Product

Polyaluminium Chloride Price Trend and Forecast

Polyaluminium Chloride Price Trend and Forecast

Polyaluminium Chloride Regional Price Overview

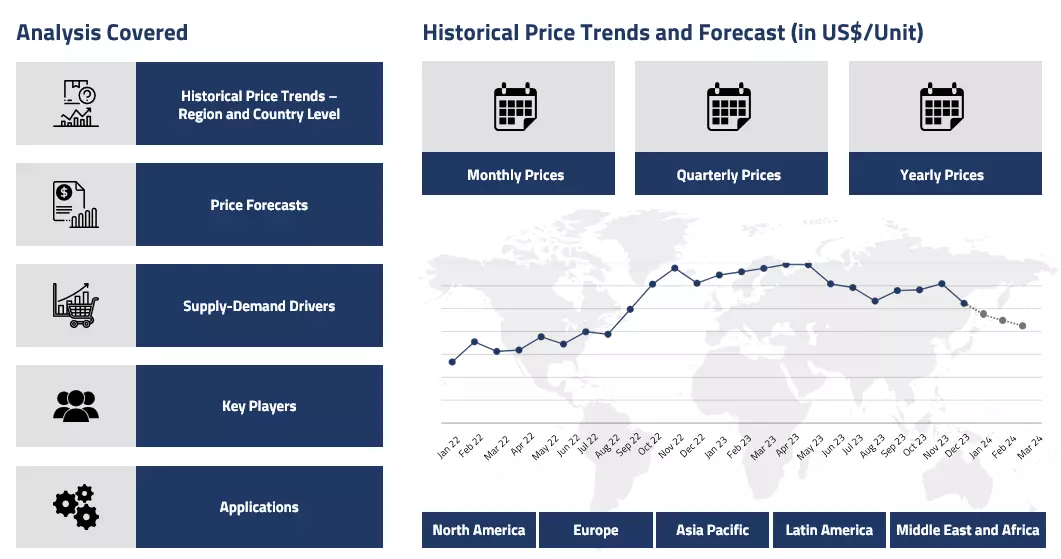

Get the latest insights on price movement and trend analysis of Polyaluminium Chloride in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Polyaluminium Chloride (PAC) Price Trend for the First Half of 2025

Asia

In the first half of 2025, the PAC market in India showed an overall upward price movement despite initial fluctuations. January saw a dip due to slow offtake from key sectors like water treatment and paper, combined with lower raw material costs and ample stock levels. However, this downward pressure was short-lived.

Polyaluminium Chloride Price Chart

Please Login or Subscribe to Access the Polyaluminium Chloride Price Chart Data

From February onward, domestic demand picked up steadily, supported by ongoing infrastructure and sanitation programs such as "Har Ghar Jal." By March, a combination of tightening supply and firm demand, especially from water treatment and industrial users, led to more noticeable price gains. The adoption of advanced manufacturing technologies and increased production capacity by major players also helped stabilize supply during this phase. Overall, the second quarter continued this trend, with firm demand and logistical improvements sustaining moderate price strength.

Europe

During H1’25, the European PAC market experienced steady but moderate price increases. Demand remained strong from municipal water treatment and the pulp and paper sector, especially in Western Europe where regulatory requirements for water quality remained high. Although economic uncertainty persisted, investment in green infrastructure projects helped maintain demand.

On the supply side, manufacturers faced rising production costs due to high energy prices and environmental compliance burdens. Additionally, reduced imports from Asia created tighter supply conditions in the region. These factors combined to support a cautious but firm pricing trend throughout the half-year.

North America

In North America, the PAC market maintained stable price growth through the first half of 2025, supported by consistent demand from both municipal and industrial water treatment sectors. The U.S., as a major global consumer, led regional usage, especially under the influence of strict water safety and environmental regulations.

While production levels remained steady, manufacturers faced margin pressure due to rising costs of key raw materials like aluminium hydroxide and hydrochloric acid. Efforts to improve production efficiency and develop hybrid PAC formulations helped offset some of these challenges, keeping the market balanced.

Analyst Insight

According to Procurement Resource, Polyaluminium Chloride (PAC) prices are expected to remain firm in the near term, supported by stable demand, higher aluminium input costs, and sustained regulatory pressure on water treatment standards globally.

Polyaluminium Chloride Price Trend for Q4 of 2024

Asia

In Asia, the Polyaluminium Chloride (PAC) market faced notable fluctuations during Q4’24. Rising raw material costs, particularly due to increasing aluminium prices and chlorine feedstock shortages, put upward pressure on prices in the region. In China, where most of the PAC production occurs, manufacturers experienced production challenges as raw material costs surged.

In response, several key producers, particularly in Shandong province, reduced their operating rates. This led to tighter supply conditions, especially in November. Despite these issues, demand for PAC remained relatively stable, driven by the water treatment sector and industrial applications. Towards the end of the quarter, softer downstream demand helped ease some of the price pressures, but the market remained volatile.

Europe

In Europe, the Polyaluminium Chloride market showed a more stable upward trend during Q4’24. The region benefited from steady demand from key sectors, including water treatment, where PAC is widely used. However, the market faced cost pressures due to higher energy prices and tight supply chains. European producers dealt with production hurdles, which were compounded by reduced imports from Asia. As a result, supply remained tight, contributing to price increases throughout the quarter. The market showed heightened activity in early November, with strong demand supporting price stability. By December, however, activity slowed down slightly as industry players adjusted to the end-of-year economic uncertainties, though prices continued to trend upwards due to cost pressures.

North America

In North America, the PAC market demonstrated relative stability throughout Q4’24, with prices following the global aluminium cost trend. Regional manufacturers maintained steady production levels, although they faced similar challenges related to rising raw material costs. The water treatment industry, a major consumer of PAC, remained a key driver of demand. Other industrial applications showed mixed performance, which led to cautious trading behavior among buyers. Many kept minimal inventories, responding to uncertainties in the global market. While the market saw some price increases due to global aluminium price trends, these were somewhat moderated by stable supply conditions and slower demand growth in certain sectors.

Analyst Insight

According to Procurement Resource, the Polyaluminium Chloride market is expected to remain firm in early 2025, driven by continued strength in aluminium prices and steady demand from key end-use sectors, particularly water treatment.

Polyaluminium Chloride Price Trend for Q3 of 2024

Asia

The Asian region demonstrated robust price appreciation, driven by dynamic market fundamentals. China's supply landscape faced disruptions due to flooding at key production facilities.

India emerged as a significant price movement indicator, showing consistent strength throughout the quarter. However, the momentum moderated in the final month as industrial activity experienced its first slowdown in over a year. The regional pricing was further supported by strong water treatment sector demand and industrial consumption patterns.

Europe

European markets tracked a predominantly bearish trend, influenced by persistent demand weakness across key end-use sectors. Germany's market particularly reflected this downturn, with water treatment and textile industry consumption remaining sluggish. The improved logistics situation, characterized by declining freight rates and better container availability, provided additional downward pressure on prices. Despite occasional restocking activities, broader economic challenges continued to weigh on market sentiment.

North America

The market exhibited contrasting dynamics throughout Q3, with a notable shift from initial price declines to an upward trajectory by quarter-end. Early quarter weakness stemmed from subdued industrial consumption and water treatment sector demand. However, the market narrative changed significantly with the hurricane season's onset, particularly Hurricane Francine's impact on Gulf Coast operations. Production disruptions, coupled with heightened emergency water treatment demands due to flooding, created supply tightness. The energy sector disruptions in the Gulf of Mexico further amplified manufacturing cost pressures, establishing a bullish price environment by quarter-end.

Analyst Insight

According to Procurement Resource, the price trend for Polyaluminium Chloride is expected to behave similarly in the upcoming months given the current market dynamics and pricing fundamentals.

Polyaluminium Chloride Price Trend for Q2 of 2024

Asia

The Asian market of polyaluminium chloride enjoyed a positive demand trend from the downstream industries as major countries of the region ramped up their industrial production rates. This rising demand from the consumer sector, particularly from the paper-pulp and water treatment industries, however, met with limited supply of the commodity.

This gap between the supply and demand sectors of the market eventually translated into the inclining prices of polyaluminium chloride. Further, the market also received ample cost support from the feedstock industries as well, as they also struggled with the limited availability resulting in an overall escalation of production cost of the commodity.

Europe

Given the revival of global downstream markets of polyaluminium chloride, the pricing pattern of polyaluminium chloride in the European countries also followed a northward trail during the second quarter of 2024. The market received consistent support from the end-user industries, reflected in their enhanced production rates and surge in the number of inquiries.

The positive stance of the market was further solidified by the significant uptick in overseas orders and well. Meanwhile, the influx of cheap Asian imports initiated a wave of competition among the market players; however, due to escalating freight charges and transportation delays, it had only a limited impact on the overall momentum of the polyaluminium chloride price trend.

North America

In the initial phase of the second quarter, the pace of inclination in the prices of polyaluminium chloride was slow as compared to the latter phase. Initially, the market momentum was only propelled by the incline in procurement rates of the downstream industries; however, in the end phase, several other market drivers also contributed to keeping the pricing of polyaluminium chloride in the green zone.

Among these factors, the surge in production costs and the stressed functioning of supply chains held the major share in driving the upward momentum of polyaluminium chloride prices. Further, the surge in freight charges and delays in the arrival of Asian shipments further played a significant role in sustaining the northward movement of the market.

Analyst Insight

According to Procurement Resource, the price of Polyaluminium Chloride is estimated to showcase smooth inclination in the forthcoming quarters on the back of improving demand from the end user industries and escalating cost of production globally.

Polyaluminium Chloride Price Trend for Q1 of 2024

| Product | Category | Region | Price | Time Period |

| Polyaluminium Chloride | Chemicals | Asia | 540 USD/MT | March 2024 |

Stay updated with the latest Polyaluminium Chloride prices, historical data, and tailored regional analysis

Asia

In the Asian market, the price trends of polyaluminium chloride were influenced by various regional factors. Early in the quarter, aluminium prices were driven up by high raw material costs and a constrained supply, partly due to operational halts at major production facilities such as Rio Tinto's unit in Australia. This supply disruption contributed to the upward pressure on polyaluminium chloride prices.

However, as the quarter progressed, the market began to stabilize. The demand from sectors like photovoltaic modules weakened, and increased production capacities, particularly in Yunnan, began to exert downward pressure on prices. By the end of the quarter, these factors had contributed to a more balanced market, with polyaluminium chloride prices stabilizing as a result.

Europe

In Europe, the aluminium market faced significant challenges during Q1 2024, which in turn affected polyaluminium chloride prices. Declining production rates, especially in Germany, were a major concern, driven by high energy costs and competitive pressures from cheaper Turkish imports. Although there were efforts to increase the production of recycled aluminium, the overall market sentiment remained subdued. Key sectors like construction and electric vehicles showed low demand, further dampening the market. This environment of economic competition and cautious outlook led to a restrained price trend for polyaluminium chloride in Europe.

North America

In North America, aluminium prices experienced a complex dynamic due to geopolitical and economic factors. The Biden administration's imposition of additional tariffs on Chinese aluminium imports exacerbated the already strained market, which was also affected by sanctions on Russian trade. Initially, this led to an increase in aluminium prices, which had a ripple effect on polyaluminium chloride prices. However, as domestic production caught up with demand, the market began to stabilize. This stabilization of aluminium prices ultimately led to a more balanced outlook for polyaluminium chloride prices in North America towards the end of the quarter.

Analyst Insight

According to Procurement Resource, the price of Polyaluminium Chloride is estimated to resonate in a narrow range under the influence of scanty supply and expanding demand for the commodity.

Polyaluminium Chloride Price Trend for the Second Half of 2023

Asia

The domestic Asian market of polyaluminium chloride struggled with the oscillations in the cost of feedstock aluminium chloride. The cautious nature of the consumers throughout the third and fourth quarters of 2023 led to an excessive rise in the level of inventories and weak fundamentals of the market. Also, the depreciation in the Asian economy and the fall in currency levels as compared to the US dollar further lowered the confidence of the investors.

Although certain government initiatives worked in order to stabilize the cost of feedstock materials the pricing movement of polyaluminium chloride was yet to showcase any effect of these policies.

Europe

The shrinking coverage of the manufacturing sector amid excessive rise in the inventory levels projected a dim outlook for the polyaluminium chloride price trend. Even after reducing their operational rates, the fall in existent demand for the commodity led to an excessive rise in inventory levels. Furthermore, the stringent government initiatives in order to curb the rising pressure of inflation forced the banking sector to raise their interest rates, limiting borrowing activities and guiding the trajectory of polyaluminium chloride prices in a downward direction.

North America

The rising economic uncertainties and debt crises in the North American region kept the pricing patterns of polyaluminium chloride oscillating throughout the third and fourth quarters of 2023. Additionally, the decline in the number of new orders from the domestic and overseas players caused the inventories to shoot up and prompted the traders to take up destocking options and offer huge discounts on bulk purchases in order to stabilize the supply-demand equilibria of the market, declining the prices of polyaluminium chloride in the region.

Analyst Insight

According to Procurement Resource, the price trend of Polyaluminium Chloride is estimated to work on the lines of limited support from the downstream industries and falling interest of the direct and indirect consumers.

Polyaluminium Chloride Price Trend for the First Half of 2023

Asia

In Asia, polyaluminium chloride prices were significantly influenced by the market dynamics of the aluminum and chlorine markets. The chlorine market faced several challenges, such as increasing inventory levels and sluggish downstream industry activities, along with challenging economic conditions. However, the aluminum market remained stable and even witnessed growth as COVID-related restrictions eased. This contributed to price fluctuations in polyaluminium chloride during the initial two quarters of 2023.

Europe

The European polyaluminium chloride market encountered difficulties due to the weak position of the chlorine industry. The fall in trade activities and reduced demand from end-user sectors played a substantial role in determining the trend of polyaluminium chloride prices in the first and second quarters of 2023. The rates of exports from France to other countries declined because of an excess supply of the product in the market, which negatively impacted the chlorine market and subsequently affected polyaluminium chloride prices.

North America

In North America, the prices of polyaluminium chloride experienced a decline in the first two quarters of 2023 due to diminishing feedstock prices. The chlorine market faced challenges with low demand and surplus supply. These conditions resulted in a poor number of sales and decreased trading activities, which had a negative impact on the polyaluminium chloride market.

Analyst Insight

According to Procurement Resource, the price trend of Polyaluminium Chloride is estimated to trace a southwards journey as its demand from the downstream sectors does not seem to follow a growing trend.

Polyaluminium Chloride Price Trend for First Quarter of 2022

Asia

Domestic mainstream quotations for industrial polyaluminum chloride were 2373.75 RMB/MT on March 29. The Chinese market had mostly stayed stable. Due to strict epidemic prevention and control measures in several sections of important industrial areas, manufacturers' output remained normal, spot inventories remained adequate, and downstream procurement volume did not dramatically improve. Transit of raw materials and finished products was impeded to some extent. The market for raw and domestic hydrochloric acid fluctuated, downstream demand remained consistent, and the market for upstream liquid chlorine climbed marginally.

Polyaluminium Chloride Price Trend for Fourth Quarter of 2021

Asia

After October, the majority of Asian countries' HCl prices fluctuated in a limited range. The drop in demand for the chemical in India following the festive season had a direct impact on its cost. Due to constant demand, the PAC sector's pricing remained stable. In China, the price was somewhere around 2600 RMB/MT in November.

Europe

Following the limited product availability, market sentiment remained strong throughout Q4. Prices of feedstock HCl rose sharply at the start of November as availability of the basic ingredient Chlorine remained limited, with companies looking for the best deal to offset high energy costs.

Natural gas prices in Europe rose at an unprecedented rate, raising fears of a severe power shortage. Several European chemical companies raised their product pricing in response to sharp increases in energy prices. HCl prices were recorded at 125 USD/MT FOB Hamburg.

North America

HCl prices in North America increased significantly in early Q4, owing to a prolonged shortage of chlorine in the region. Oxychem's Chlor-Alkali plant's force majeure continued to affect HCl pricing in Q4. The Ex-Works price was assessed at 165 USD/MT. As a result, polyaluminium chloride prices increased as well.

Polyaluminium Chloride Price Trend for First, Second and Third Quarters of 2021

Asia

During the first quarter of 2021, the Asian HCL market was neutral. Because major Chinese manufacturers' inventory levels were lowered during the Lunar New Year holidays in China, prices rose in Q1 2021. In the Indian market, however, the average price of HCL fell by 10% due to adequate stock availability and lower demand from the downstream sector. Polyaluminium chloride prices in Asian markets were directly influenced by this price fluctuation.

HCL prices surged throughout the third quarter, owing to restricted feedstock availability and strong demand from downstream sectors in Q3 2021. Despite the supply chain interruption induced by port congestion, a small increase in HCl pricing was recorded in China due to the abundant availability of the commodity in this timeframe. In India, acid prices rose significantly, owing to strong demand from downstream industries in both the domestic and foreign markets.

Europe

HCl demand from downstream industries fell in the first quarter of 2021. Lower downstream consumption was one of the main explanations, notwithstanding an increase in COVID 19 instances across the region. This coincided with a decrease in the market's demand for PAC and related items. As a result, polyaluminium chloride prices dropped.

During the second quarter, the HCl market held steady. Throughout the quarter, demand for the feedstock increased somewhat, while supply remained tight enough to keep the price upswing going.

Throughout the third quarter, demand grew steadily, but supply remained tight, allowing the price increase to continue. The downstream sectors, such as PAC, were upbeat.

North America

Due to a persistent lack of feedstock chemicals and interrupted production activity, polyaluminium chloride prices rose dramatically across the region. Multiple hurricanes had already caused a severe shortage of HCl in Q4 2020, but devastating winter storms halted all manufacturing efforts again in Q1 2021.

HCl prices in North America remained stable in the second quarter, owing to constrained availability of the feedstock chlorine and improving downstream demand. Because of the severe shortage of chlorine in the United States as a result of the lengthy shutdown of major chlor-alkali plants, the price of practically all chlorine derivatives skyrocketed.

Prices of HCl soared by an order of magnitude in the third quarter, owing to a severe lack of chlorine in the region. As a result, polyaluminium chloride prices also witnessed an increasing trend. Chlorine is a necessary feedstock for the production of HCl, which is then used to make PAC. When Hurricane Ida hit the Gulf Coast of the United States in late August, many chemical plants were still reeling from the effects of winter storm Uri.

Oxychem claimed force majeure at its chlor-alkali plant, severely disrupting chlorine supply in the region. The circumstances put even more pressure on the HCl market because many of the chlorine factories were already shut down at the time. As a result, the pricing trend of the chemical in this quarter was supported by restricted feedstock supply and strong demand from downstream sectors.

Polyaluminium Chloride Price Trend for the Year 2020

Europe

Due to the collapse of upstream isocyanate factories in various sites, the European region had a feedstock hydrochloric acid supply constraint in Q3 2020. In September 2020, HCl costs increased by 10% on a month-over-month basis. The rising cost of HCl resulted to an increase in the cost of PAC.

North America

Due to a significant decrease in feedstock supplies in Q3 2020, manufacturers lowered manufacturing rates. HCL demand from the oil and energy sector was stifled in the third quarter due to restrictions on its use in hydraulic and fracturing operations while the auto industry slowly recovered from the pandemic's impacts. Polyaluminium chloride prices rose due to a decline in its supply in European markets.

Procurement Resource provides latest prices of Polyaluminum Chloride. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Polyaluminium Chloride

Polyaluminium Chloride is a water chemical composed of aluminium, oxygen, hydrogen, and chlorine. It is a yellow-colored, water-soluble solid. Polyaluminium Chloride (PAC) 28 percent and Polyaluminium Chloride (PAC) 30 percent are the two forms of the chemical. This chemical has many industrial applications, but it is most commonly used in the flocculation processes used in water treatment industries.

Polyaluminium Chloride Product Details

| Report Features | Details |

| Product Name | Polyaluminium Chloride |

| Industrial Uses | Water Treatment, Coagulant, Cosmetic and Personal Care |

| Chemical Formula | Al2Cl(OH)5 |

| Synonyms | Aluminum chlorohydrate, Aluminum chlorhydroxide, Aluminum chloride basic, Aluminum hydroxychloride |

| Molecular Weight | 174.45 g/mol |

| Supplier Database | Kemira Oyj, Grasim, Central Glass Co., Ltd., USALCO, GACL, Henan Aierfuke Chemicals Co. Ltd, Lvyuan Chem |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Polyaluminium Chloride Production Processes

- Production of PAC from Aluminum Hydroxide

Aluminum hydroxide is added to sulfuric acid and hydrochloric acid inside a reactor during this process. The calcium carbonate is then used to neutralise the acid. As a byproduct of this process, gypsum crystals are produced.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com