Product

NP Fertiliser Price Trend and Forecast

NP Fertiliser Price Trend and Forecast

NP Fertiliser Regional Price Overview

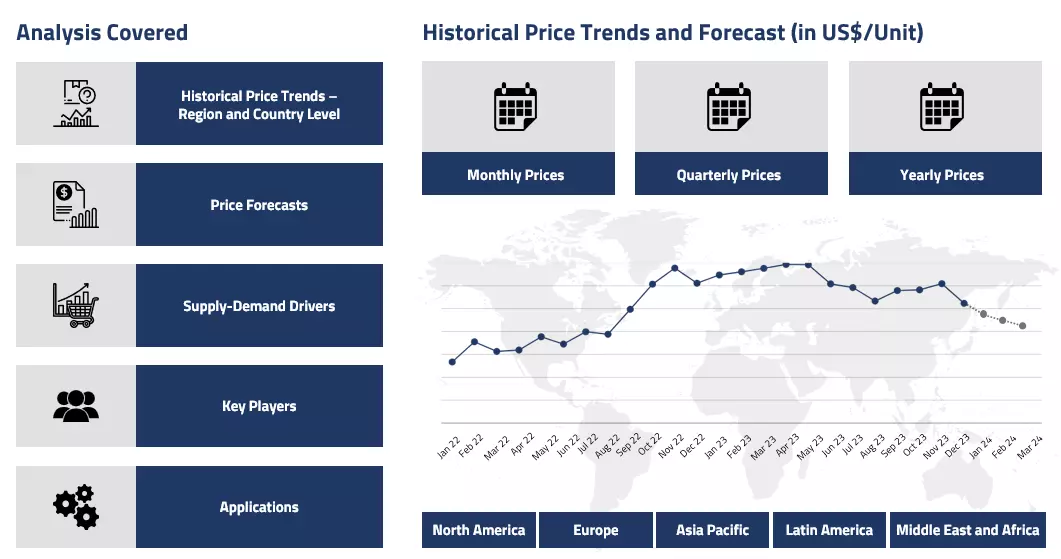

Get the latest insights on price movement and trend analysis of NP Fertiliser in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

NP fertilizer Price Trend for the Second Half of 2023

Asia

The Asian countries experienced a number of hits during the third and fourth quarters of 2023, which was well reflected in the oscillating trajectory of the NP fertilizer price trend. The Asian purchasers of fertilizers moved away from China as their main source due to the imposed measures on export quotas.

NP Fertiliser Price Chart

Please Login or Subscribe to Access the NP Fertiliser Price Chart Data

This reduced the availability of the material, dried the inventories at a quicker pace, and gave the traders a little room to increase their price quotations of NP fertilizer. The demand from the agricultural industries also showcased significant improvement by the end of the year, favored by the delay in planting season.

Europe

The upbeat momentum of the NP fertilizer price trend in the European countries was based on the rising instances of fertilizer shortage and limited supply from overseas producers. The overseas traders also raised concerns about the decline in the number of international shipments reaching the European ports as the ongoing Israel-Hamas crisis disrupted the Red Sea route. Additionally, the demand from the downstream industries and the rising cost of feedstock materials also played a significant role in keeping the prices of NP fertilizer on the higher end of the pricing spectrum.

North America

The H2 of 2023 witnessed a mixed trend in the prices of NP fertilizer as the prices of feedstock materials dwindled during the said duration. The scanty supply of these fertilizers and robust demand from the downstream industries supported an exponential route for the pricing trajectory of NP fertilizer, but a fall in the prices of crude oil and, in turn, the operational costs restricted the uprise in NP fertilizer prices.

Analyst Insight

According to Procurement Resource, the price trend of NP fertilizer is estimated to be based on the shifting patterns of planting season and uneven distribution of the global approach.

NP Fertiliser Price Trend for the First Half of 2023

Asia

After creating havoc with the upsurge in 2022, the NP Fertiliser prices declined significantly in the discussed period of H1’23. At the beginning of the first quarter itself, the FOB (Free on Board) Urea prices were substantially down from last year’s prices, and rock phosphate prices also reduced.

Owing to the reduction in these feedstock costs, the upstream rates took a significant dip. From Jan to Feb, a slight incline was noticed in the NPK fertiliser price graph in the Chinese market. However, there was no retrieval after that. Prices kept on the declining trajectory for the rest of the first and second quarters. Overall, slumping market trends were witnessed.

Europe

The Black Sea deal between Russia, Ukraine, and the United Nations primarily caused a decline in the European NP Fertiliser market as the product movement started from these war-torn countries. Inflation also started easing as the Chinese market started opening up after a long halt because of the COVID-19 pandemic.

Disrupted supply chains started restoring, and newer trade routes facilitated trade. Improved basic trade fundamentals supported NP Fertiliser exchanges, but the excess of supplies and the unsustainable surge of prices in the previous year caused the price normalization in the said period.

North America

Compared to the other major NP fertiliser markets, the American markets were more inclined. This was a direct result of the difficult economic situation in the country. High inflation made fertilizer procurement expensive. The first quarter saw swift inclinations, and then for some time, the fertiliser prices observed a little stagnancy for the first half of the second quarter. However, the second quarter ended in a slump here as well, following the sluggishness in the global market.

Analyst Insight

According to Procurement Resource, after some normalization in the NP Fertiliser market, the prices are likely to rise in the upcoming months, with inventories vacating quickly amidst steady demands.

NP Fertilizers Price Trend for the Second Half of 2022

Asia Pacific

During the third quarter, the cost of water-soluble NP fertilizers significantly increased. The market's sudden and strong demand was greater than the supply could handle. Demand for the product increased dramatically in both the Chinese and Indian markets in the third quarter of 2022.

NP fertilizer prices, however, decreased in the fourth quarter. Due to the lower costs of imports from Northeast Asia and the abundance of stock in that region, the NP fertilizers’ prices fell. The primary contributor to this decline was the stagnant demand from the industrial and agricultural sectors.

Europe

Throughout the third quarter, the prices of NP fertilizers remained strong. The European market witnessed an increase in agricultural activities which fueled increasing demand from the market. The weather patterns and rising energy production costs in the area continued to be advantageous for fertilizer price rise. The fourth quarter did not, however, continue this pattern. The price trend was negatively impacted by rising energy costs and saturated demand.

North America

In the third quarter, the prices of NP fertilizers increased as a result of the skyrocketing demand from the agricultural sector. The agricultural industries dominated the third quarter and drove up the demand for fertilizer and in turn the price trend. However, the cost of these fertilizers fell precipitously in the fourth quarter considering the region's persistently high supply compared to demand.

Analyst Insight

According to Procurement Resource, the price trend for NP fertilizers are expected to decline in the upcoming quarter as the demand from the end-user industries seems to be declining. The rising energy costs and disruption in the supply-demand dynamics will lead to a decline in the prices of NP fertilizers.

NP Fertiliser Price Trend For the First Half of 2022

Asia

Following an increase of 80% the previous year, fertiliser prices in China have increased by almost 30% since the year's beginning. Several interrelated reasons, such as rising ingredient costs, supply disruptions brought on by sanctions (against Belarus and Russia), and export limitations, all contributed to price increases (China). While phosphate and potash prices were closer to their 2008 peaks, urea prices were higher.

The war in Ukraine heightened worries about the cost and availability of fertiliser. Ammonia output was drastically reduced as a result of rising natural gas prices, particularly in Europe.

Ammonia is a crucial component of nitrogen-based fertilisers. China's ammonia plants were prompted to reduce production due to skyrocketing coal prices, which raised the price of urea. Ammonia and phosphate costs have increased, which has also inflated the price trend for NP fertilisers.

Europe

The cost of Np fertiliser in Europe dropped across the board toward the end of the primary fertiliser season. Granulated urea's international basket price index decreased from just under 1,000 USD/MT to under 700 USD/MT.

Numerous factors contributed to the decrease in the price of nitrogen, including the softening of the cost of natural gas during that time, high prices that reduced demand for nitrogen, and the conclusion of the primary fertiliser season.

North America

Despite stabilising or declining slightly in the five months following Russia's invasion of Ukraine, NP fertiliser prices are still significantly higher than in 2021, so farmers who bought early to start preparing their crops for 2023 did see the same cost savings as they did last year. However, the second week of June 2022 saw a small decline in retail fertiliser costs.

Procurement Resource provides latest prices of NP Fertiliser. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About NP Fertiliser

Nitrogen and superphosphate are both present in NP fertilisers, sometimes referred to as granular fertilisers. Because they use a lot of ammonium sulphate, they are known to contain a lot of sulphur. The crops and soils receive a balanced amount of nutrients from NP fertilisers. S, Ca (Calcium), and Mg (Magnesium), which are secondary nutrients included in NP fertilisers, may lower the likelihood of soil deficiency, resulting in a higher yield and higher-quality produce.

Furthermore, NP fertilisers are well renowned for their exceptional hardness, which ensures that quality is maintained during handling, blending, and field application. These fertilisers also have the advantage of being completely soluble or miscible with all nutrients readily available for plant absorption.

NP Fertiliser Product Details

| Report Features | Details |

| Product Name | NP Fertiliser |

| Supplier Database | Acron Group, Aries Agro Limited, Azomures, Borealis AG, Carbotecnia SL |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

NP Fertiliser Production Processes

- Production of NP Fertiliser from Rock Phosphate

In order to separate calcium nitrate from phosphoric acid as crystals, phosphate rock is first acidified with nitric acid to produce a combination of calcium nitrate and phosphoric acid. To create NP fertiliser, the residual phosphoric acid filtrate—which also contained traces of calcium nitrate and nitric acid—is ultimately neutralised with ammonia.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com