hit of fresh momentum and demand from the downstream packaging sector caused the LLDPE prices to rise, averaging 8035 RMB/MT towards the end of June’23.

Europe

The European market recorded an oscillating trend in LLDPE prices in the first half of 2023. The prices inclined a bit during the first quarter due to market uncertainties. However, the LLDPE prices witnessed a sharp decline in the second quarter.

Due to trade normalization, the demand dynamics thawed the market sentiments a little, but low consumer activity in related sectors plummeted the offtakes further, thereby dipping the prices further. The cheap imports from the Asian market saturated the already subdued Europe, pushing prices downwards.

North America

The LLPDE prices witnessed a fluctuating pattern in the US domestic market. Some momentary peaks were observed. However, the prices kept low, swinging for most of H1’23. This downward trajectory was attributed to low production costs and hampered demands. After two major US banks failed in the last months, consumer confidence in the market dwindled, hampering the purchasing momentum and, thus, the pricing fundamentals.

Analyst Insight

According to Procurement Resource, the price trend for LLDPE will likely oscillate in the coming months unless a major shift in demand dynamics is seen. The rising speculations of a global recession amid contracting purchasing power will negatively impact the market sentiments.

Linear Low-Density Polyethene (LLDPE) Price Trend for the Second Half of 2022

Asia

Linear Low-Density Polyethylene (LLDPE) price trend remained mixed throughout the second half of the year 2022. Initially, prices drowned because of reduced offtakes as the restrictions in Chinese markets hindered daily purchasing activities. After the lockdown was reversed at the beginning of Q4 economic activities resumed and the price trend showed some positive turns, after some tribulations, LLDPE closed the year 2022 on a higher note with upward trend.

Europe

The heightened inflation compromised the purchasing power of European customers a lot. Economic activities got lowered and slowed. Because of the dampened demand the LLDPE suppliers cut down on getting more products for the inventories. As upstream costs too had reduced for Linear Low-Density Polyethylene, the price trend mostly dwelled on the lower end for most of the second half of 2022. It was only in the last two months of the year that prices picked up a little pace, because of emptied inventories and a little rise in demand.

North America

The LLDPE market in North America remained sluggish in H2 2022. Feedstock ethylene costs were reduced throughout the period, affecting the Linear Low-Density Polyethylene prices in the same manner. Reduced upstream costs pushed the market down; on the other hand, dampened demands too pushed the market in the same direction. Overall, LLDPE price trend observed a lower inclination throughout the second half of the year 2022.

Analyst Insight

According to Procurement Resource, LLDPE is expected to have a mixed price pattern in the coming months. The rebounding end-consumer demand and erratic upstream costs are going to be the determining factors.

Linear Low-Density Polyethene (LLDPE) Price Trend For the First Half of 2022

Asia

Due to supply shortages brought on by the Chinese government's strict COVID-19 protocols, which forced a significant amount of production units to shut down and delayed container transit into and out of crucial container terminals like Ningbo and Shanghai, prices for LLDPE in China increased. Manufacturers like SABIC, RIL, and ONGC Petro additions Ltd. Raised their prices in the latter half of January. RIL further increased the contracts by 9500 INR/MT in February.

The price trend for Linear Low-Density Polyethylene (LLDPE) fluctuated in the Asia-Pacific region during the second quarter of 2022.LLDPE prices rose in China in April before falling in May and picking up again in June. LLDPE Film Extrusion Grade's market value at FOB Shanghai went from 1410 USD/MT in May to 1440 USD/MT in June 2022.

Europe

The disruption of natural gas supplies during the first part of the quarter put a tremendous amount of pressure on European LLDPE production during the quarter ending in March.

The average price for standard linear low-density polyethylene (LLDPE) film in northwest Europe averaged roughly 2000 Euro/MT. The constant increase in oil prices and robust downstream demand from the packaging and film industries were two major drivers of LLDPE price growth in the second quarter. As a result, the cost of LLDPE Film FD Hamburg constructed rose from USD 1870/MT in April to USD 1925/MT in June, a 2.9% increase.

North America

The first quarter of 2022 saw a supply shock in the feedstock ethylene market (required for the production of linear low-density polyethylene )as the largest refinery in the area at ExxonMobil's Baytown facility in Texas caught fire in the final week of December 2021. By the second week of February, demand had significantly increased, prompting large domestic producers including ExxonMobil, Lyondell Basel, and Dow Chemicals to plan a cost-push of 0.07 USD/lb.

During the second quarter of 2022, LLDPE prices displayed conflicting feelings, supported by shifting supply and demand dynamics. LLDPE's market value started to incline in April, and from then until June, the pricing pattern was stable to slightly falling. LLDPE Film Butene-based Grade FOB (Spot) Nevada's assessed value was 2015 USD/MT in April before declining to 2009 USD/MT in June.

Analyst Insight

According to Procurement Resource, the prices of LLDPE are anticipated to slump significantly. The major reason behind the crashing prices would be the debilitating prices of Ethylene and the doomed costs of upstream processes, where LLDPE gets a substantial launchpad to keep the prices affirmed. Moreover, the end-user industry is expected to ditch the LLDPE prices amidst copious supplies and bearish sentiments.

Procurement Resource provides latest prices of Linear Low-Density Polyethene (LLDPE). Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About LLDPE

LLDPE is a linear polymer of polyethene with low levels of branching. It is formed by the copolymerization of ethylene with long-chained olefins like hexene or octene. LDPE (Low-density polyethene) is often recycled to create LLDPE. Owing to its high tensile strength, high impact resistance and excellent flexibility, it has a wide range of industrial applications.

LLDPE Product Details

| Report Features | Details |

| Product Name | Linear Low-Density Polyethene (LLDPE) |

| HS CODE | 390110 |

| CAS Number | 25087-34-7 |

| Industrial Uses | Pond Liners, Plastic Sheeting, Geomembranes, Flexible Tubules, Flooring |

| Synonyms | Linear Low-Density Polyethene |

| Supplier Database | Exxon Mobil, The Dow Chemical Company, Chevron Phillips Chemical Company LLC, MMC chemicals, Westlake Chemical |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

LLDPE Production Processes

- Production of LLDPE from Copolymerization

Three major types of low-pressure technologies are employed for LLDPE production: slurry, solution, and gas-phase processes. LLDPE is made by copolymerization of ethylene with alpha-olefins using Ziegler-Natta catalysts. Usually, octene is used as the comonomer in the gaseous phase, while butene or hexene is used in the gaseous phase copolymerization.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Related News

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com